- Ethereum surged by 5% amid Bitcoin ETF excitement.

- Vitalik Buterin proposed a gas limit increase for Ethereum’s network efficiency.

The cryptocurrency market experienced a surge in excitement as the Bitcoin spot ETF approval resonated across various assets. Following this, Ethereum [ETH] recorded a 5% price growth within the last 24 hours, fueled by the positive sentiment in the market.

However, what are the chances of an Ethereum ETF getting approved?

ETF saga continues

Anticipation is building around the looming deadline for Ethereum’s ETF decision, set for 23rd May with VanEck’s spot ETH ETF.

New deadline to obsess over just dropped

May 23rd is the final deadline for decision on VanEck’s spot ETH ETF pic.twitter.com/dgi5EVbPeQ

— Will (@WClementeIII) January 10, 2024

With the approval of 11 BTC ETFs, it is expected that ETH ETFs would have a sure shot at SEC’s approval. The approval is also expected to have a palpable impact on the state of ETH.

There could be also be massive accumulation of ETH prior to the approval.

Vitalik chimes in

Separately, in a recent Reddit ask-me-anything (AMA) session hosted by the Ethereum Foundation’s research team on 10th January, Vitalik Buterin brought attention to the gas limit, proposing a modest increase to enhance network throughput.

Buterin highlighted the nearly three-year period during which the gas limit remained static, suggesting that a 33% increase to around 40 million from the current 30 million could contribute to the network’s efficiency.

This adjustment aligns with Buterin’s vision for maintaining Ethereum’s technological advancement.

The proposed increase in the gas limit holds significant implications for Ethereum, as it aims to address scalability challenges and enhance the overall performance of the network.

By accommodating more transactions within each block, Ethereum can potentially lower transaction fees and improve user experience. Only time will tell whether this will help Ethereum attract more users to its network.

How is ETH doing?

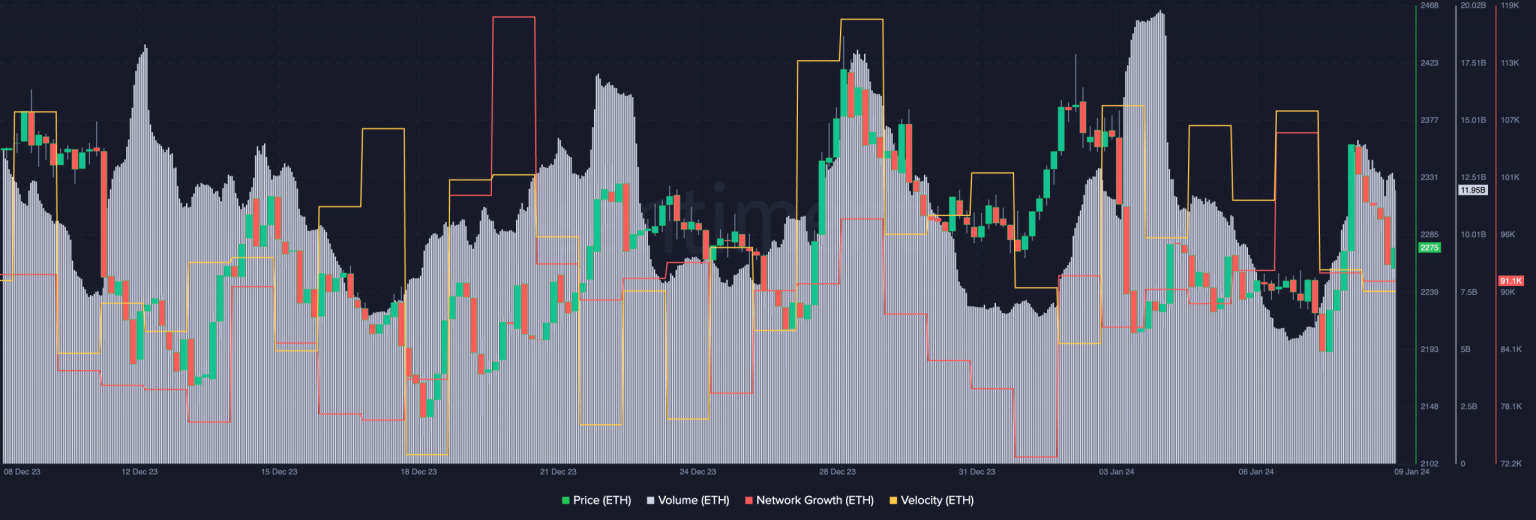

At the time of writing, Ethereum was trading at $2,415.34, reflecting a 5.07% price growth in the last 24 hours.

Moreover, there was a surge in trading volume and an increased network growth. This showed that the spike in ETH’s price was being driven by new addresses.

How much are 1,10,100 ETHs worth today?

However, the velocity at which ETH was trading had declined which meant that the number of addresses transferring their ETH declined materially in the last few days.

This could act as a hindrance in the price movement of ETH going forward.