NFT

Ever wanted to own an original, signed Andy Warhol screen print? Now you can, starting at just $20… per tokenized share via a new fractionalized art platform. Also, you have to buy at least 10 shares to grab a fraction of ownership.

Freeport—a platform and community gallery for tokenized fine art—is auctioning the famed pop art icon’s work as its first-ever collection. A four-piece curated set of original Andy Warhol screen prints is now available from the platform, ranging in price from about $20 to $78 per share, based on the piece.

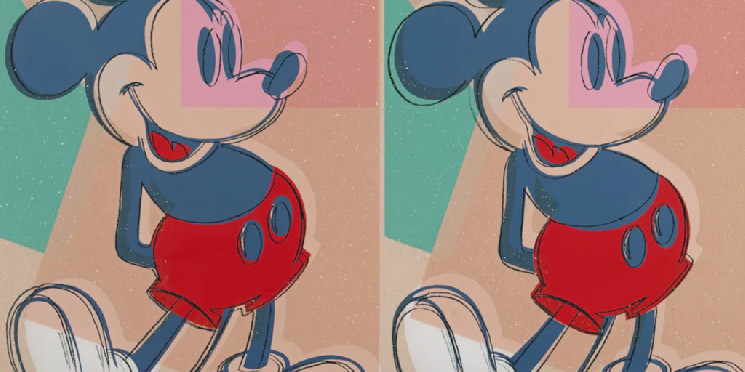

The selection includes original, signed screen prints of Warhol’s “Marilyn” (1967), “Double Mickey” (1981), “Mick Jagger” (1967), and “Rebel Without a Cause” (1985). All are signed by Warhol, with the “Mick Jagger” piece also featuring the iconic Rolling Stones frontman’s signature.

The landscape of fine art collecting changes today.

Invest in shares backed by historic pieces – starting with a collection by the legendary Andy Warhol.

Marilyn. Mick Jagger. James Dean. Mickey Mouse

✅Iconic art

✅Real investmentsOffering circular https://t.co/ADmCJcE1dN pic.twitter.com/o9iaLqpzPx

— Freeport (@freeport_app) May 10, 2023

Each piece is represented by 10,000 tokenized shares minted on the Ethereum blockchain, putting the estimated value of each work at between nearly $199,000 and $782,000 apiece.

Any user looking to invest in one of the four pieces must purchase at least 10 NFT-based shares of the work, and can own as many as 1,000 shares. In other words, up to 1,000 total people can own a single piece due to fractionalized shares.

Fractionalized assets break down a whole asset—whether digital or physical—into smaller shares or pieces. These tokens create liquidity for something that was previously considered illiquid, enabling more people to invest in an asset. This has been done with physical art, digital art, and even real estate.

Eventually, should Freeport sell each original work, prorated profits will be passed down to the token holders and the tokens will then be burned (or permanently destroyed).

In the meantime, tokenized share owners can view and display a digital version of each piece via Freeport’s app, and the company says it’s planning to add further utility for holders. A secondary market for shares will also be established, eventually letting holders sell them off to others while the original asset remains in Freeport’s custody.

Artizen Fund Raises $2.2 Million to Create NFT Cultural Artifacts

Freeport proudly claims that it’s the “first company of its kind to complete a Regulation A review” with the U.S. Securities and Exchange Commission (SEC) to release a “blockchain platform for investment grade art.” Given the SEC’s increasing crackdown on crypto companies and murky regulatory clarity on fractionalized NFTs, that might give some prospective collectors peace of mind.

Fashion icon “Baby” Jane Holzer is among the original Warhol print owners who sold their work to Freeport for this tokenized offering.

“As a lifelong collector of art, I am passionate about Warhol. He was a dear friend and always pushing the envelope in the art world,” Holzer said, per a statement. “Freeport too is pushing the art envelope with their offering to democratize art ownership. They’re disruptively bridging a gap between art appreciation and ownership for all.”

Interestingly, this isn’t the first time Warhol’s work has been fractionalized and sold via blockchain. Back in 2018, Dadiani Syndicate—a subsidiary of Dadiani Fine Art—also offered fractionalized Warhol works. In this case, it was Warhol’s 1980 piece “14 Electric Chairs,” which was valued at $5.6 million at the time.

More recently in 2022, the Showpiece platform sold fractional shares of Warhol’s Reigning Queens 1985 print. The piece, which depicts the now-late Queen Elizabeth II, was divided into 3,500 shares for £100 each.