NFT Finance, also known as NFTfi, is the confluence of nonfungible tokens (NFTs) with decentralized finance (DeFi) – a convergence that creates endless possibilities for innovative financial solutions.

NFTfi applications increase the liquidity and capital efficiency of NFT assets by facilitating the financialization of NFTs. You can generate tangible returns from otherwise unused assets by taking advantage of them.

There are many options to explore, from taking on loans by using NFTs as collaterals to buy now and pay later, and even collective ownership.

#1 How do NFT lending and borrowing work?

Decentralized lending protocols make up an essential division of NFTfi. Through permissionless smart contracts, they allow users to borrow and lend against valuable NFT assets. It’s a brilliant way for NFT holders to unlock the value of their assets without having to sell them off.

NFTfi, BendDao, Arcade, X2Y2, and Paraspace dominate the segment.

Peer-to-peer vs. Peer-to-pool with NFTfi

While some NFT lending dapps work in a peer-to-peer fashion – such as NFTfi and X2Y2 – others choose a different path, like BendDao, and follow the peer-to-pool model.

Here is how the process works on peer-to-peer platforms. The borrower lists their NFT as collateral to get a crypto loan. The lender makes a crypto loan offer against that NFT in order to earn interest. If the borrower accepts the offer, they must pay off the borrowed amount plus the interest at the end of the loan period. But if they fail to do so, the lender becomes the new owner of the NFT.

Most decentralized lending and borrowing applications enable customizable loan terms. For example, with NFTfi, it’s possible to borrow wETH, DAI, and USDC loans. While listing their NFTs as collaterals, borrowers can set their desired loan amount in these currencies. Additionally, they can also specify the interest rate and loan duration. These values give lenders an idea about the borrower’s expectations. Based on them, they can make offers.

On the other hand, the peer-to-pool liquidity protocol BendDao allows NFT holders to access instant NFT-backed ETH loans. In this case, the lenders don’t make direct loan offers; instead, they provide liquidity by depositing ETH into the protocol.

#2 Fractionalizing NFT assets for collective ownership

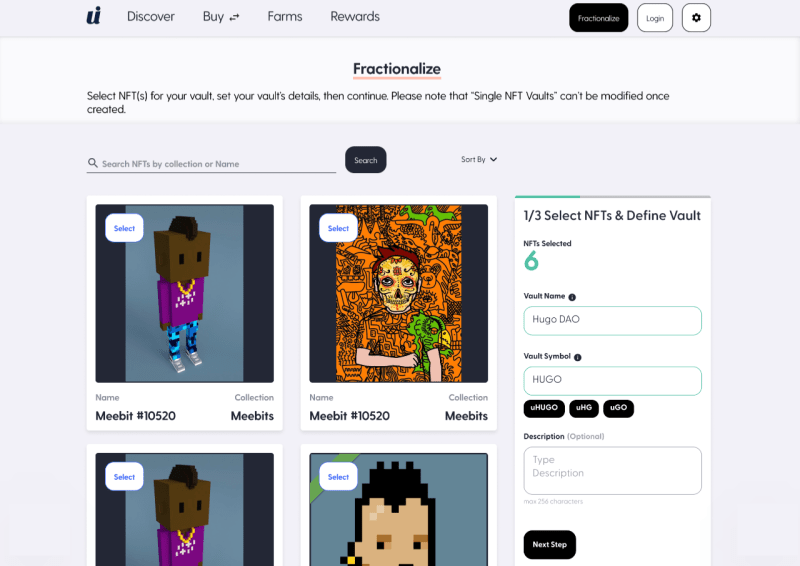

NFT fractionalization paves the way for collective ownership by breaking down high-value NFT assets (ERC-721) into multiple tokens (ERC-20). It has many applications ranging from community collections, crowdfunding donations, or forming new DAOs.

To illustrate, on Unic.ly and NFTx.io, you can fractionalize NFTs, deposit them into a vault, and mint share tokens of the protocols to earn staking rewards on decentralized exchanges.

PartyBid allows you to build a party and invest in NFT assets as a group. You can, for instance, support a charity or own and benefit from NFT utilities as a collective.

#3 Buy now and pay later (BNPL) for NFTs

BNPL allows owning an asset over time by paying the debt in installments. This tried-and-true financing method has arrived in the NFT space for the first time, thanks to the Cyan dapp.

Users who roll out a BNPL plan on Cyan make four initial installments with one down payment. They must pay off the other installments every 31 days.

After the plan starts, the user receives a cNFT version of the NFT until full ownership. This version transfers some of the utilities of the underlying NFT, such as the ERC-20 and ERC-721 airdrops.

So, you can benefit from these as far as you start the BNPL plan and as long as you keep the cNFT in your wallet and make all payments to date. You receive the original NFT in your wallet on the last payment.

Halliday is another BNPL solution, but it deploys a different approach. When NFT games or marketplaces integrate with Halliday, they can offer users a BNPL payment option at checkout. Consequently, users can start using game assets immediately and pay for the full ownership in four installments.

The bottom line

There is a plethora of other ways DeFi and NFTs merge. Whether you’re looking to invest in NFTs or unlock the potential of your existing assets, NFTfi has something to offer for everyone.