- USDC’s market cap fell from $43.56 billion to $38.9 billion, a drop of over 11%.

- As per Nansen, Circle burned $2.34 billion worth of USDC in the last 24 hours.

USD Coin [USDC], lost its dollar peg on some exchanges, over concerns that reserves backing the second-largest stablecoin by market cap, were stuck in the failed Silicon Valley Bank (SVB).

Circle, the company that manages the popular Stablecoin, disclosed that $3.3 billion of the $40 billion of USDC reserves remained locked up at SVB. Thus, triggering significant FUD about the state of its reserves.

1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

— Circle (@circle) March 11, 2023

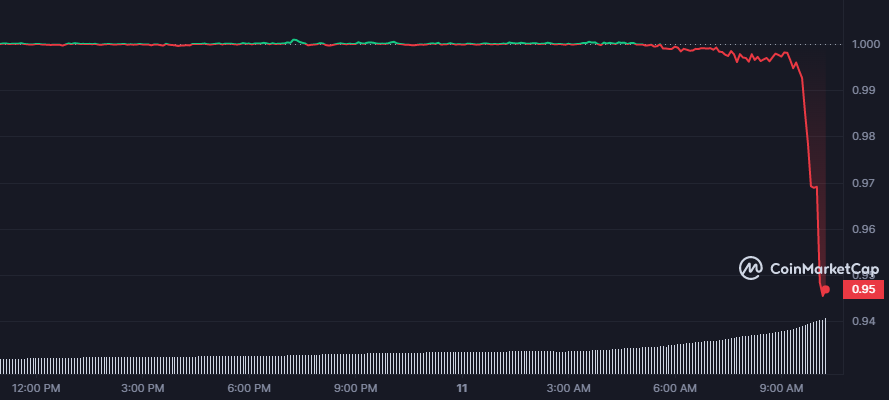

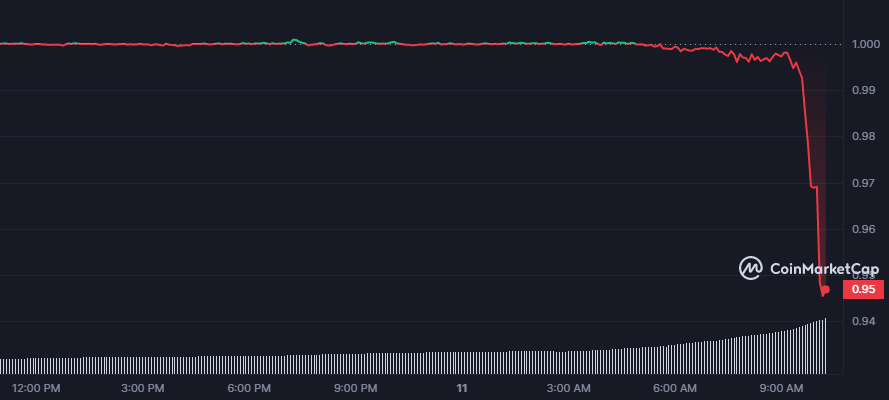

USDC, which is supposed to maintain a 1:1 peg with the USD, fell to $0.946 at the time of writing, data from CoinMarketCap showed. Additionally, its market cap declined from $43.56 billion to 38.9 billion, a drop of over 11%.

Source: CoinMarketCap

Silicon Valley Bank contagion

SVB, one of the largest retail sector banks in the United States, was shut down by regulators on Friday (10 March), as the cash-strapped lender struggled with falling deposits, compounded by interest rate hikes by the Federal reserve.

According to Circle’s transparency report, Silicon Valley Bank was one of six banking partners where it held a portion of its cash reserves backing the USDC stablecoin.

This represented about 7.5% of the total reserves, which apart from cash, included the portfolio of the Circle Reserve Fund, consisting of short-dated U.S. treasuries.

As per blockchain analytics firm Nansen, Circle burned $2.34 billion worth of USDC in the last 24 hours, as jittery investors rushed to redeem dollars for their falling USDC.

Top exchanges pause USDC conversions

Meanwhile, Coinbase, the largest cryptocurrency exchange in the United States, said that it was pausing the conversions between USDC and USD over the weekend and the same will re-commence on Monday.

We are temporarily pausing USDC:USD conversions over the weekend while banks are closed. During periods of heightened activity, conversions rely on USD transfers from the banks that clear during normal banking hours. When banks open on Monday, we plan to re-commence conversions.

— Coinbase (@coinbase) March 11, 2023

On the other hand, Binance, the world’s largest cryptocurrency exchange, followed suit and announced the suspension of USDC to BUSD conversions due to ‘current market conditions’.

That said, one analyst on Twitter, Adam Cochran, opined that things, at press time, had started to stabilize as USDC moved towards its dollar peg and the FUD was likely to subside.

It should be noted here that USDC became the latest victim of the stablecoin family. Well, the BUSD saga preceded it- the time when issuer Paxos stopped minting new Binance USD [BUSD] tokens at the direction of a New York regulator last month.