- MakerDAO reveals an emergency proposal to reinforce its platform against stablecoin risks.

- USDC de-pegging inadvertently triggers demand for MKR.

MakerDAO is making moves aimed at protecting against exposure to risk associated with stablecoins. This is in response to USDC’s recent de-pegging which reignited concerns about stablecoins under unfavorable market conditions.

Is your portfolio green? Check out the Maker Profit Calculator

MakerDAO aims to address the stablecoin challenge with an emergency proposal. The latter will focus to limit exposure to distressed stablecoins while also strengthening the stability of DAI’s peg.

The DeFi platform reportedly aims to achieve those goals by increasing USDC-DAI swap fees. A 250 million DAI daily mint limit will also be implemented if the proposal is passed.

To address the uncertainty surrounding the centralized stablecoin market, the Risk Core Unit has submitted an emergency proposal for Executive Vote to limit Maker’s exposure to impaired stablecoins and reinforce the DAI peg.

— Maker (@MakerDAO) March 11, 2023

The rationale for higher swap fees is that it will discourage USDC-DAI swaps while offering an incentive for alternative ways of offloading USDC. Failure to execute such moves may lead to more exposure to liquidity risks associated with stablecoin runs.

Some of the incentives in the proposal include a higher debt ceiling of 1 billion DAI. The DeFi platform also aims to reduce the USDP to DAI swap fee to 0%.

MKR promptly switches to the recovery lane aided by discount buying

MakerDAO’s native token MKR fell off a bearish cliff last week, resulting in a 37% pullback from its previous high.

A strong selloff saw it push as low as $597.12, followed by a 20% recovery to its $728 press time price. The recovery on Saturday (11 March) makes it one of the few top tokens that have achieved a sizable bounceback.

Source: TradingView

MKR traders should note that the token held on well to its relative strength despite the bearish outcome so far in March.

It only pushed slightly below the RSI mid-level despite the heavy downside.

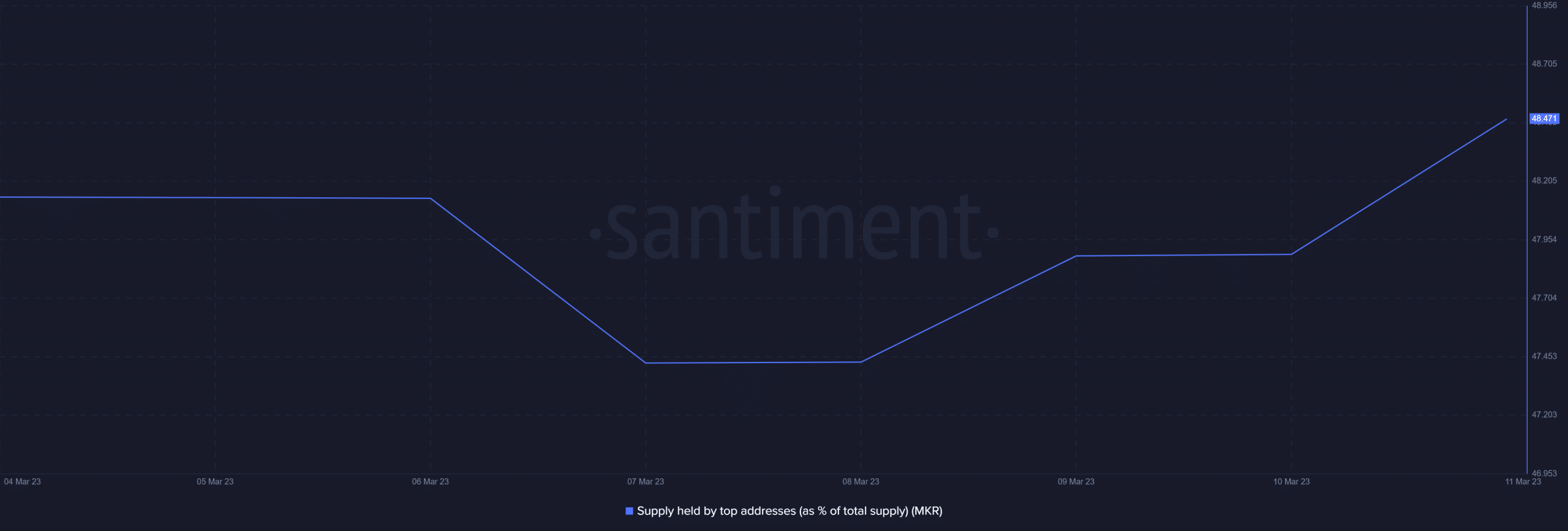

But why the sharp bounce back? It turns out that MKR was among the most purchased tokens by whales. They have been taking advantage of the discounted price to buy some more as evidenced in the supply held by top addresses metric.

Source: Santiment

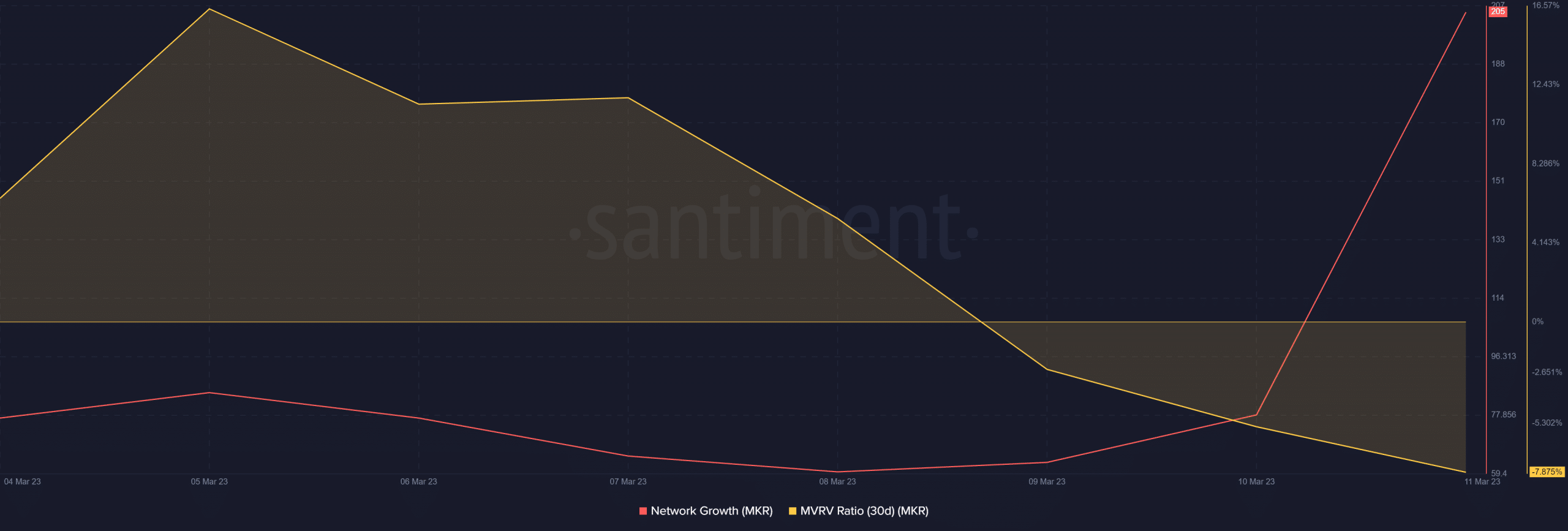

MKR’s MVRV ratio is down to a weekly low despite the whale accumulation. This is a sign that MKR has been changing hands a lot lately. On the other hand, the network growth surged to a new weekly high, potentially offering a confidence boost to MKR buyers.

Source: Santiment

How many are 1,10,100 MKRs worth today?

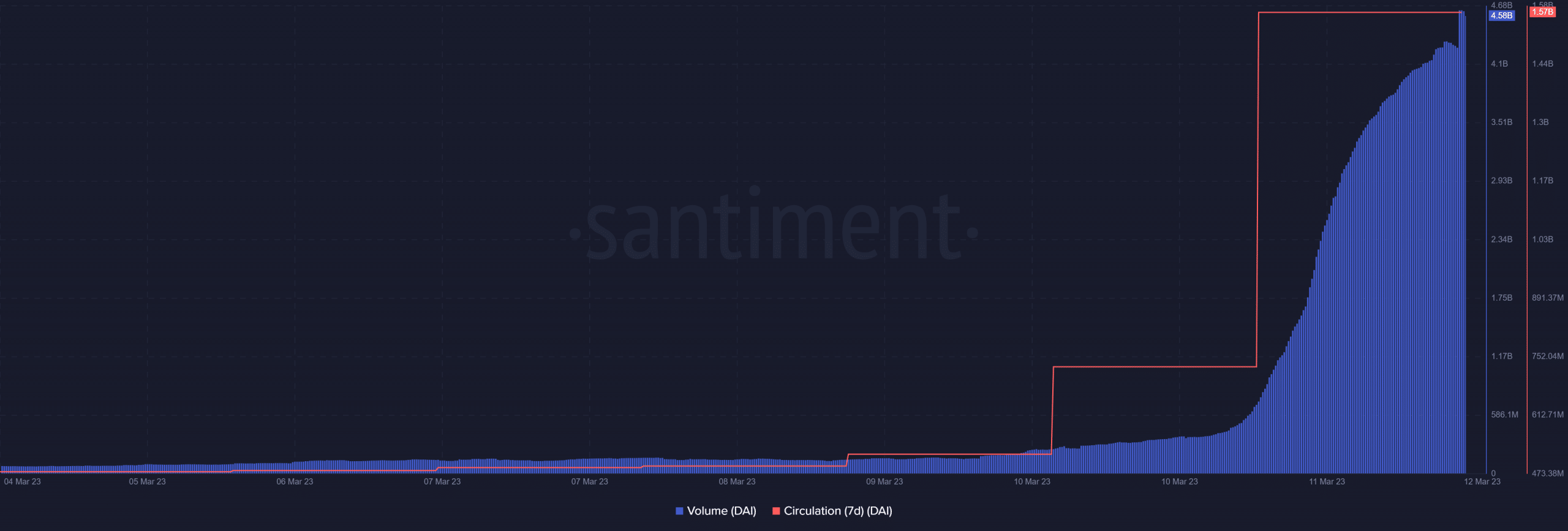

While the network growth seems to be a convincing enough reason, it is the reason behind it that might be encouraging whales to buy. Its stablecoin DAI experienced a surge in volume and circulation in the last 48 hours.

Source: Santiment

The above observations confirm a strong demand for DAI as traders migrate from centralized stablecoins. This is on account of USDC’s de-pegging, hence fueling a resurgence of MKR demand.

![MakerDAO [MKR] reacts to Stablecoin contagion with this proposal](https://patrolcrypto.com/wp-content/uploads/2023/03/MKRUSD_2023-03-12_03-23-02-1024x523.png)