– The proposal to return the token allocated to the Arbitrum Foundation has hit a roadblock.

– Interest in ARB has increased as the token value continued to gain.

Arbtirum [ARB], after its token launch in March, has been marred with some setbacks, raising questions about the project’s stance and prospects. The latest of these several developments is the rejection of the AIP 1.05, which its community voted against.

Is your portfolio green? Check the Arbitrum Profit Calculator

The proposal was a follow-up to the Decentralized Autonomous Organization’s (DAO) point of the “unjust” allocation of 700 million ARB to the Arbitrum Foundation. The DAO noted that the incident has caused a stir around the community, pointing out that it undermined the input of the governance token holders.

Return of a knock-back

Noting that it was unclear why such a decision was abruptly taken, the AIP 1.05 proposal mentioned that it was necessary to vote on the matter before any other budget allocation. However, the outcome of the process of 84.01% against 14.57% support for the proposal.

But the proposal had also mentioned that, irrespective of the implications, it was ready to support other parts of the Arbitrum roadmap. Despite the rebuff, the aura around ARB remained a substantial positive point, according to the weighted sentiment analysis.

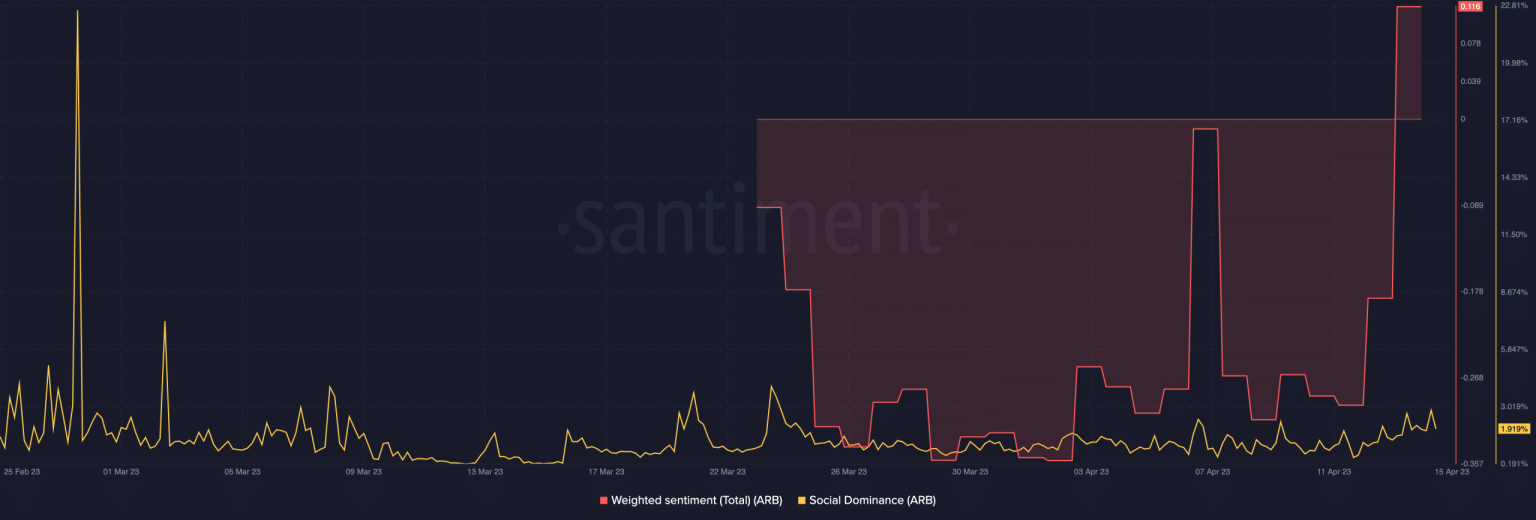

The weighted sentiment spikes when the messages regarding assets reek of admiration. And the metric falls when the perception is negative. According to Santiment, the weighted sentiment was 0.0116 — a level higher than the period the token was on a non-stop dump.

Source: Santiment

Thus, this hike suggests that investors were elated about the recent ARB performance. Furthermore, on-chain data also revealed that social dominance had left the ground level at 1.91%. The metric considers behavioral asymmetry with respect to the hype and share of the discussion out of the top 100 in market capitalization.

Therefore, the data above implies that there was growing mainstream interest in the Ethereum [ETH] scaling solution. One factor that might have contributed to this renewed delight is the way the ARB value has been impressive.

Arbitrum: Making up for old times

As a matter of fact, the token shrugged off its disappointing performance in its first week of launch, registering a 39.37% uptick in the last seven days. Per the four-hour chart, ARB was still ranging around an overbought region based on the Relative Strength Index (RSI).

At press time, the RSI was 71.12. Thus, ARB risks a correction in the short term. Interestingly, the Directional Movement Index (DMI) was already showing signs of the aforementioned possibility.

![Arbitrum [ARB] price action](https://statics.ambcrypto.com/wp-content/uploads/2023/04/ARBUSD_2023-04-15_12-51-12.png)

Source: TradingView

How much are 1,10,100 ARBs worth today?

At the time of writing, the +DMI (green) fell from its crest to 34.04. Yet, the +DMI (red) could not gather a solid momentum to override its opposite number. And since the Average Directional Index (ADX), in yellow, was still in support of the current directional movement, ARB retracement might be minimal.

However, ARB’s circulation in the last 24 hours decreased to 22.59 million. This means that the number of tokens involved in transactions was less. But active addresses over the last 30 days have grown exponentially. As of this writing, the metric was 993,00, implying better crowd recognition. And an increase in this regard could trigger price swings and volatility around the token.

![Arbitrum [ARB] circulation and active addresses](https://statics.ambcrypto.com/wp-content/uploads/2023/04/Bitcoin-BTC-13.02.54-15-Apr-2023.png)

Source: Santiment