- As BTC was getting scarcer, investors showed more willingness to HODL.

- The quarterly issuance was set to drop to around 40,000 after halving.

Bitcoin [BTC] holders were waiting anxiously for the upcoming halving in 2024, with hopes that the pivotal event would kickstart the bull run and drive the largest digital asset’s price to even higher levels than previously seen.

Moreover, if history is anything to go by, these occurrences did actually precede periods of high returns. Hence, investors who witnessed a significant dent in their portfolios in the bear market had a lot at stake.

How investors are preparing for the halving

Considering the importance of the event, a marked shift in investor behavior and supply started coming to light. Users became reluctant to let go of their stashes and adopted the HODLing strategy.

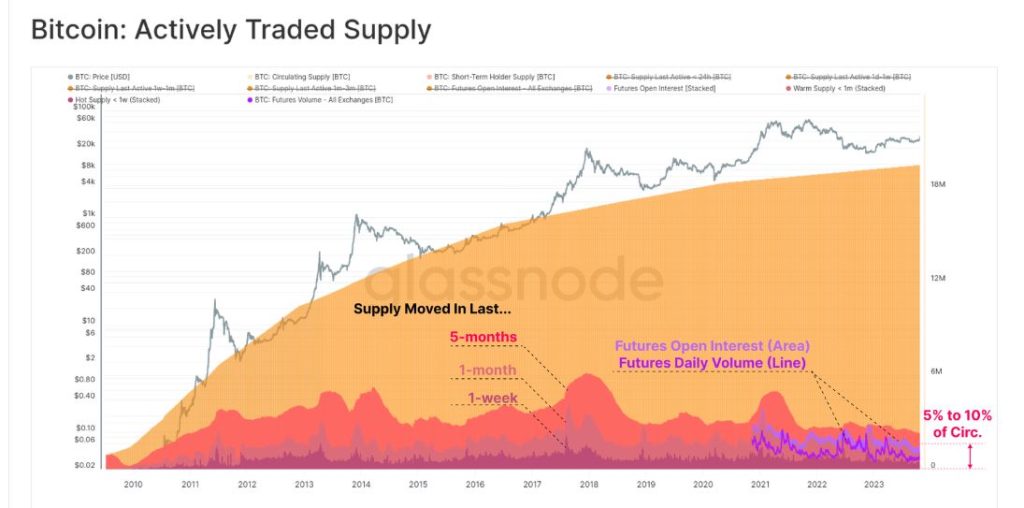

The result – a sharp dip in BTC supply available for traders to buy and sell. According to a recent report by on-chain analytics firm Glassnode, the actively traded supply represented just 5%-10% of the total circulating supply.

Furthermore, the supply of coins moving into liquid wallets, i.e., those who received coins and had a strong track record of spending them, was on a multi-year decline.

Instead, most coins withdrawn from exchanges were finding their way to illiquid wallets, with little to no track record of investing.

An interesting aspect of the rise in illiquid supply was the growth of institutional custody products such as the Grayscale Bitcoin Trust (GBTC).

Take note of how the March 2020 turning point highlighted above coincided with a substantial increase in demand for GBTC.

The glaring divergence

In contrast to the decline in actively traded supply of BTC, the long-term holder (LTH) supply showed a substantial increase in the last two years. A glaring divergence was observed between the two, as evident below.

The divergence implied that more and more coins have moved out of exchange custody to cold wallets and self-custody of long-term holders.

But how does the jump in illiquid supply fit into the upcoming halving and post-halving scenarios?

Illiquid supply growing faster than issuance

As per the report, roughly 81,000 BTC coins were being mined each quarter. The count was set to decrease to around 40,000 after the halving.

In contrast, the illiquid supply was ramping up at a rate of 180,000 BTCs each quarter. This was nearly 2.2 times more than the issuance rates. In fact, all previous halvings witnessed sustained accumulation in the lead-up to the event.

The stored supply exceeding the new issuance in a pre-halving environment reflected investors’ sentiment around Bitcoin. With the supply becoming scarcer in the future, such a strategy might become more common than it was at the time of publication.

Moreover, LTHs accumulate coins during a consolidating market and wait for a bull run to distribute their holdings. This is a historically proven narrative that played out during the 2021 bull run.

Combining the aforementioned trends, one can see how halving events act as one of the primary drivers of BTC’s bull cycle.

Market sees correction

Meanwhile, the market experienced a correction in the last 24 hours as BTC slipped below $37,000. According to Coinglass, the total liquidations on the network hit $174 million, with 70% of them being long liquidations.

The Open interest (OI) in Bitcoin futures was marginally affected by the price dip, decreasing by 1.45% in the last 24 hours.

How much are 1,10,100 BTCs worth today?

However, by and large, the market was still optimistic about the near-term outlook. Riding on the ETF wave, Bitcoin as well as Ethereum [ETH] looked well poised to attract the next wave of liquidity in the coming months.

Shivam Thakral, CEO of Indian cryptocurrency exchange, opined,

“Open interest in BTC options surpassed $16 billion as buyers are dominating the current market. We may be witnessing early signs of the next bull run with the market indicators pointing toward a healthy come back.”