- The newly passed proposal would bring certain changes to the fundamentals of the network.

- MKR’s on-chain metrics and market indicators remained in the bulls’ favor.

MakerDAO [MKR] recently approved a proposal that would bring multiple changes to its ecosystem. The MakerDAO community voted in favor of the proposal GOV12.1.2, which will introduce the Enhanced Dai Savings Rate (EDSR).

Realistic or not, here’s MKR market cap in BTC’s terms

The proposal will temporarily increase the effective DSR available to users in the early bootstrapping stage, when DSR utilization is low. Amidst this, MKR bulls entered the market as the token’s price registered massive gains over the last few days.

Decoding MakerDAO’s latest proposal

To begin with, the motive of GOV 12.1.2 was to introduce the Enhanced Dai Savings Rate (EDSR). For starters, the Enhanced Dai Savings Rate is a system to temporarily increase the effective DSR available to users in the early bootstrapping stage when DSR utilization is low.

As per the official proposal, the EDSR is determined based on the DSR and the DSR utilization rate, and decreases over time as utilization increases, until it eventually disappears when utilization gets high enough.

Since the EDSR is a one-time, one-way temporary mechanism, it can only go down over time and never go up again, even if DSR utilization decreases. The introduction of EDRS will also increase DSR utilization.

Maker investors are going gaga

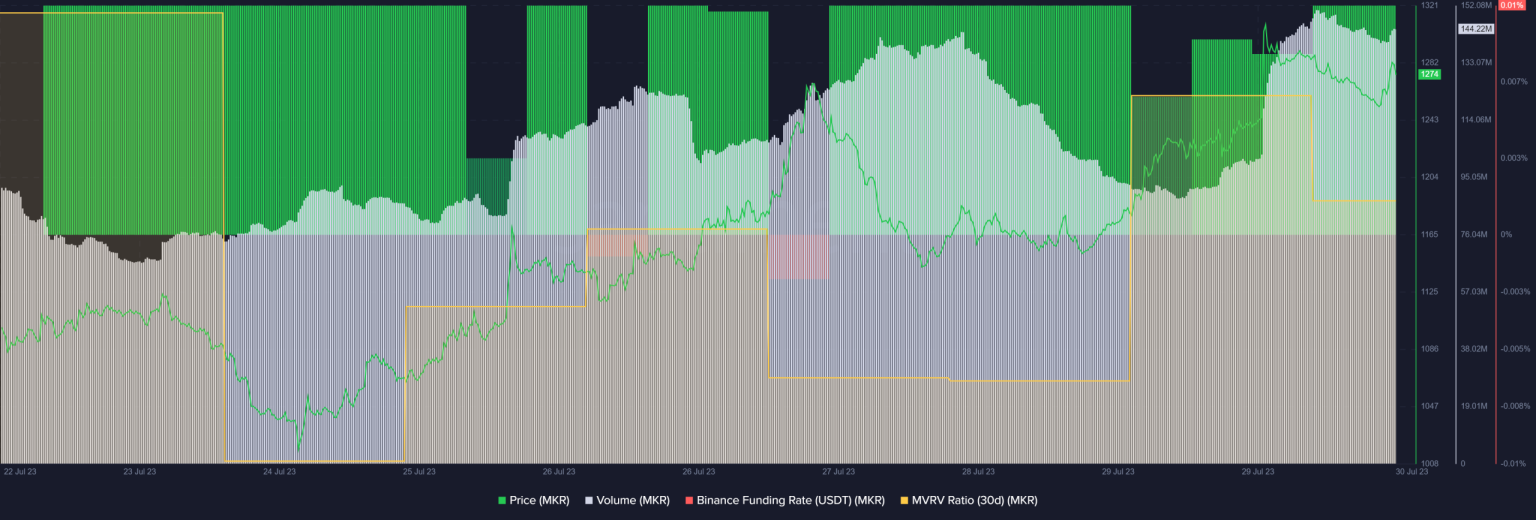

While the community voted for this proposal, the MKR bulls stepped up their game as the token’s price went up. According to CoinMarketCap, MKR’s price had gone up by 4% and 15% during the last 24 hours and past week, respectively.

At the time of writing, it was trading at $1,280.09 with a market capitalization of more than $1.25 billion. A check on its on-chain metrics gave an idea of what was backing the surge.

First and foremost, MKR’s trading volume increased, which is a typical bull signal when prices rise. MKR’s funding rate was green, reflecting its demand in the derivatives market. Its MVRV has also recovered lately.

CryptoQuant’s data revealed that MakerDAO’s exchange reserve was decreasing, suggesting that the token was not under selling pressure.

Source: Santiment

Read MakerDAO’s [MKR] Price Prediction 2023-24

A look at MKR’s daily chart gave a bullish notion, as the indicators suggested that the token’s price could go up further. For instance, the MACD and Exponential Moving Average (EMA) Ribbon clearly revealed a bullish upper hand in the market.

MakerDAO’s Bollinger Bands pointed out that the token’s price was in a high volatility zone, further increasing the chances of a continued uptrend. Nonetheless, the Relative Strength Index (RSI) was hovering in the overbought zone, which could increase selling pressure in the coming days.

Source: TradingView