Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The market structure was bearish at press time.

- The divergence showed that the near-term downtrend was likely to continue.

Binance Coin [BNB] fell beneath the $305 mark at the time of writing and had a short-term bearish bias. The buyers had stepped in with force when BNB dipped below $300 over the weekend. However, it looked like another drop was just around the corner.

How much is 1, 10, 100 BNB worth today?

Bitcoin [BTC] was also indecisive and leaned in favor of the sellers. It oscillated from $23.1k to $23.9k on Monday, marking these as near-term support and resistance levels. A move beneath $23.1k will likely see BTC drop to the higher timeframe support in the $21.6k-$22k area.

Hidden divergences showed a continuation of the near-term downtrend

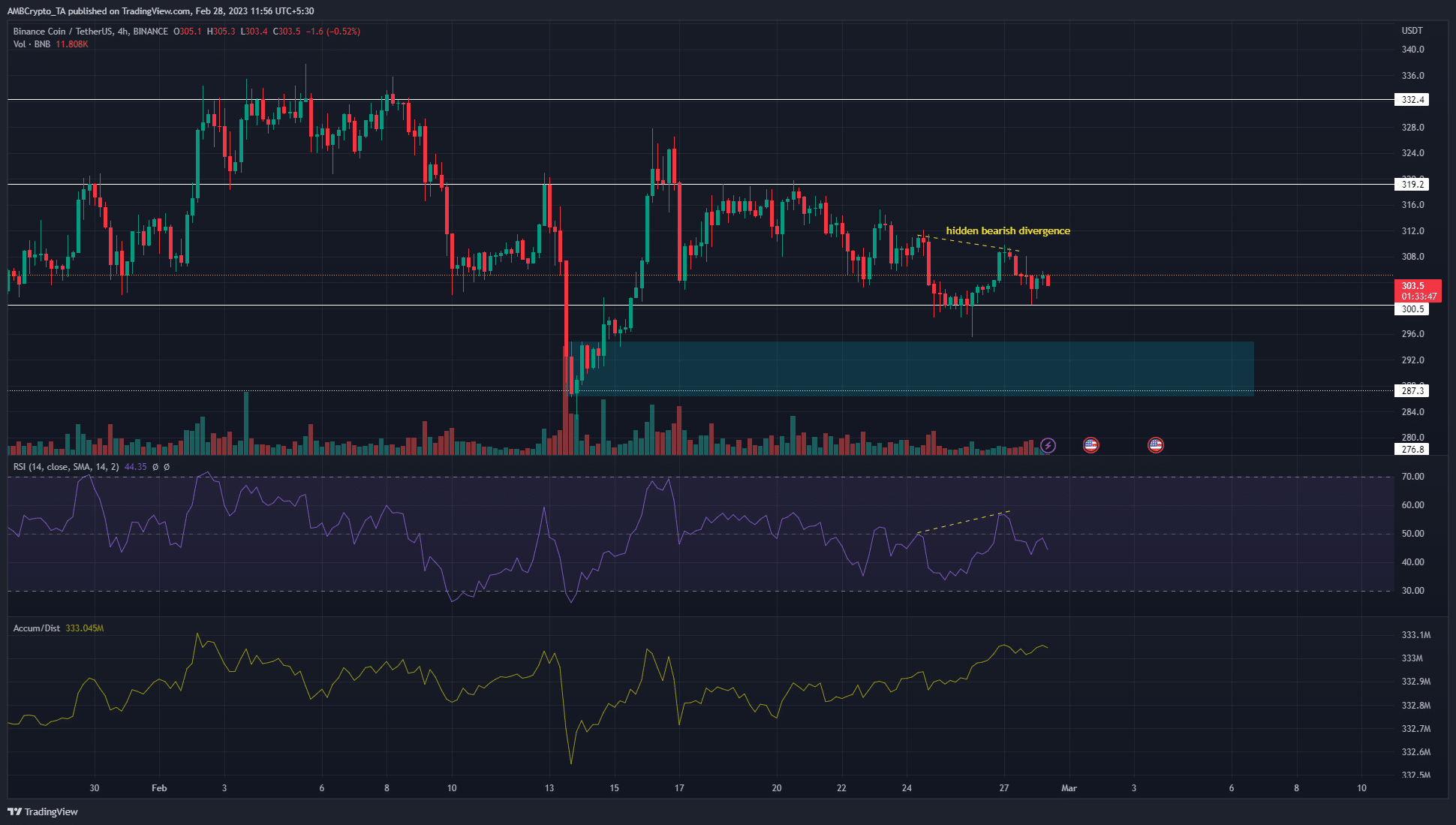

Source: BNB/USDT on TradingView

On 13 February, Binance Coin fell sharply onto the $287 support level. In the days that followed, the bulls were quick to rally, pushing prices as high as $327.8 on 16 February. Since then, the price has formed a series of lower highs. BNB also fell beneath the $305 support level, which made it more likely that a drop beneath $300 was imminent.

The price also formed a hidden bearish divergence (yellow) with the RSI, further strengthening the idea that losses would continue. At the time of writing, the RSI stood at 44, and showed neutral to weak bearish momentum.

In the $286-$294 area sat an H4 bullish order block. BNB bulls must exercise patience and caution and wait for a favorable reaction from this zone before buying the asset. Meanwhile, short sellers can look to book profits on a test of this zone.

Despite the recent losses, the A/D line has continued to move upward. This signified buying pressure was steady in the past few days. Hence, a bullish reversal could occur in the coming days.

Realistic or not, here’s BNB’s market cap in BTC’s terms

The sentiment remained bearish, but buyers have been active

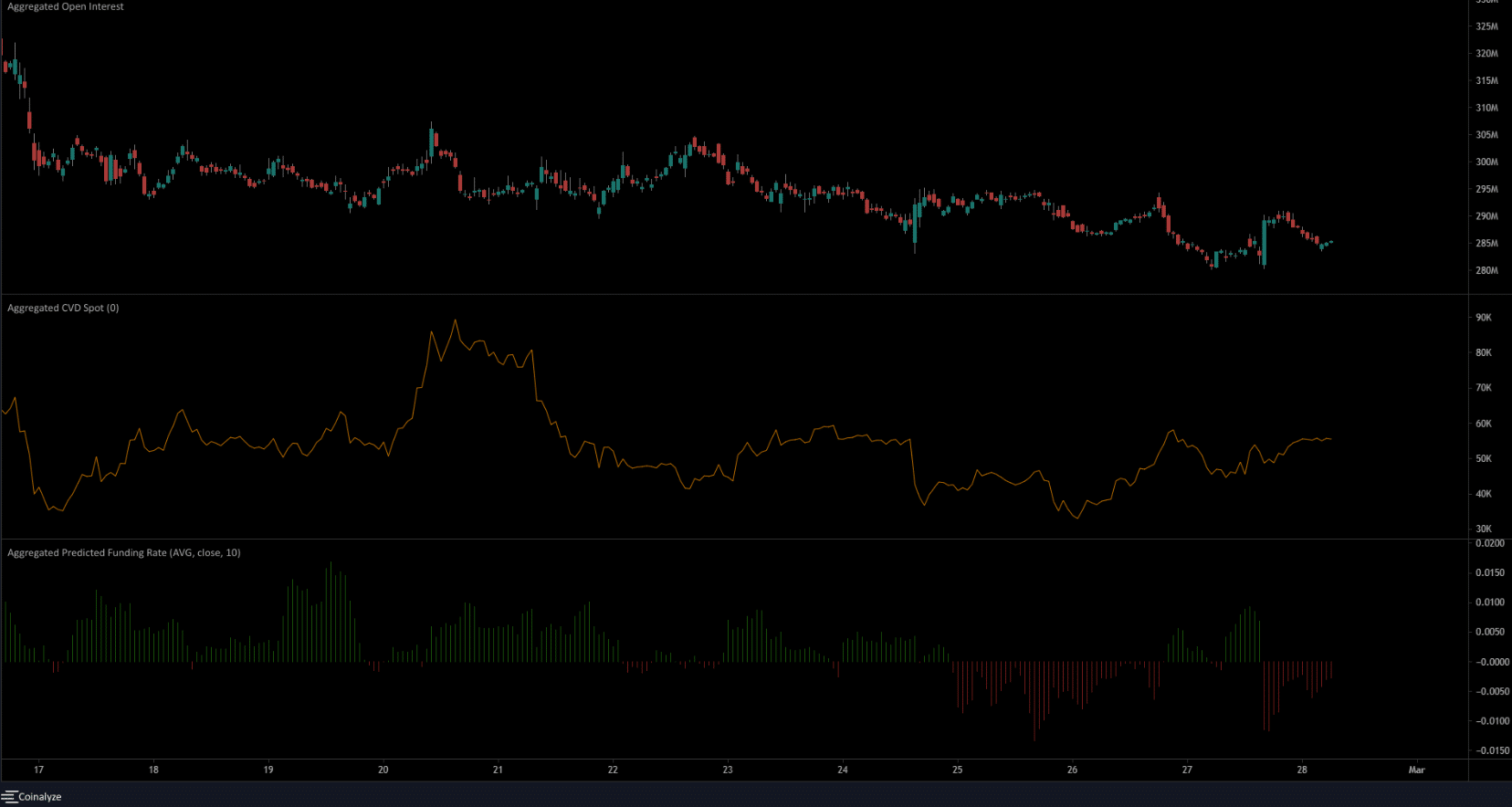

Source: Coinalyze

In line with the bearish market structure, the Open Interest also denoted bearish sentiment. The one-hour chart above showed the OI has declined alongside prices, and showed long positions were discouraged. The funding rate was also negative and showed BNB sellers have been dominant.

Yet, like the rising A/D line, the spot CVD showed buying volume. Therefore, further losses before a reversal were a likelihood.

![Binance Coin [BNB] bulls harbor hope despite losses: Here’s why](https://patrolcrypto.com/wp-content/uploads/2023/02/PP-1-BNB-price-2-1536x870.png)