- ETH demand soars on both the spot and derivatives market after a successful upgrade.

- Assessing the prospects of a retracement as some ETH whales take profit.

More than 24 hours have passed since the Ethereum [ETH] network successfully deployed the Shanghai upgrade. The hype around the upgrade will rapidly die down but what does this mean for ETH?

Major blockchain networks have historically been characterized by a strong bull run for their native cryptocurrencies. A resurgence of sell pressure tends to follow during or after the upgrade. Will that be the same case for ETH now that the highly anticipated Shanghai upgrade has been launched?

Is your portfolio green? Check out the Ethereum Profit Calculator

Initial responses post the upgrade have been positive, especially from the derivatives market. Glassnode recently revealed that ETH open interest perpetual contracts soared to a two-year high on OKex in the last 24 hours. They were up to a 15-month high on rival exchange ByBit.

???? #Ethereum $ETH Open Interest in Perpetual Futures Contracts just reached a 2-year high of $1,126,441,832.21 on #Okex

Previous 2-year high of $1,107,993,160.84 was observed on 08 February 2023

View metric:https://t.co/L43VVP6PlY pic.twitter.com/QbEqt6yPlO

— glassnode alerts (@glassnodealerts) April 13, 2023

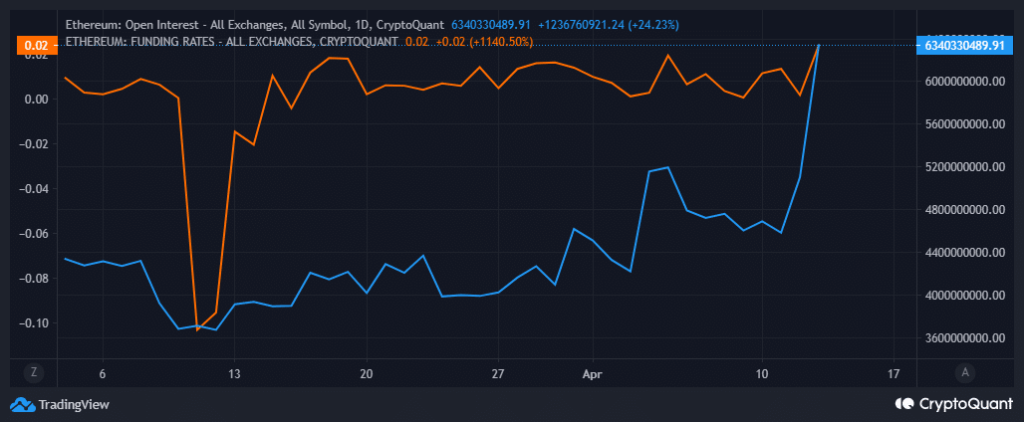

The bulk of the open interest flooded into the market between 11 and 13 April. This means the demand started flowing in just before the merge. ETH’s funding rate was at its highest level in the last four week at press time.

Source: CryptoQuant

Strong demand fuel’s ETH rally above $2,000

The derivatives demand surge confirmed a clear and strong response from investors. Such an outcome is often characterized by a more price volatility and that has been the case with ETH.

The derivatives market demand coupled with strong spot performance triggered favored ETH bulls because it finally rocketed above the highly coveted $2,000 price level. ETH exchanged hands at $2009 at press time.

Source: TradingView

Can ETH bulls maintain the momentum and sustain prices above $2,000? If the outcome will be consistent with historic observations, the latest ETH rally will likely be followed by strong sell pressure. Multiple signals already point towards such an outcome. For example, ETH, at the time of writing, was overbought according to the RSI.

ETH exchange flows are the next noteworthy signal courtesy of the recent pivot in flows. It suggested that buying volumes post upgrade might already be slowing down. Despite this, the latest exchange flows revealed that outflows outweighed exchange inflows by a significant margin.

Source: CryptoQuant

An opportunity for short sellers?

Some whales are already selling as indicated by ETH’s supply distribution. Addresses in the 10,000 to 100,000 ETH and 1 million to 10 million range offloaded some ETH in the last 24 hours.

Most of the other whale categories were still buying during the same period. The same accumulating whale categories had a larger share of the circulating supply, thus explaining why the price remained bullish.

Source: Santiment

How much are 1,10,100 ETHs worth today?

Short sellers might also have a solid chance to secure some gains if more whales start taking profits. A shift in the tide in favor of the bears may trigger a cascading effect. This is because ETH’s latest rally was fueled by leverage.

Source: CryptoQuant

A price pivot will likely trigger leverage liquidations, forcing long traders to sell to cover losses. While a bearish retracement is on the cards, ETH traders should also watch out for an extended upside courtesy of the influx of market confidence.