Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Is this a deviation before a nuke, or consolidation before a pump?

- Evidence suggested that bulls and bears can wait for a proper break before entering positions.

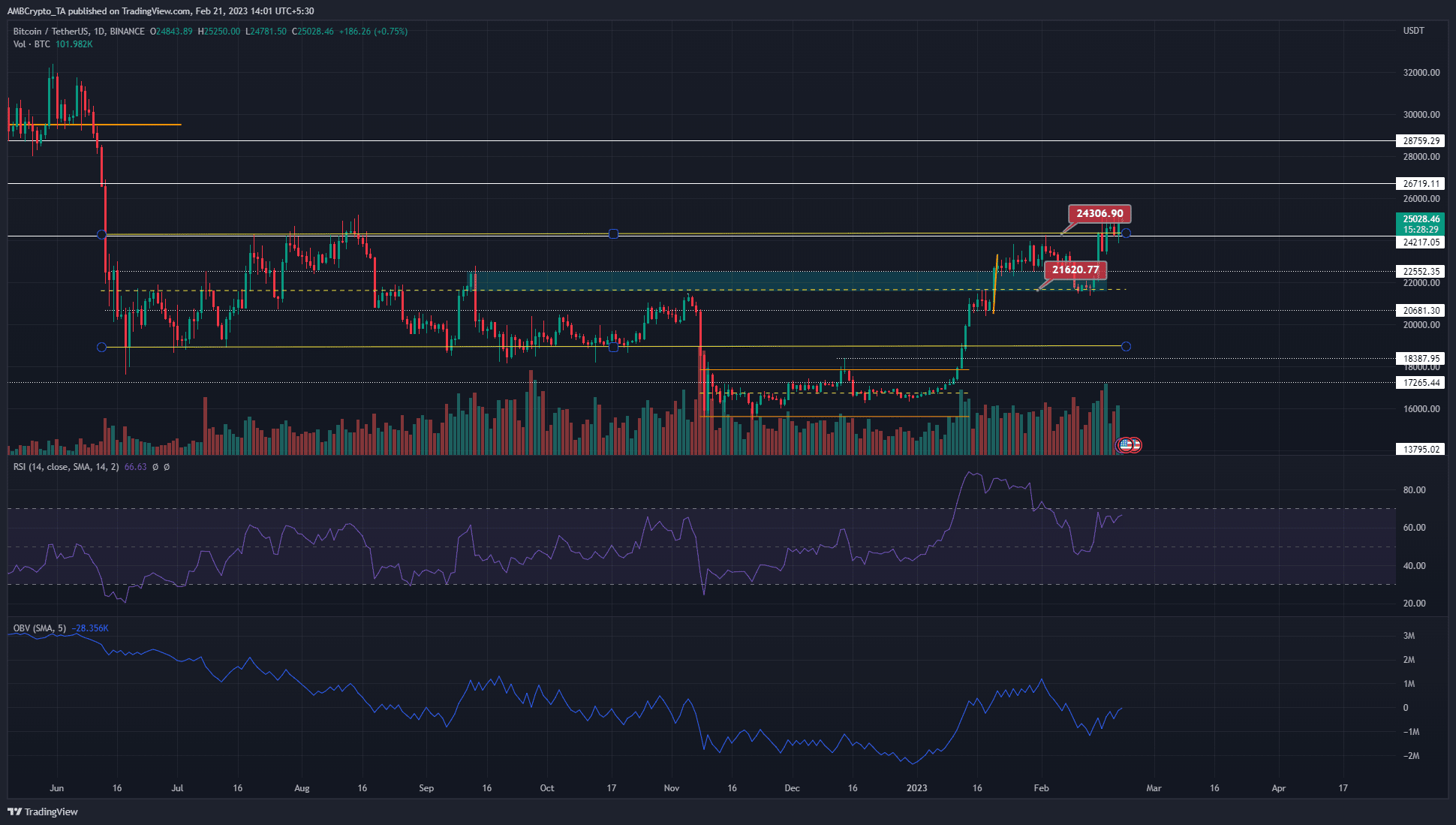

January was a solidly bullish month for Bitcoin [BTC]. The prices climbed from $16.5k to $23.7k. It retraced to the $21.6k support level in February before rallying hard to the $25.2k resistance. As things stand, further gains looked likely for BTC.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Alongside the crypto market rally, USDT’s [Tether] dominance fell, which meant Bitcoin’s rally was reflected across the altcoin market as well. A breakout past the resistance from July would likely see large gains relatively quick.

Stiff resistance at $25.2k but relatively thin air beyond

Source: BTC/USDT on TradingView

On the daily chart, a former bearish order block stood at the $22k region. It was converted to a bullish breaker after the retest of $21.6k as support in early February. This level also marked the mid-point of a range that BTC traded from July to November, thus marking it as a significant support level.

The RSI was at 66, and has not slipped below the neutral 50 mark since January. This indicated that bullish sentiment was dominant and that the trend hadn’t shifted. Looking at it from a market structure perspective, we can see that BTC has only made higher lows since the move above $17.8k in January.

At the time of writing, this bullish structure was unbroken. A daily session close below $21.6k would be required to flip the bias to bearish.

During the recent pullback, the OBV also saw a decline. The rally since then has been backed by a rising OBV. Hence, there were no divergences between the price action and the OBV. Sustained buying pressure will likely see a breakout past $25.2k. The drop from $28k to $22k happened quickly in June, taking only three days. This meant a large FVG was above $25.2k, which BTC could rush upward and fill.

Yet, bulls must be cautious. There was a chance that a push to $25.5k could be a deviation before a downturn. Hence, risk management must be a priority for any buyers.

Is your portfolio green? Check the Bitcoin Profit Calculator

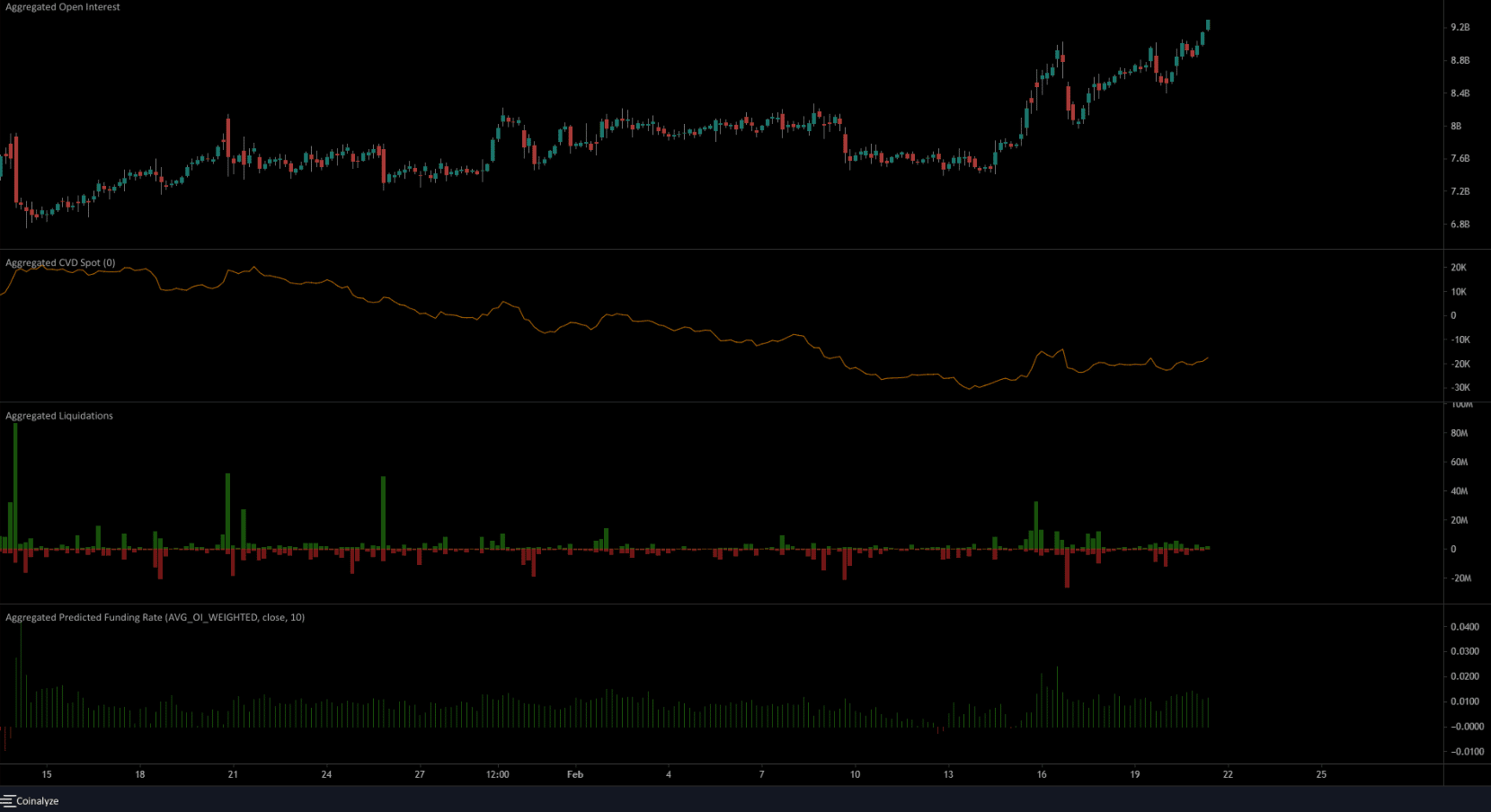

Open Interest pushes higher and spot CVD takes a positive turn

Source: Coinalyze

On the four-hour chart, the spot CVD has made higher lows over the past month. This was an encouraging sign for buyers as it reinforced bullish pressure. The predicted funding rate was also positive to highlight bullish sentiment, even though the price sat beneath a higher timeframe resistance.

Most importantly, the rising prices also saw a surge in Open Interest. This was another factor in favor of the bulls and showed market participants were likely positioned for a bullish breakout. Conversely, willing buyers near the $25k mark could provide liquidity to the sellers before a leg downward, which would cause enormous pain for most market participants.