Blockchains don’t need middlemen, but they do need consensus. That’s where delegated proof-of-stake (DPoS) comes in—it’s a blockchain consensus mechanism that uses community elections to keep things fast, efficient, and secure.

What Is Delegated Proof-of-Stake (DPoS)?

Delegated proof-of-stake is a consensus mechanism used in many blockchain networks. It helps a decentralized network agree on which transactions are valid and which blocks to add next.

In this consensus protocol, token holders delegate voting power to elect validators—also called block producers, witnesses, or super representatives. Because fewer people handle validation, the network can reach decisions faster and at a lower cost. This system was designed to make block production quicker and cheaper.

DPoS vs. Proof-of-Stake: What’s Different

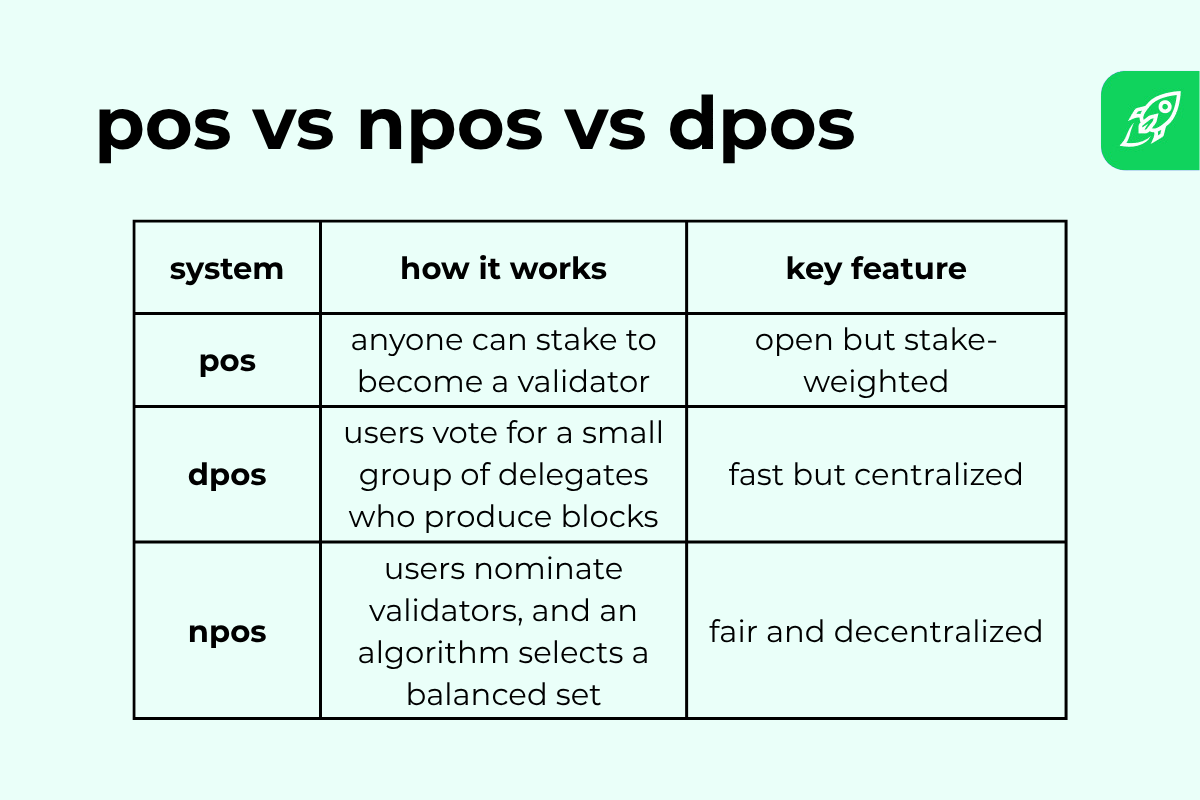

Both systems share the same PoS concept—you stake coins to help secure the network. But how they pick validators is very different.

In a typical proof-of-stake model, anyone can become a validator by locking tokens. This PoS mechanism is permissionless, and selection is weighted by stake. More coins means more chances to validate blocks.

Delegated proof-of-stake (DPoS) takes another path. You vote for a small, elected committee to do the work. Governance in DPoS is continuous, since token holders can reassign votes at any time.

This design speeds up block production but limits the number of participants.

Origin of Delegated Proof-of-Stake

The DPoS system was created in 2014 by software engineer Daniel Larimer. He designed it as a faster and fairer way to secure blockchains without the heavy costs of mining. At the time, early blockchain projects like BitShares and Steem needed a scalable solution. Their communities wanted high throughput and real-time voting.

DPoS introduced a new consensus algorithm where users could elect a few trusted validators instead of thousands of random ones. It quickly became a popular evolution of proof-of-stake, powering later networks such as EOS and TRON.

How Delegated Proof-of-Stake Works (Step by Step)

The DPoS model runs on a voting and delegation mechanism. It gives every user a say in who maintains the network. In this voting system, you use your coins to elect delegates—trusted validators who confirm transactions and create blocks.

Voters maintain control because they can reassign their votes anytime. The system uses weighted voting, meaning your voting weight equals your token balance. Some chains also set a quorum & threshold to make sure only top candidates are chosen.

Every election cycle updates who gets to validate the network next.

Step 1: Token Holders Delegate Their Stake

Token holders lock a part of their stake to vote. Each voter’s stake represents trust in the network. The larger the user’s stake, the stronger their influence in elections.

Step 2: Election of Validators (Block Producers or Witnesses)

After voting, the top block producers—sometimes called witnesses—become active validators. The delegates chosen form a small team responsible for running the blockchain. Each particular delegate has equal authority to a validator, and the committee size is fixed, such as 21 for EOS or 27 for TRON.

Step 3: Validator Schedule and Block Production

Active validators follow a fixed order for block production. They take turns in a deterministic schedule, where each proposes exactly one block per round. This predictable scheduling prevents overlap. Each block proposal must follow the rules for block creation, keeping the chain secure and continuous.

Step 4: How Finality Is Reached in DPoS

Validators validate transactions and verify transactions in sequence. Once enough blocks are created and most validators validate blocks, the results reach finality. Many DPoS systems use Byzantine Fault Tolerance (BFT)—a rule that finalizes a block when two-thirds agree. Some also add a randomness beacon to prevent collusion or predictable validator order.

Step 5: Reward Distribution to Validators and Delegators

When validators produce a block, they earn transaction fees and sometimes more tokens as rewards. These are shared through reward distribution with voters. Users vote to support honest validators and earn part of the reward from such transactions.

Step 6: Lock-Up and Unbonding Period Explained

Most DPoS chains require collateral staking to secure votes. The larger the deposit, the higher your voting power, but even a smaller stake can participate. To maintain stability, rewards are released after an epoch, and withdrawals may take an unbonding period. This lock-up period ensures validators can’t abandon the network mid-cycle.

DPoS Actors and Roles

Every DPoS network relies on three main groups: token holders, validators, and governance delegates. Together, these network users keep the system secure and fair.

Users decide who validates transactions and propose updates to improve the network’s design. These decisions shape the system’s effective operation. When everyone participates, the blockchain runs smoothly and stays decentralized.

Token Holders: Voters in the Network

Each voter’s stake represents a voice in the system. You can support anyone you trust, and voters maintain control because votes can be changed anytime. This ongoing choice keeps validators accountable to their communities.

Validators: Block Producers and Network Operators

Validators hold block validation rights. They run the software, verify transactions, and add new blocks. If they display bad behavior, such as downtime or manipulation, they risk losing support or future rewards.

Proxy Voting and Governance Delegates

DPoS chains often support proxy voting, where you delegate your vote to someone more active. These structures create interesting governance models that make decision-making more financially inclusive. They also bring more decentralization, since even users with small balances can influence the network through trusted representatives.

Benefits of Delegated Proof-of-Stake

The DPoS consensus model offers speed, energy savings, and community control. By reducing the number of validators, it keeps the decentralized network fast while still secure. That balance allows effective operation even under heavy load.

DPoS systems power a vast diversity of blockchains, from gaming to DeFi. Each adapts the same idea—community voting and elected validators—to its own needs. Let’s break down what makes this model so efficient.

Faster Transactions and Higher Throughput

In DPoS, the validator responsible for the next block is pre-determined (scheduled in advance).

So instead of validators competing—like in proof-of-work—each one knows exactly when it’s their turn to create a block. This organized schedule removes delays and wasted effort. As a result, the network can process thousands of transactions per second, achieving much higher throughput than older consensus systems.

Lower Latency and Quick Finality

With fewer producers, blocks are added in rapid sequence. Each new block appears within seconds, reducing latency and improving user experience. High liveness ensures the network keeps running smoothly, even if one validator goes offline.

Energy Efficiency and Scalability

DPoS doesn’t depend on mining or expensive hardware. The computing power required is minimal because validators take turns instead of racing to solve puzzles. This saves massive computing power and makes scaling easier as the user base grows.

On-Chain Governance and Accountability

DPoS uses a built-in voting system where users choose who represents them. Well-informed delegators can replace inactive or dishonest validators at any time, creating direct accountability inside the protocol.

Risks and Disadvantages of DPoS

DPoS brings speed and efficiency, but these benefits come with trade-offs.

Centralization and Cartelization Risk

Having only a few validators increases cartelization risk. The same groups may dominate elections for long periods, forming alliances or trading votes. This limits competition and makes the system less open than it appears.

Malicious Attempts and Takeover Scenarios

A smaller validator set also makes DPoS more vulnerable to malicious attempts to take over. If several validators act together, they could control governance or censor transactions. These takeover scenarios are harder to achieve in large-scale PoS networks with thousands of independent nodes.

Double Spending and Security Gaps

Another possible issue is double spending. When a few validators cooperate dishonestly, they might confirm conflicting transactions. This weakens security and confuses the ledger. To reduce such attacks, most DPoS chains rely on short election cycles and penalties for cheating.

Reduced Censorship Resistance

Fewer validators can lower censorship resistance. A small group could freeze accounts or delay transactions without broad consensus. The Nakamoto coefficient—a measure of how many entities control the network—is usually lower in DPoS systems than in larger proof-of-stake networks.

DPoS Compared to Other Consensus Mechanisms

Delegated proof-of-stake is one of several consensus algorithms that help blockchains reach agreement on valid transactions. Every consensus protocol has trade-offs between speed, security, and decentralization. Understanding these differences helps you see where DPoS fits into modern blockchain technology.

DPoS vs. Proof-of-Work (PoW)

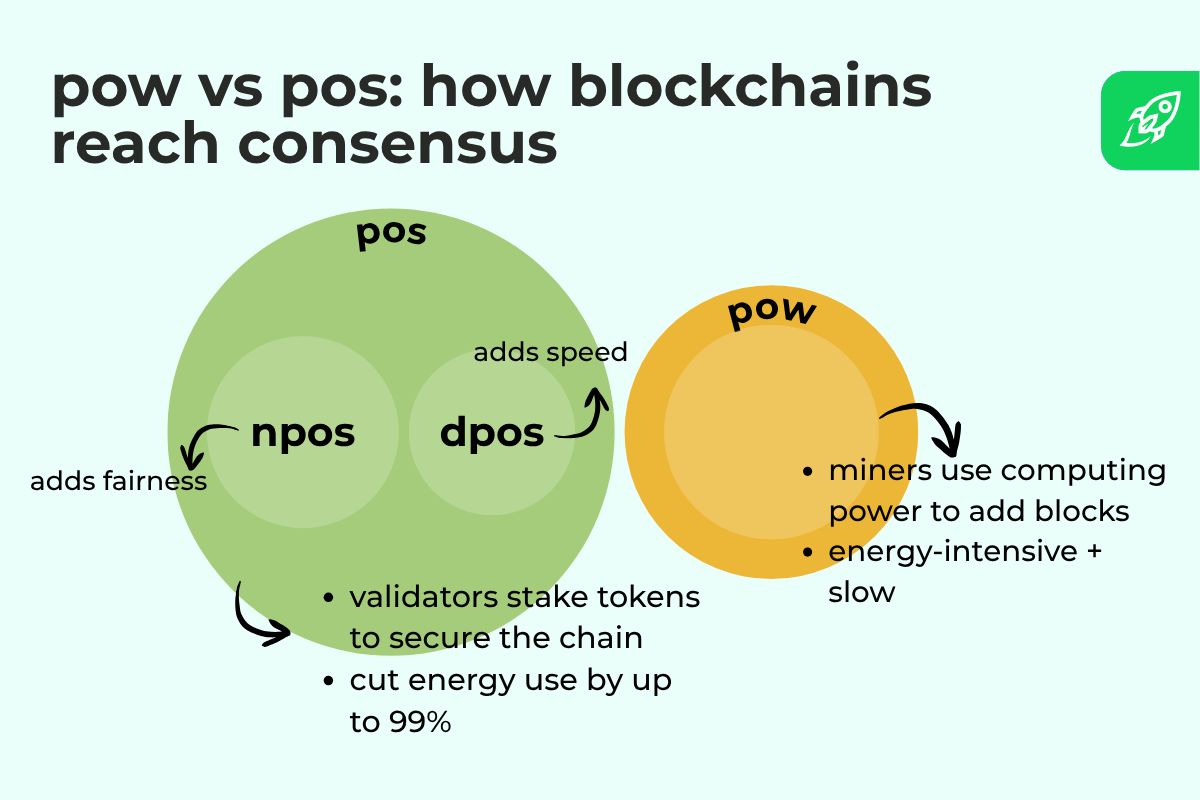

Proof-of-work was the first consensus model, used by Bitcoin. It relies on miners solving complex puzzles with massive computing power. This design makes attacks expensive but also slows down block creation and wastes energy.

In DPoS, there’s no competition to find new blocks. Instead, a few trusted validators take turns confirming transactions. This gives DPoS faster block times and lower energy use but reduces openness—only elected validators have block validation rights.

While PoW secures blockchains through cost and electricity, DPoS achieves efficiency through coordination and community voting.

DPoS vs. Nominated Proof-of-Stake (Polkadot)

Polkadot uses nominated proof-of-stake (NPoS), a system designed to maintain fairness and scalability. In this model, nominators support validators by contributing to a staking pool. The network then chooses a diverse validator set to maximize security.

Polkadot (NPoS) automatically rotates validators, reducing concentration of power. Compared to DPoS, NPoS is less dependent on public elections and more focused on random selection and slashing rules to prevent misconduct.

Read also: What Is Nominated Proof-of-Stake (NPoS)?

DPoS vs. Liquid Proof-of-Stake (Tezos)

Tezos (Liquid PoS) works like a flexible version of PoS. Users can delegate their tokens to “bakers” but don’t lose control of them. This keeps funds liquid and allows more decentralization, since small holders can still participate without locking their tokens.

DPoS, by contrast, uses direct elections and fixed validator counts. It’s faster but less open. Tezos favors inclusivity, while DPoS prioritizes performance and simple governance.

Real-World Examples of DPoS Blockchains

Many DPoS blockchains show how delegation and voting work in real life. Each one adapts the same model to different blockchain applications—from payments to content platforms. Let’s look at some of the best-known blockchain projects using DPoS today.

EOS and Its Block Producers

EOS is one of the largest Delegated Proof networks. It relies on 21 block producers, elected by token holders. Each producer signs blocks in a fixed schedule, creating a block every 0.5 seconds.

Blocks reach finality when 15 of 21 producers confirm them, giving the network fast and secure performance. EOS shows how a small validator set can maintain stability through frequent elections and transparent reward rules.

TRON and Its Super Representatives

TRON uses 27 validators, called Super Representatives, who are re-elected every six hours. Each one produces blocks for a short slot before passing it on.

The network averages a three-second block time and rewards each validator with TRX tokens per block produced. This setup shows DPoS as a practical model for a high-speed, low-cost payments network.

Steem and Its Witness Governance

Steem uses 21 validators, called witnesses, to produce blocks. These witnesses are re-elected often, keeping the system active and accountable.

If a witness fails to produce blocks, voters can replace them instantly. This rotation keeps Steem responsive and demonstrates how on-chain democracy works in real time.

BitShares: Early Use of DPoS

BitShares was the first project to use DPoS successfully. It introduced approval voting to select top validators and inspired later networks like EOS and Steem.

This early experiment proved that decentralization could still thrive without energy-heavy mining, paving the way for efficient governance and faster validation.

Sui and Modern DPoS Variations

Sui (DPoS-style) uses delegated staking with hundreds of validators. Each epoch lasts about 24 hours, and validators finalize transactions using modern consensus layers like Narwhal and Bullshark.

Sui blends traditional DPoS design with cutting-edge tech to improve scalability. It’s one of the most financially inclusive and interesting governance models among modern smart-contract platforms, showing how flexible delegation can power next-generation systems.

Final Thoughts

Delegated proof-of-stake shows how democracy can power speed. By letting users vote for trusted validators, it creates efficient yet transparent systems. Despite some centralization risks, DPoS offers strong network security and good protection against failures. Its evolution proves that governance and performance can coexist in modern blockchain design.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.