You’ve got all your crypto sitting online—but is it really safe? A single hack or some malware can drain it all, fast. That’s why smart investors use a cold wallet, since it keeps your private keys offline and out of reach. In this guide, you’ll see what a cold wallet is, why they’re safer than hot wallets for storage, and how you can protect your digital assets for good.

What Is a Cold Wallet?

A cold wallet stores your private keys completely offline—what’s called “cold storage”. It can be a hardware wallet, a paper wallet, even a sound wallet. Cold wallets are ideal for long-term holding and larger sums. They trade the convenience of hot wallets for security, and for most investors, that’s a smart deal.

There are two main types of crypto wallets: hot and cold wallets. A hot wallet stays connected to the internet, making it fast and convenient for daily use. But that connection is also its weak spot. Hackers, phishing, and malware are all more likely to target online (“hot”) wallets.

How Cold Wallets Work

A cold wallet works by keeping your private keys offline—completely cut off from the internet. That’s the whole trick. No connection means no hacking route, no malware risk, and no remote theft.

Here’s how that actually happens: When you set up a cold wallet, it generates your private keys inside the physical device itself—never online. Those keys stay locked there, used only to sign transactions when you decide to move your crypto. The wallet creates a digital signature, confirms the transaction, then sends it out through an internet-connected device like your phone or computer. Notice how, during the entire process, your keys never leave the cold wallet.

Types of Cold Wallets Explained

All cold wallets aim to do the same thing—making sure your private keys stay offline—but they are all totally different from each other. Here’s how they stack up.

Hardware Wallets (e.g., Trezor, Ledger, Coldcard)

A hardware wallet is a small physical device built to store private keys. Think of it as a digital vault you can hold in the palm of your hand. You connect a hardware wallet to a wallet app or USB drive only when signing transactions. Then it goes right back offline. That’s why hardware wallets are the go-to for serious holders—they offer strong protection, easy recovery, and peace of mind.

Paper Wallets (How They Work and Risks)

A paper wallet is the simplest form of cold storage. It’s literally a sheet of paper with your public and private keys printed on it—sometimes with QR codes for scanning. With a paper wallet, you can store private keys offline without spending a cent.

But there’s a catch. Paper wallets can burn, fade, or get lost easily. If that happens, you lose access to your crypto forever. Plus, if someone sees or copies your key from your paper wallet, your funds are as good as gone.

Air-Gapped Wallets (Completely Offline Devices)

An air-gapped device never connects to Wi-Fi, Bluetooth, or USB. It’s a fully offline wallet used for signing transactions without touching the internet. These wallets use QR codes, microSD cards, or cameras to pass data back and forth safely. This system keeps your keys offline at all times while still letting you send crypto when needed.

Deep Cold Storage (Vaults, Safes, Hidden Devices)

Deep cold storage is for the truly cautious… or the truly rich. It means locking your cold wallet or digital assets offline in a vault, safe, or hidden device. Sometimes even underground.

Institutions often use Hardware Security Modules (HSMs) for this. They’re specialized machines which secure massive holdings of private keys. Individual investors, meanwhile, might store a hardware wallet in a fireproof safe or split backups across multiple locations.

Are Cold Wallets Really That Safe?

Definitely—cold wallets are the safest way to store cryptocurrency. The security measures of cold wallets depend on how well they keep your private keys offline and out of hackers’ reach. No internet connection means no attack surface, so even malware can’t touch them. That’s why, for example, exchanges work with cold storage for storing billions in digital assets.

Still, their safety isn’t perfect. Lose your seed, damage the device, or buy from a fake seller, and all your funds are gone. Stick to non-custodial wallets, buy from official sources, and protect your backups. Your habits make all the difference.

Technical Foundations of Cold Wallets

Every cold wallet starts with a seed phrase—12 or 24 random words created using the BIP39 standard. This phrase encodes your master key, which can recreate every private key and address you own. Lose it, and your digital assets are gone.

Wallets use key derivation standards like BIP32 and BIP44 to derive all your keys from that one phrase, forming a hierarchical deterministic wallet. That means one backup controls everything. If you replace the device, re-enter the seed, you can regain access instantly.

To protect your seed, write it on paper or metal, or use SLIP-39 (Shamir Backup) to split it into recoverable pieces. Add a passphrase (aka the 25th word) for an extra layer of security, and always test your recovery with a small amount first. It’s better to learn now rather than when something goes wrong later.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

What Are the Pros and Cons of Cold Wallets?

Cold wallets provide a place to keep your private keys offline, safe from hackers and malware. Still, you trade away some convenience. Here’s how the pros and cons stack up.

| Pros | Cons |

| Offline security: Your keys never connect to the internet, preventing online threats. | Less convenient: Not great for frequent transactions. |

| Full control: You own your private keys, not a custodial wallet. | More effort: Setup and cold storage management require care. |

| Peace of mind: Great for long-term storage of digital assets. | Physical risk: Loss, theft, or damage can mean lost funds. |

| Immune to hacks: Always offline, sometimes fully air-gapped. | Upfront cost: Hardware wallets aren’t free. |

| Private: No personal data or connection required. | Recovery risk: Losing your seed phrase = losing access. |

Top Cold Wallets for Storing Cryptocurrencies

There’s no one-size-fits-all cold storage wallet. Some focus on open-source transparency, others on mobility or affordability. So let’s take a look at five of the best hardware wallets on the market right now.

1. Ledger Wallets

Ledger Nano devices are the gold standard in cold storage. They use a certified Secure Element chip to lock away your keys and support over 5,500 assets.

- Nano S Plus: affordable and USB-only.

- Nano X: adds Bluetooth for mobile device use, but still keeps keys offline.

Both pair with the Ledger Live app, but stay non-custodial so your keys never leave the device.

2. Trezor Model T

The Trezor Model T is known for simplicity and transparency. It’s fully open-source and lets you manage over 1,000 coins through the Trezor Suite app.

- Features a color touchscreen, so no need to trust your computer keyboard.

- Supports SLIP-39 (Shamir Backup) for recovery shares.

- Adds an optional passphrase, which is an extra layer of protection.

Trezor is the ideal choice for users who value independence and code transparency.

3. Tangem Wallet

The Tangem Wallet is unlike any other. It’s a credit-card-sized device with a built-in Secure Element, accessed by tapping it on your phone.

- There’s no battery or cable—it runs entirely on NFC.

- Comes in packs of two or three identical cards for backups.

- Your private keys never leave the card.

Tangem’s mobile wallet app makes storing cryptocurrency as easy as tapping to pay, but still completely offline.

4. KeepKey

KeepKey stands out for its big OLED screen and simple design. It supports over 7,000 cryptocurrencies and integrates with ShapeShift and MetaMask.

- Large display for verifying full transaction details.

- Randomized PIN layout prevents keylogging.

- USB connection only, with no wireless features for full security.

Affordable, open-source, and beginner-friendly—this is a solid choice for anyone new to crypto cold storage.

5. SafePal S1

The SafePal S1 is built for total isolation. It’s fully air-gapped, using QR codes and a camera instead of cables or Bluetooth.

- No internet, no USB, no leaks.

- Built-in Secure Element chip (EAL5+ rated).

- Auto self-wipe if tampered with.

It supports 100+ blockchains and thousands of tokens, all managed through the SafePal app while the device stays offline.

Best Crypto Cold Wallets: Comparative Table

Still not sure which cold wallet fits you best? Here’s a quick side-by-side look at the most trusted options in cold storage today.

| Wallet Name | Supported Cryptocurrencies | Key Features | Price (USD) | Security Features | Ideal For |

| Ledger Nano X | 5,500+ coins and tokens | Bluetooth + USB; built-in battery; supports up to 100 apps; integrates with MetaMask and Mycelium | $149 | Secure Element (EAL5+), PIN, secret recovery phrase, Bluetooth encryption, private keys stored offline | Users who want mobility and wide asset support with cold storage peace of mind |

| Ledger Nano S Plus | 5,500+ coins and tokens | USB-only connection; supports 100+ apps; budget-friendly; non-custodial wallet | $79 | Offline storage of keys; PIN protection; seed phrase backup | Security-focused users who don’t need Bluetooth |

| Trezor Model T | 1,200+ assets | Color touchscreen; password manager; SLIP-39 Shamir backup; open-source firmware | $179 | PIN; passphrase, recovery phrase; no Secure Element but full transparency | Privacy-minded investors who prefer open hardware and flexible backups |

| KeepKey | 7,000+ coins across 350+ blockchains | Large OLED display; integrates with ShapeShift and MetaMask; durable aluminum body | $49 | Offline private key storage; randomized PIN; recovery phrase | Users who want simplicity, style, and affordable cold storage |

| SafePal S1 | 10,000+ cryptocurrencies | Fully air-gapped; large color touchscreen; QR code signing; no Wi-Fi, Bluetooth, or USB | $49.99 | Secure Element; self-erase if tampered; keys stay offline | Budget users who want air-gapped security and mobile compatibility |

Hot Wallets vs. Cold Wallets: What’s the Difference?

When storing crypto, you have two options: cold and hot wallets. One is for maximizing security, and the other is for quickly accessing funds. Let’s see how they compare.

| Feature | Hot Wallets | Cold Wallets |

| Connection | Always connected to the internet | Stays offline—true cold storage |

| Access | Instant and convenient access for quick transfers. Easier access. | Requires manual setup or connection to sign transactions |

| Security Level | Higher exposure to cyber threats, phishing, and malware | Immune to online attacks as private keys stay offline |

| Best Use Case | Frequent transactions, day trading, and small balances | Long-term storage and holding significant funds safely |

| Examples | MetaMask, Trust Wallet, Coinbase Wallet | Ledger Nano, Trezor, SafePal S1, Tangem |

| Backup Method | Typically cloud-based or in-app | Seed phrase, recovery phrase, or SLIP-39 backup |

| Cost | Usually free | One-time purchase ($49–$179 range) |

| Control Type | Often custodial or semi-custodial | Fully non-custodial wallet. You own your keys |

Who Really Needs a Cold Wallet?

If you’re security-conscious, or hold large amounts of crypto, then you probably need one. These wallets shine when you want maximum safety and don’t need to move funds daily.

Here’s who benefits the most from crypto cold storage:

- Long-term investors who hold crypto for years and want protection from online threats.

- High-value holders securing large sums in hardware wallets or deep cold storage.

- Businesses and institutions using Hardware Security Modules (HSMs) for top security.

- Privacy-focused users who prefer non-custodial wallets and full control of keys.

- Active traders keeping most of their funds in cold wallets, and small amounts in hot wallets.

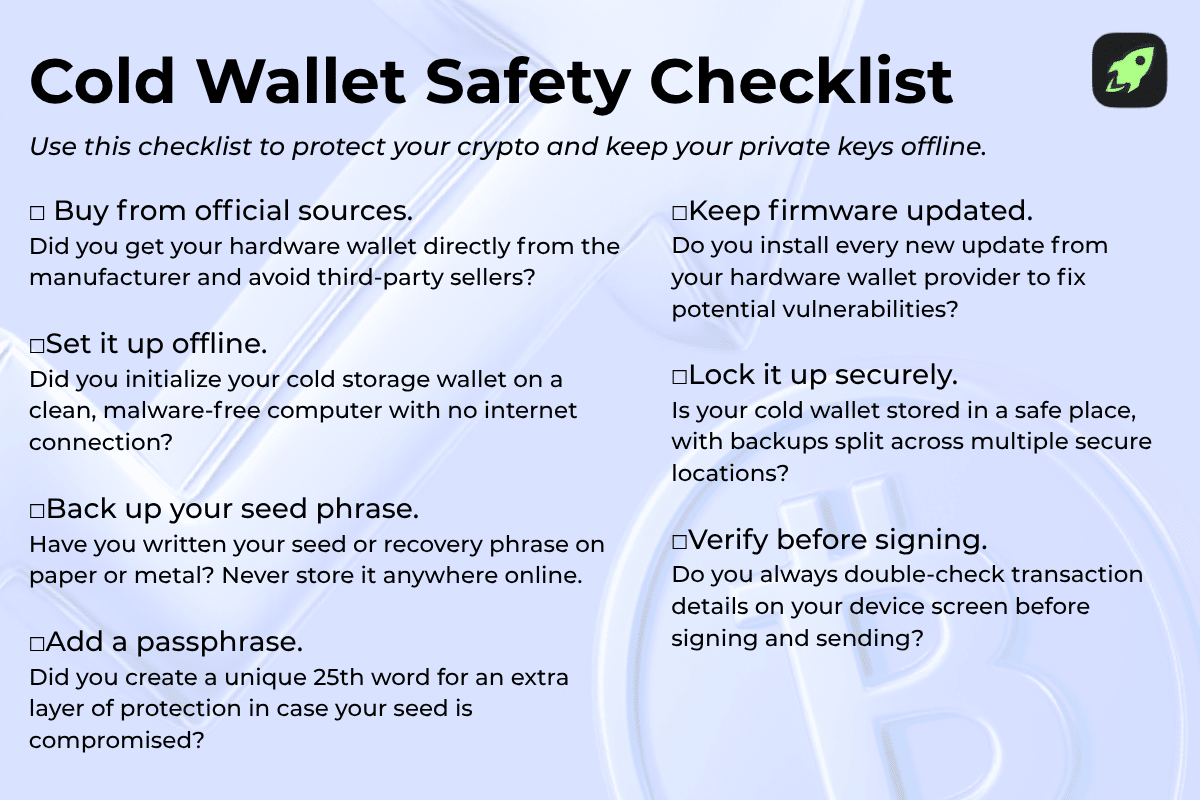

Cold Wallet Safety Checklist

How to Transfer Crypto to a Cold Wallet

Moving your crypto into cold storage isn’t hard, but every step matters. Here’s how to do it safely without putting your private keys at risk.

- Set up your cold wallet. Initialize your hardware wallet or cold storage wallet following the official instructions. Write down your seed phrase and store it securely.

- Get your receiving address. On the wallet screen, generate a public address (or scan the QR code) for the coin you’re transferring. Double-check it directly on the device, not just the computer.

- Use your exchange or hot wallet to send. Log in to your exchange or hot crypto wallet, paste the address, and enter the amount. Be sure you’re sending the correct asset to the correct network.

- Confirm and sign the transaction. The exchange broadcasts it to the blockchain. Your cold wallet doesn’t need to be connected to the internet, it only receives the funds through the blockchain ledger itself.

- Verify receipt. Once confirmed on the blockchain explorer, check your balance using a watch-only wallet or companion app. Your private keys remain in offline storage the entire time.

- Test before going big. Always do a small test transfer first. Make sure it lands safely before moving larger amounts.

Final Thoughts: Should You Use a Cold Wallet?

If you’re serious about long-term crypto investing, you need a cold wallet. It gives you full control, since your private keys are yours, and your crypto stays safe. At first, that responsibility might feel daunting, but soon it turns into something else entirely—real peace of mind.

FAQ

Are cold wallets for beginners?

Yes. Cold crypto wallets are beginner-friendly once you get the basics down. Many hardware wallets include step-by-step apps that guide setup and cold storage use safely.

Can you lose crypto in a cold wallet?

Only if you lose your seed phrase or private keys. The wallet itself just stores them, so without a backup, your digital assets can’t be recovered.

Can someone hack a cold wallet?

Not remotely. Cold wallets provide a completely offline place to store your keys, making online threats and cyber attacks ineffective. Physical theft or human error are the only real risks.

Are there any free cold wallet options?

Yes. Paper wallets are free but risky. They can burn, fade, or get lost, so most users prefer affordable hardware wallets for better cold storage protection.

What happens if I lose my cold wallet?

You can regain access using your seed phrase on a new device. Without that backup, your private keys—and funds—are gone for good.

Can I still make transactions with a cold wallet?

Yes. You sign transactions offline, then send them through an internet-connected device or QR code. Your private keys never leave the wallet.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.