- Bitcoin now seeing renewed interest, however, new investors could lose out

- Inscriptions have also contributed to the hike in interest in BTC

Because of the Silvergate and SVB (Silicon Valley Bank) saga, many investors have lost faith in traditional banking systems. In fact, due to the aforementioned, there has been a new wave of sustained interest in the crypto-market, especially blue chip coins such as BTC and ETH.

Read BTC’s Price Prediction 2023-2024

Holding on

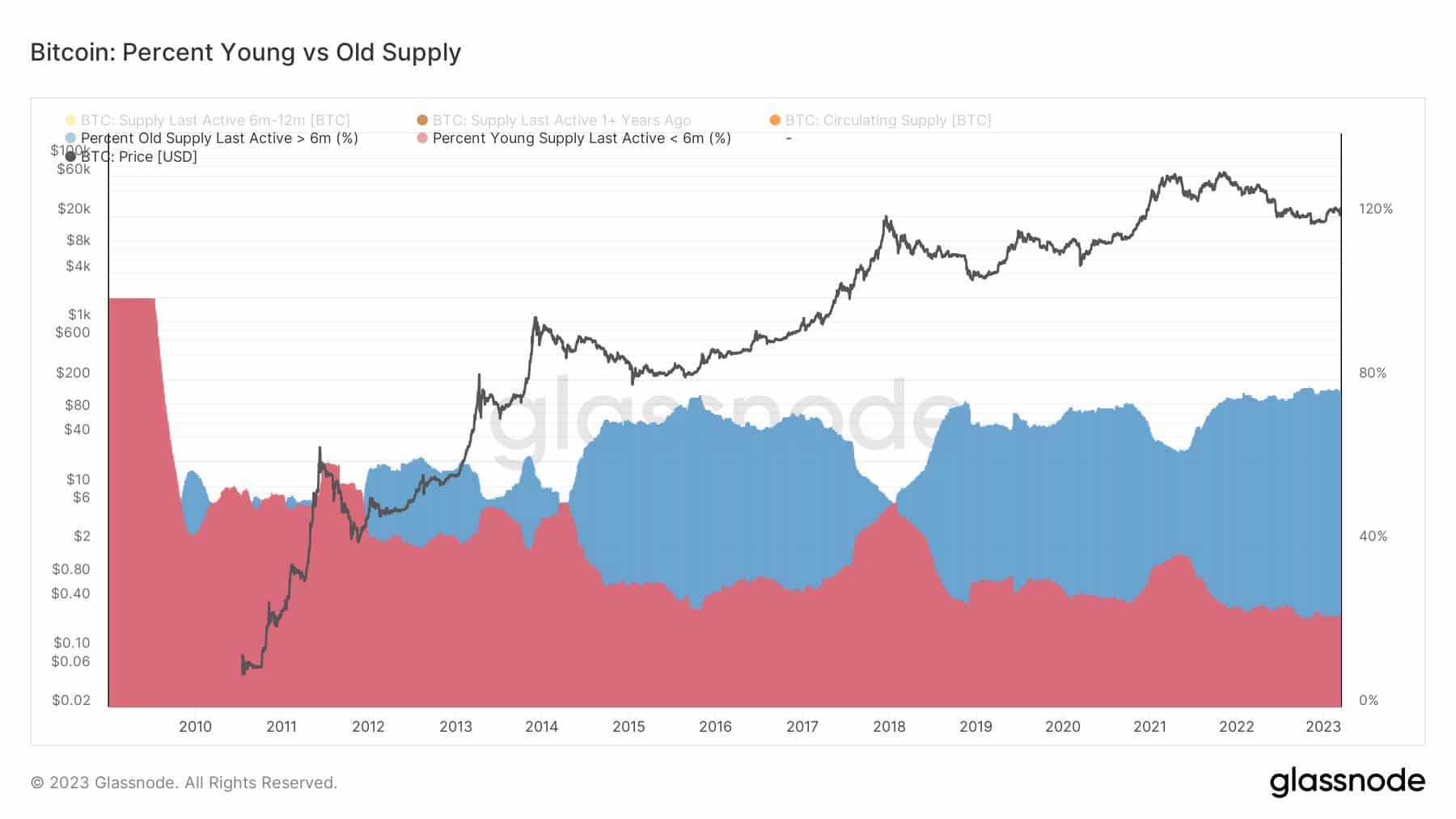

However, new addresses planning to buy BTC may have a tough time doing so as currently, long-term investors make up 73% of the overall supply. These long-term investors are less likely to sell their holdings and are more prone to HODL their BTC.

This would make it difficult for new investors to get their hands on BTC at discounted rates.

To investors realizing that they might want to own some Bitcoin now that the Fed is already intervening, good luck getting what’s left.

Long-term holders now have 73% of the total supply.

You’re not getting my coins, and there are many others like me. pic.twitter.com/0sAZxskXl9

— Will Clemente (@WClementeIII) March 13, 2023

As the popularity of Bitcoins continues to rise, so will its prices, which would make it harder for new addresses to buy BTC.

The hike in BTC’s growing popularity cannot be attributed solely to the USDC incident, however, as recent developments related to BTC inscriptions have also contributed to the same.

BTC inscriptions have now allowed for NFTs to be minted through the Bitcoin network. They now make up for 63% of all inscription activity. NFTs such as Bitcoin Punks, Rocks, and Taproot Wizards have been showing huge potential for Bitcoin’s NFT market.

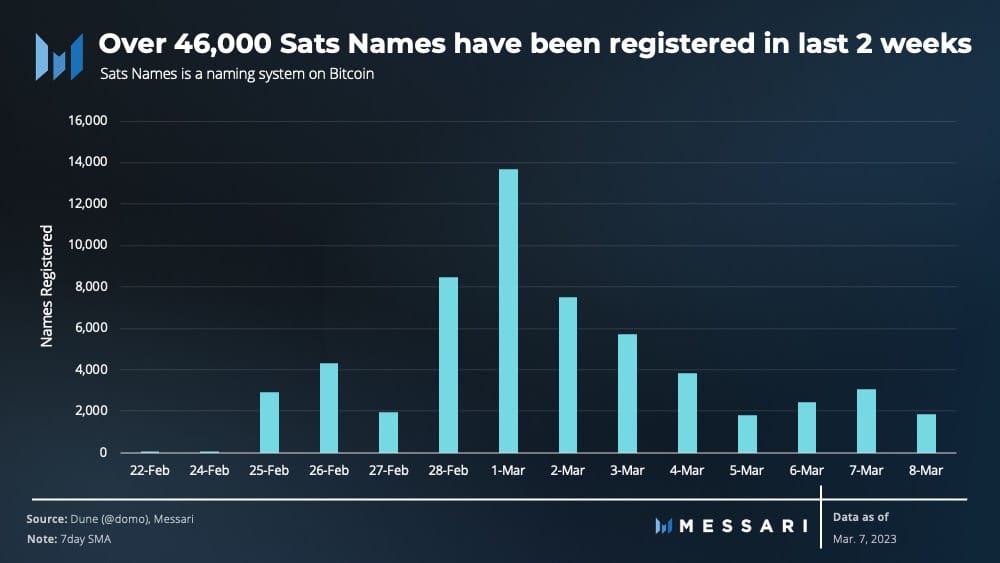

Aside from NFT’s, other services such as naming systems have also generated interest in the Bitcoin network. The same was evidenced by the popularity of Sats Names, with the latter recording 46,000 new registrations over the last 2 weeks.

Source: Messari

Due to all these factors, it is unlikely that new addresses could get a hold of new BTC at lower rates anytime soon. However, there are other indicators that suggest that there may be an incentive for some BTC holders to sell their current holdings.

The lure of profits…

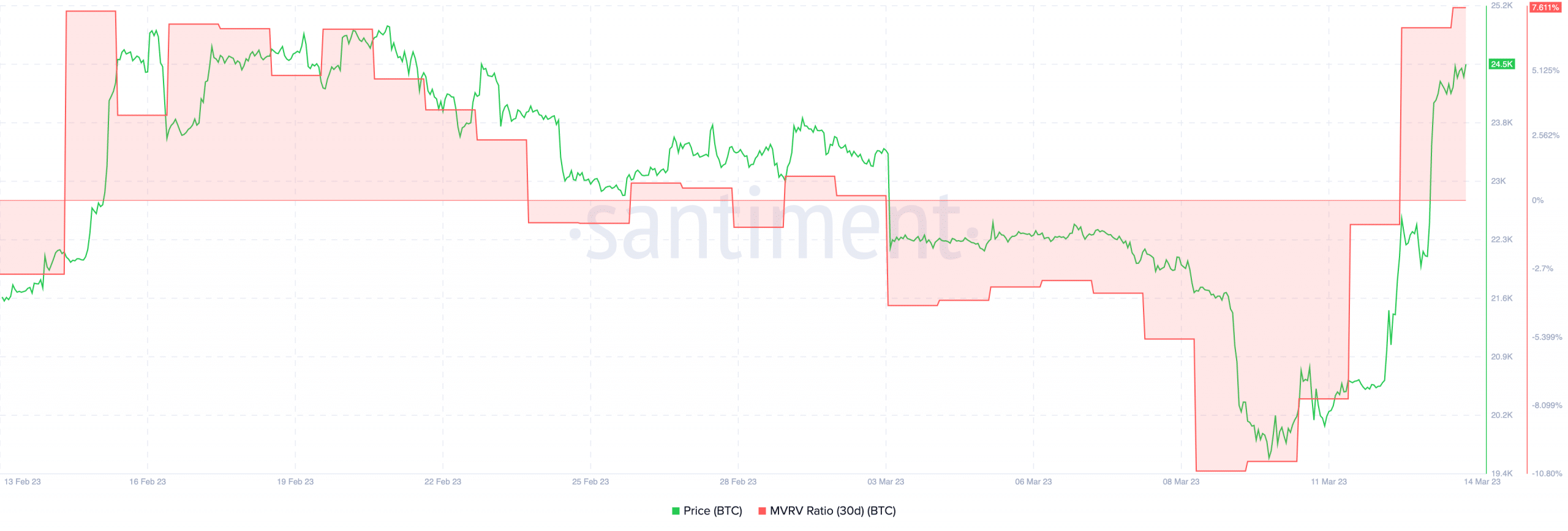

According to Santiment, the MVRV ratio for BTC has hit a new high over the last few days. This suggested that a vast majority of BTC holders could sell their coins for a profit.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Source: Santiment

Even though long-term holders may not be as incentivized to sell their holdings, many of the short-term holders that are still active could end up exiting their positions.

This could drive BTC’s prices down and give new investors an opportunity to buy BTC at an attractive rate.

Source: glassnode

![Want to get in on Bitcoin [BTC]? Here’s the long and short of it all](https://patrolcrypto.com/wp-content/uploads/2023/03/FrICKPMaQAA70cX.jpeg)