- Uniswap had the highest network penetration among major DEXes on Ethereum.

- UNI was the most widely held token by top Ethereum whales, at the time of writing.

Uniswap [UNI], the largest decentralized exchange (DEX) by trading volume, made promising gains since the start of 2023. In fact, the native token recorded a growth of 44% on a year-to-date (YTD) basis until mid-February, after which market uncertainties got the better of the coin.

Against this backdrop, a blockchain analytics firm, Messari, stated that Uniswap had the highest ‘network penetration’ among major DEXes on Ethereum [ETH].

Network penetration, which measures the number of users that interacted with a protocol out of its total user count, was 46% for Uniswap at the time of writing, well over other DEXes like Sushiswap [SUSHI] and Curve Finance [CRV].

1/ With increased competition across #ethereum, @optimismFND, & @arbitrum, can @Uniswap maintain its dominance?

To measure market share and growth potential, we analyze ‘network penetration’, which compares a particular protocols engaged users to a network’s total user count.???? pic.twitter.com/26m9jZweDf

— Messari (@MessariCrypto) March 9, 2023

The analysis also pointed out that despite the entry of more competitors, Uniswap’s network penetration continued to increase and even eclipsed the user growth on Ethereum from July 2020 to July 2021.

Read Uniswap’s [UNI] Price Prediction 2023-2024

Trading activity slows down

Uniswap was the preferred automatic market maker (AMM) after the FTX contagion as users rushed towards DEXes to secure their funds. The start of 2023 saw a sharp increase in the trading activity on the protocol with the volume reaching its peak in February.

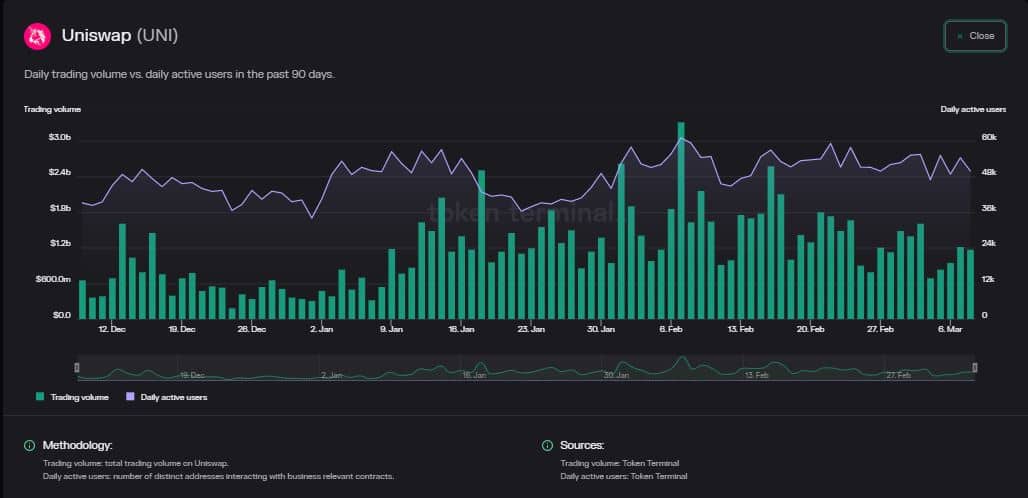

However, as regulator uncertainties and liquidity crisis came back to bite the crypto markets, Uniswap too felt the pinch. Since mid-February, the trading volume halved until press time while the daily active users fell by more than 18%, as per Token Terminal.

Source: Token Terminal

On the total value locked (TVL) front too, Uniswap faced a decline. In the last seven days, the TVL declined by nearly 10%, which was among the biggest drops among major DEXes.

Source: DeFiLlama

UNI remains the first preference of Whales

On the other hand, as per user distribution trends across DEXes, Uniswap managed to retain the majority of different user segments, including a retention rate of 80% for whales.

This was backed up by data from WhaleStats which showed that UNI was the most widely held token by top Ethereum whales at the time of writing.

Realistic or not, here’s UNI’s market cap in BTC’s terms

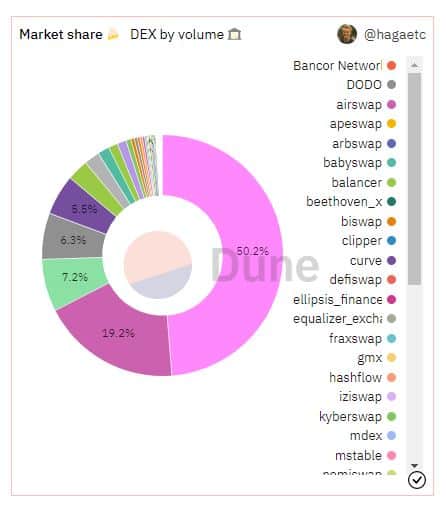

According to Dune Analytics, Uniswap accounted for half of the total DEX volume in the last seven days at press time.

In the last 24 hours, however, it lost its place to Sushiswap, which generated more than $1.9 billion in volume as compared to Uniswap’s $1.7 billion.

Source: Dune Analytics

![Uniswap [UNI] surpasses SUSHI and CRV on this front](https://patrolcrypto.com/wp-content/uploads/2023/03/Uniswap-3-4-1024x496.jpg)