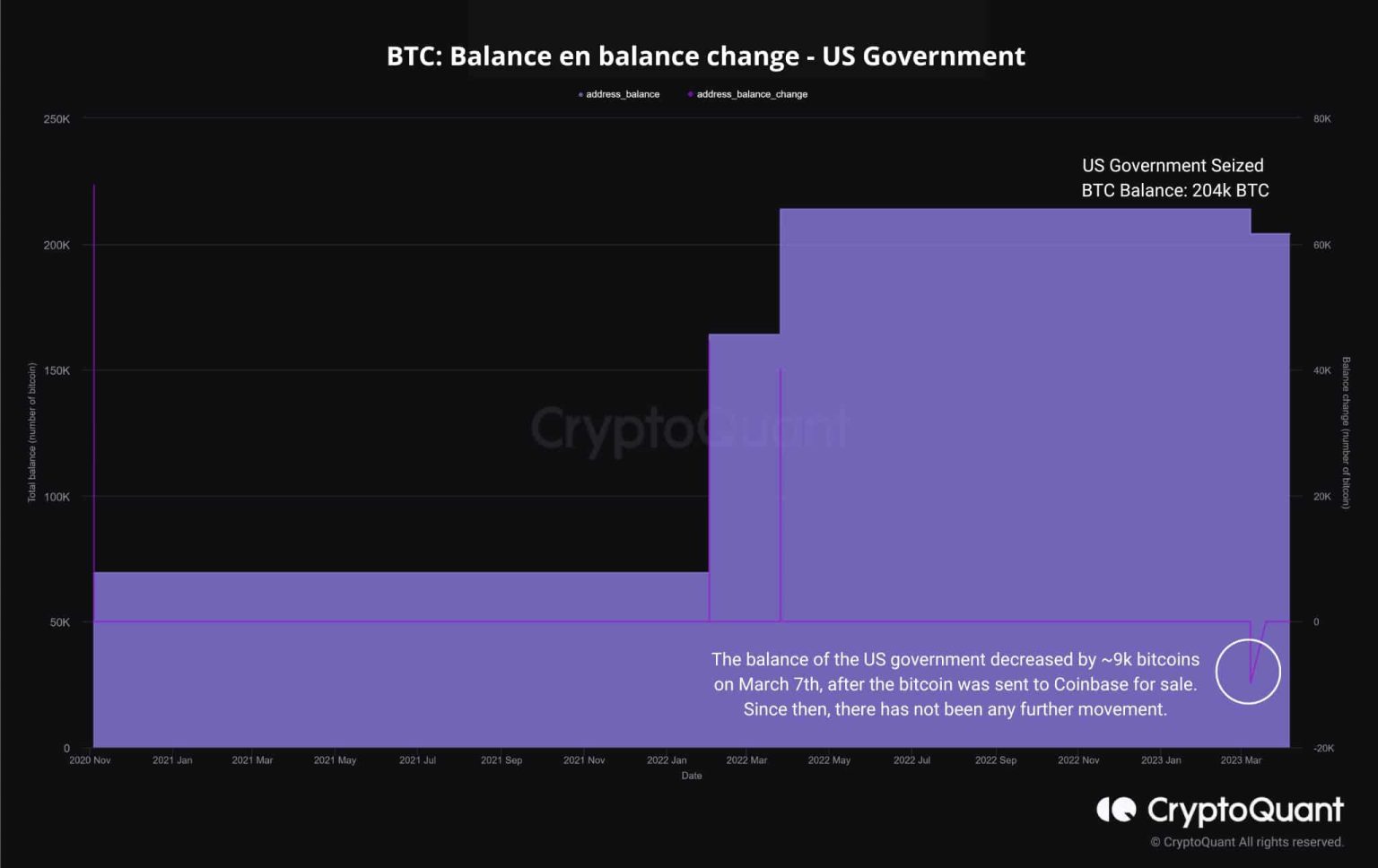

– The U.S government made plans to sell its BTC holdings over the next year.

– Markets can be impacted temporarily due to these sell-offs, but currently, traders remain optimistic.

The U.S. government has been very critical of the crypto space over the past few months. The regulatory issues surrounding the space, coupled with scams that have impacted the general population, have made the U.S. government more cynical about the cryptocurrency market and Bitcoin [BTC].

Read Bitcoin’s [BTC] Price Prediction 2023-2024

U.S. to sell off its BTC holdings

The cynicism is one reason why the U.S. has decided to sell off its BTC holdings. The government acquired these Bitcoins through three cases. They include the Mt.Gox scandal, the Bitfinex hack and the seizure of Bitcoin from James Zhong.

The U.S. government now has just 41,491 BTC as some were sold earlier this year on 14 March. The remaining coins will go through a sale in four batches later in the year.

According to Maartunn, a market viewer with CryptoQuant, if we divide the number of days in a year by the number of batches, we get 73 days. Interestingly, the first batch was sold on day 73 of 2023.

If a selling pattern arise from the U.S. government, we may see sales of the remaining batches every 73 days. And this may have a negative short-term impact on BTC prices, allowing short sellers to potentially profit.

Source: CryptoQuant

However, traders did not exhibit any bearish behavior at press time. Glassnode’s data further revealed that even with the increasing prices, the put-to-call ratio for Bitcoin has dropped. This suggests that there are more call options than put options on exchanges at press time.

Additionally, a spike in number of call options also suggests a belief amongst traders that Bitcoin’s price will continue to rise.

Source: Glassnode

Some “Mine”r issues

Even though traders were observed to be optimistic about Bitcoin’s future, the same couldn’t be said about the miners. According to Glassnode’s data, the Miner Outflow Multiple has reached a 1-month high. This indicates that miners have been selling the majority of the BTC that they mined.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Moreover, the plunge in fees earned by miners is a contributing factor to this situation. Data from Blockchain.com shows that the total fees generated from transactions have dropped from $1.2 million to $653,210 in recent weeks.

It remains to be seen whether rising selling pressure on miners will have a significant impact on BTC’s prices going forward.

Source: Blockchain