- TRON confirmed that it sided with the idea of taxing cryptos if it supported healthy growth.

- The latest FOMC meeting could result in TRX’s upside.

The harsh events of the crypto market in 2022 have certainly called for a deeper focus on regulation. As a result, this will allow governments to implement taxes for the crypto market. Similarly, the TRON [TRX] network confirmed that it was open-minded to the idea of taxing cryptocurrencies if it would help the industry grow in the right direction.

Is your portfolio green? Check out the TRON Profit Calculator

TRON’s stance on cryptocurrency taxation highlighted the network’s interests in a direction that was perhaps best for the entire industry. However, it may also be guided by the network’s plans.

????Exciting news! As governments recognize the growing importance of #crypto!

Here in #TRON, we welcome fair and transparent regulations and look forward to continued growth and innovation in the space.???? #TronNetwork supports the taxation of cryptocurrencies.????#TRX #TRONICS https://t.co/mxhbvCmyqU

— TRON DAO (@trondao) February 1, 2023

Lark Davis noted that China had backtracked from its previous stance, which leaned towards a zero-tolerance policy on crypto. Instead, the Asian country now appeared to be embracing a softer approach and a tax policy that underscored regulation. A potential motivation for this was that TRON recognized the potential for WEB3 growth in China.

TRON has not made any official announcements regarding its plans for China. However, the fact that it responded to China’s policy change on cryptocurrencies. In other words, TRON’s potential interest in China remained within the realm of speculation.

Assessing TRX’s health

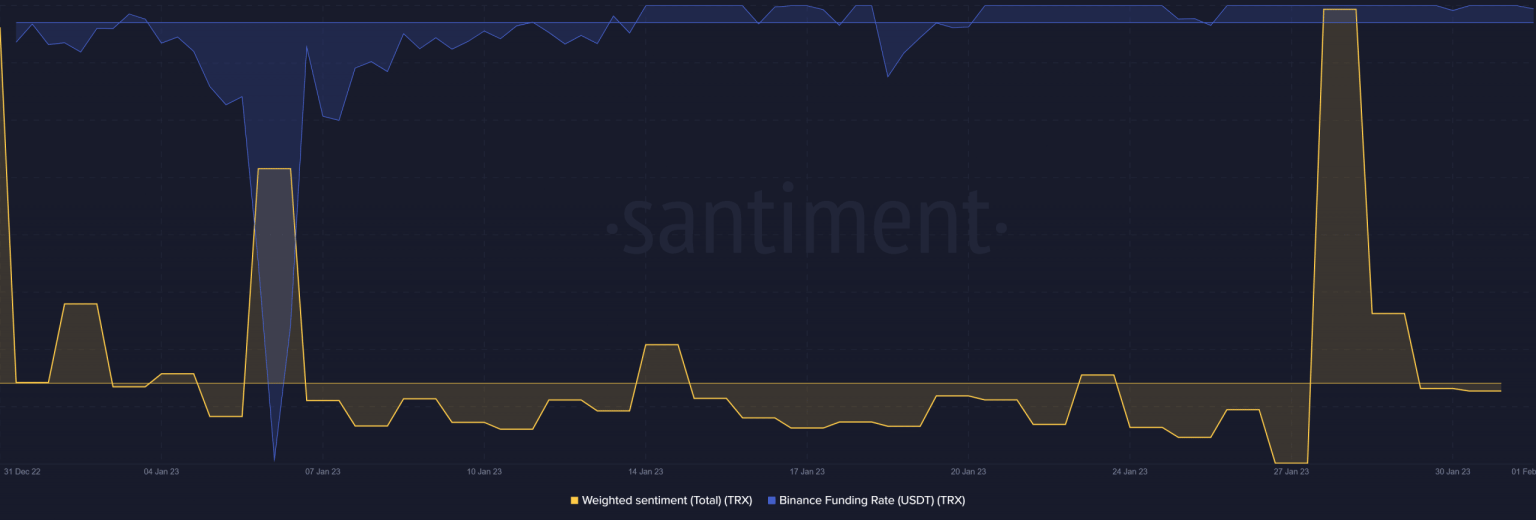

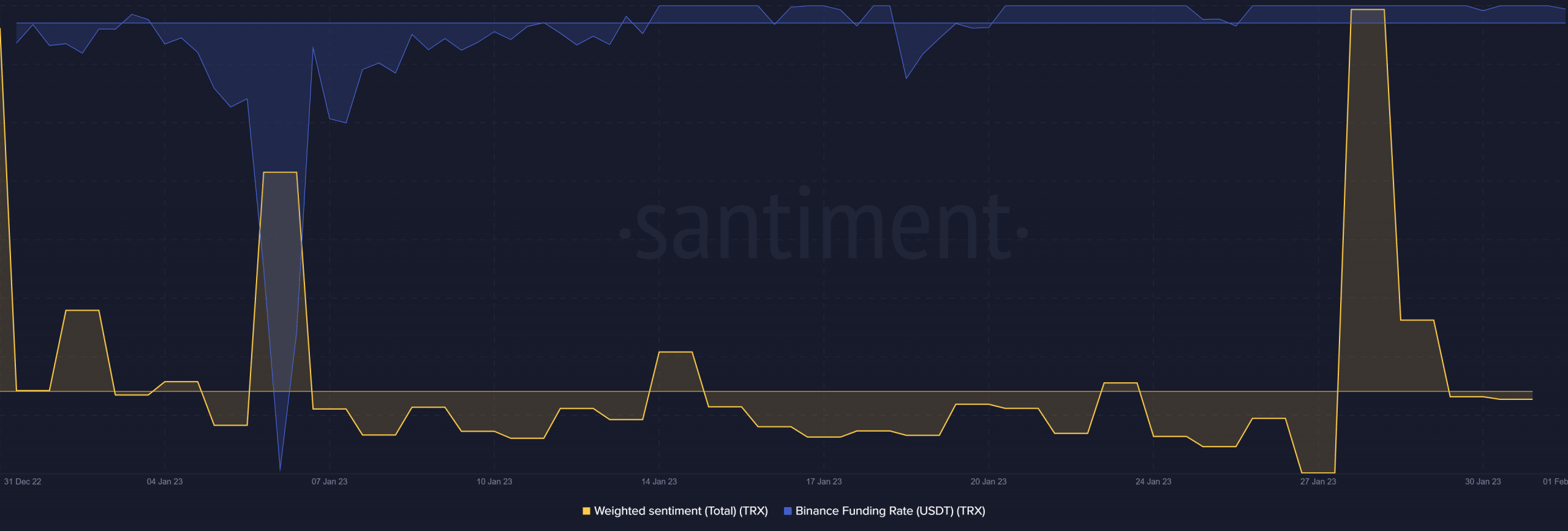

Speaking of speculation, the demand for TRON’s native cryptocurrency TRX has tanked in the last few days. This reflected the drop in investor sentiment due to uncertainty about the market direction ahead of the FOMC meeting.

Source: Santiment

Despite the shift in investor sentiment in favor of the bears, the Binance funding rate held on quite well. This suggested that there was low sell pressure from the derivatives market, which could explain why TRX maintained some resistance against the bears.

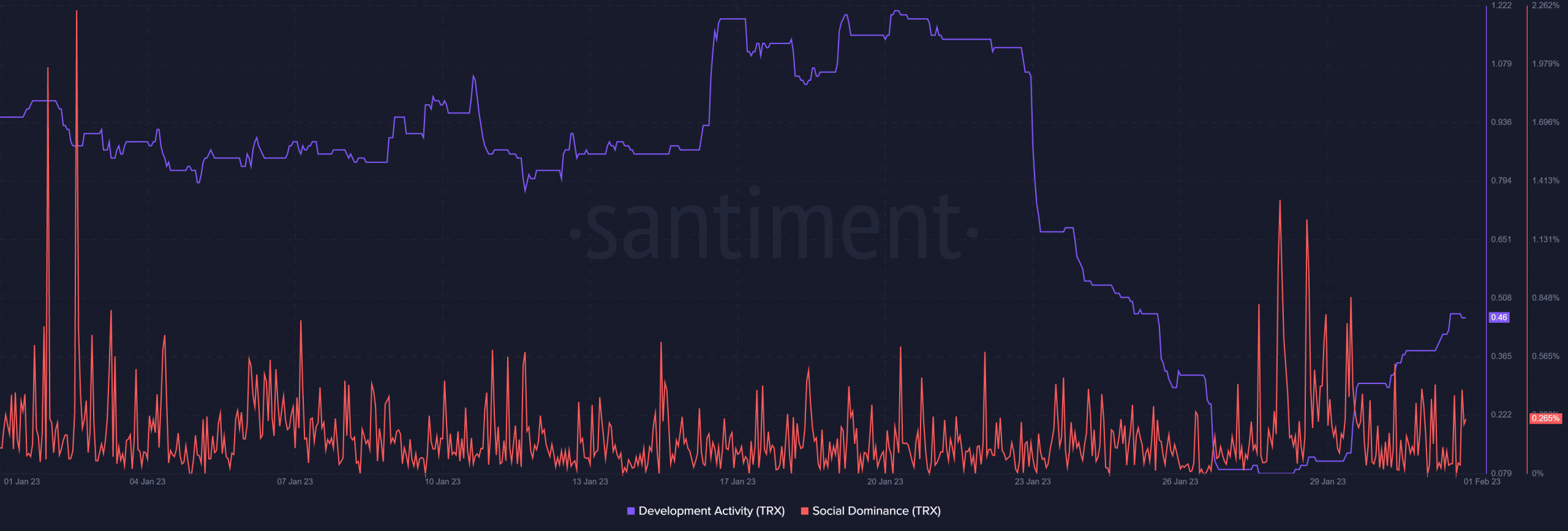

TRON registered a drop in development activity to the lowest four-week levels in the third week of January. However, it concluded the month with a resurgence in development activity in the last few days. Perhaps this encouraged a more favorable sentiment.

Source: Santiment

How many are 1,10,100 TRXs worth today?

Unfortunately for TRX, the social volume metric was low at press time, suggesting that the level of market visibility is still relatively low. In other words, it could not secure enough liquidity to support a price uptick. TRX has, until press time, remained above the 200-day moving average for the last 2 weeks.

Source; TradingView

There could be a bit more upside from TRX this week courtesy the latest FOMC event. The FED hiked rates by 25 BPS, which was in line with expectations. Investors may see this as a bullish outcome. However, the level of impact on the price depends on the subsequent level of demand and whether the FED’s announcement was priced in.