The Stoner Cats NFT project, co-founded by renowned actress Mila Kunis, has encountered trading limitations on some of the most prominent NFT marketplaces, including OpenSea, Blur, and Rarible. This decision arrives shortly after the United States Securities and Exchange Commission (SEC) brought charges against the creators of the project, accusing them of the sale of unregistered securities.

Backstory: The Rise of Stoner Cats NFTs

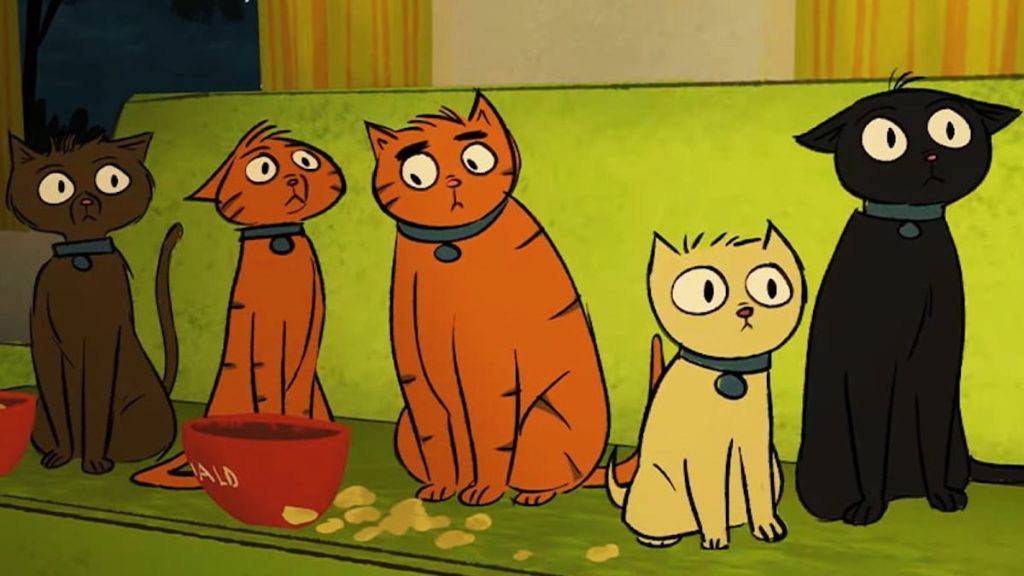

Initially introduced to the public in 2021, the Stoner Cats NFTs, tied to an animated series featuring a roster of prominent celebrities, gained rapid traction among collectors and investors. These digital assets, built on the Ethereum blockchain, were widely accessible for trading on a variety of platforms. As of July 2021, the project had reported impressive sales, with over 10,420 NFT passes sold, leading to a collection of over $8 million from their initial sale.

However, the recent regulatory scrutiny by the SEC has led to a temporary setback for the project. Both OpenSea and Blur, recognizing the legal implications, have paused active listings associated with Stoner Cats NFTs. Similarly, Rarible has opted for a cautious approach by delisting the project altogether.

Despite these developments, it’s crucial to note that the NFTs have not vanished. They continue to reside securely on the blockchain, remaining in the digital wallets of their respective holders. Platforms such as LooksRare and X2Y2 have chosen to list them, enabling current owners to trade them if desired.

SEC’s Involvement and Its Impact on the Market

The SEC’s intervention in this matter can be perceived as a sign of the regulatory body’s growing interest in overseeing the rapidly evolving NFT space. Post the allegations, the creators of Stoner Cats opted for a settlement. They concurred to pay a civil fine of $1 million, a substantial sum that will be directed towards establishing a Fair Fund. This fund is intended to facilitate the reimbursement of investors.

An interesting market dynamic emerged following the SEC’s announcement. While some might have expected the value of Stoner Cats NFTs to plummet given the legal quandary, the opposite transpired. The market witnessed an uptick in the sales volume of these NFTs. Moreover, the prices of these digital assets also saw a noteworthy rise.

The unfolding of these events underscores the importance of regulatory clarity in the ever-evolving domain of NFTs. As the space continues to expand and attract substantial investments, ensuring investor protection and compliance with established securities laws becomes paramount.

Conclusion

The Stoner Cats scenario serves as a pivotal case study, highlighting the complexities and nuances associated with the NFT market. While the project has faced challenges, its resilience in the market post the SEC’s intervention is indicative of the robust demand and interest in NFTs among digital collectors and investors alike.