Solana has consistently remained among the most popular blockchains. It keeps attracting both users and developers thanks to its speed, lower transaction fees compared to Ethereum and Bitcoin, and overall interest from projects and companies. Today, we’re taking a look at Solana projects with the highest potential for 2026.

Before we begin, take a moment to learn What Is Solana.

The Solana Blockchain’s Liquidity & Trading Layer

The liquidity and trading layer on Solana is where tokens are bought, sold, and swapped. It includes decentralized exchanges (DEXs), liquidity pools, and trading tools that let users trade assets quickly and at low cost. Because Solana processes transactions fast and with minimal fees, this layer supports smooth trading, deep liquidity, and real-time price discovery for projects built on the network.

Jupiter (JUP)

Jupiter is a leading Solana aggregator that gathers information across multiple decentralized exchanges in one place. Jupiter users get access to the most profitable trading prices and instead of having to check different platforms, they can swap tokens with low fees and minimal slippage in a single interface. Beyond simple swaps, Jupiter also offers advanced tools like limit orders, dollar-cost averaging, perpetual futures, and lending, making it a full-featured DeFi hub. Its native token, JUP, is used for governance, letting the community vote on upgrades and treasury decisions. Jupiter is interesting for users and investors alike, because it combines fast Solana performance with deep liquidity, active community participation, and a growing range of financial tools.

Check out our Jupiter (JUP) price prediction.

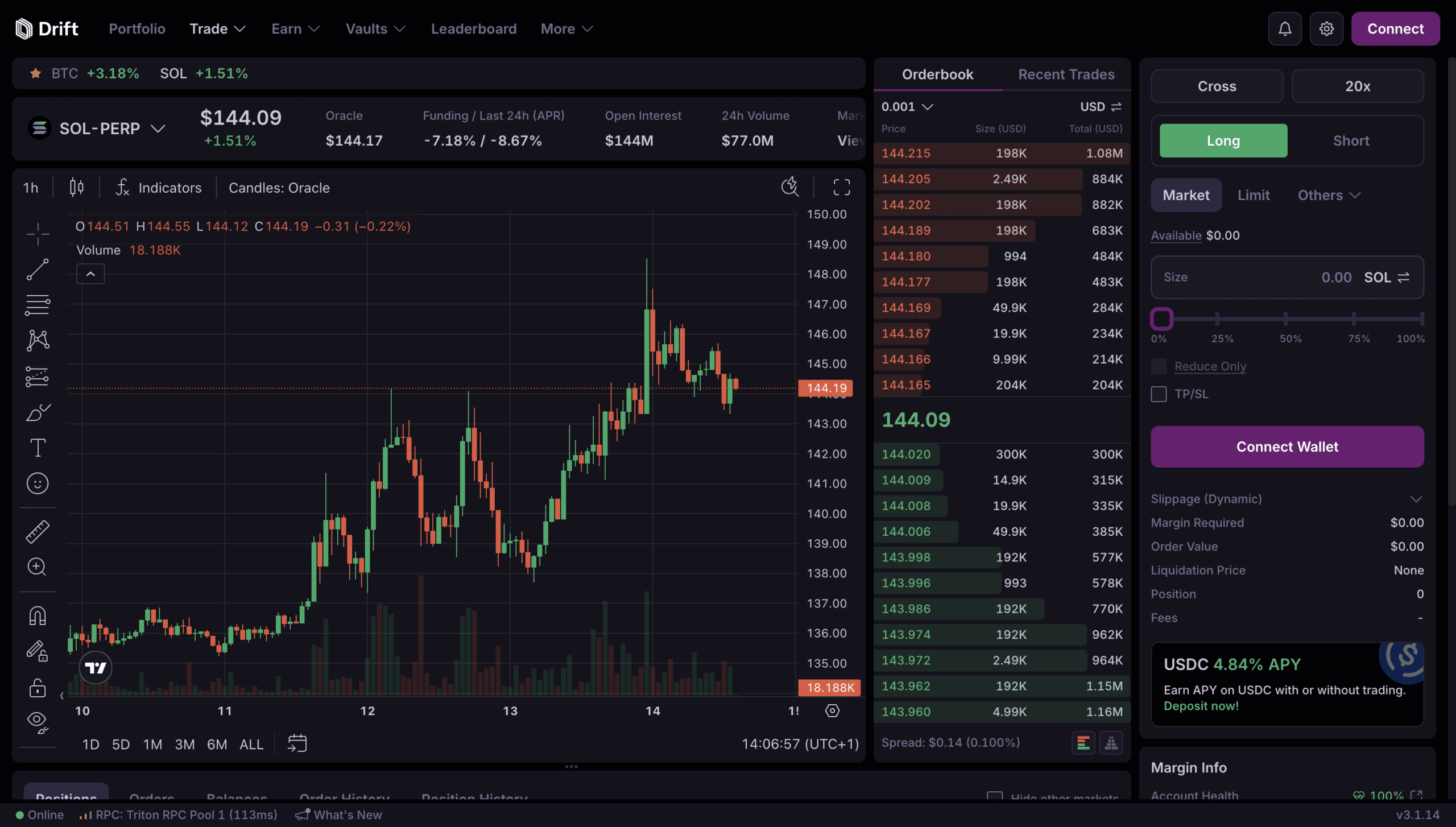

Drift (DRIFT)

Drift is a decentralized exchange on Solana that focuses on fast, on-chain derivatives trading. This means you can buy contracts that derive their value from an underlying asset, such as a cryptocurrency. Drift lets users trade perpetual futures and spot crypto assets while using different tokens—not just stablecoins—as collateral. Solana’s high throughput and low fees guarantee that trades execute quickly with minimal slippage.

Drift combines an order book with an automated market maker, so you get liquidity and efficient pricing. The platform’s native token, DRIFT, is a governance token that also offers staking rewards and fee discounts. For its users, Drift provides advanced trading tools with low transaction costs. For investors, it stands out as one of the top Solana projects driving steady growth in the decentralized space.

Check out our Drift (DRIFT) price prediction.

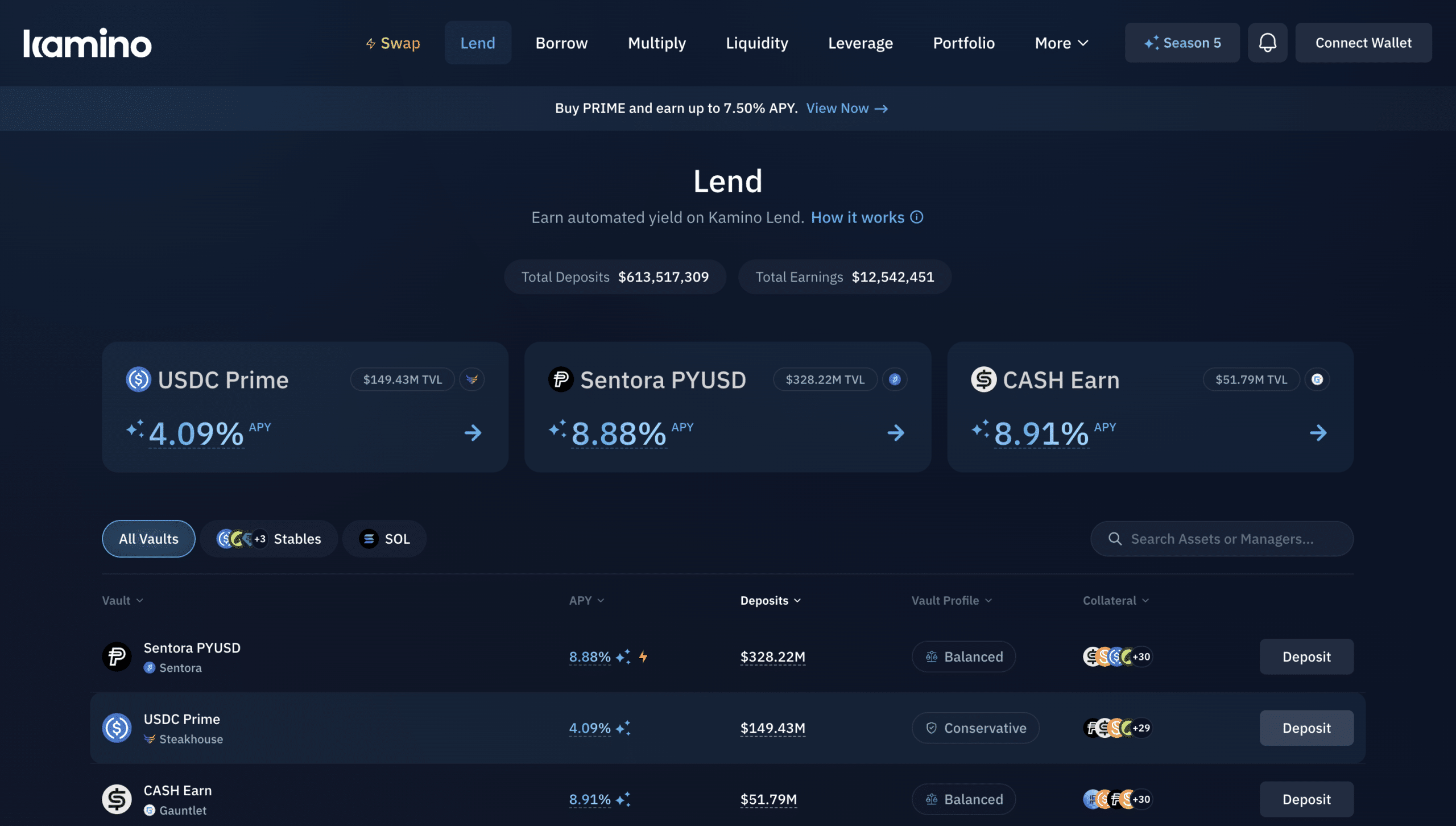

Kamino Finance (KMNO)

Kamino is a Solana-based protocol that offers automated lending and borrowing. It also provides liquidity solutions and tokenized real-world assets, with the plans to move into institutional finance.

Kamino makes DeFi easier to use for both everyday users and institutions. By automating strategies like yield farming and liquidity provision, it allows users to earn passive returns through simple vaults instead of managing trades themselves. Kamino also offers lending tools, including fixed-rate loans and borrowing against digital assets and tokenized real-world assets. Its native token, KMNO, supports decentralized governance and staking rewards. Kamino offers an intuitive interface and low fees for users. For investors, it stands out among the highest-ranked Solana projects by combining retail DeFi with enterprise-grade solutions in a growing ecosystem.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

Yield & Staking in the Solana Ecosystem

Yield & staking is a core layer of the Solana ecosystem focused on helping users earn passive income from their digital assets. These protocols let users lock tokens into liquidity pools, staking contracts, or yield farming strategies, in exchange for staking rewards. They benefit from Solana’s high performance and throughput, making frequent rewards practical.

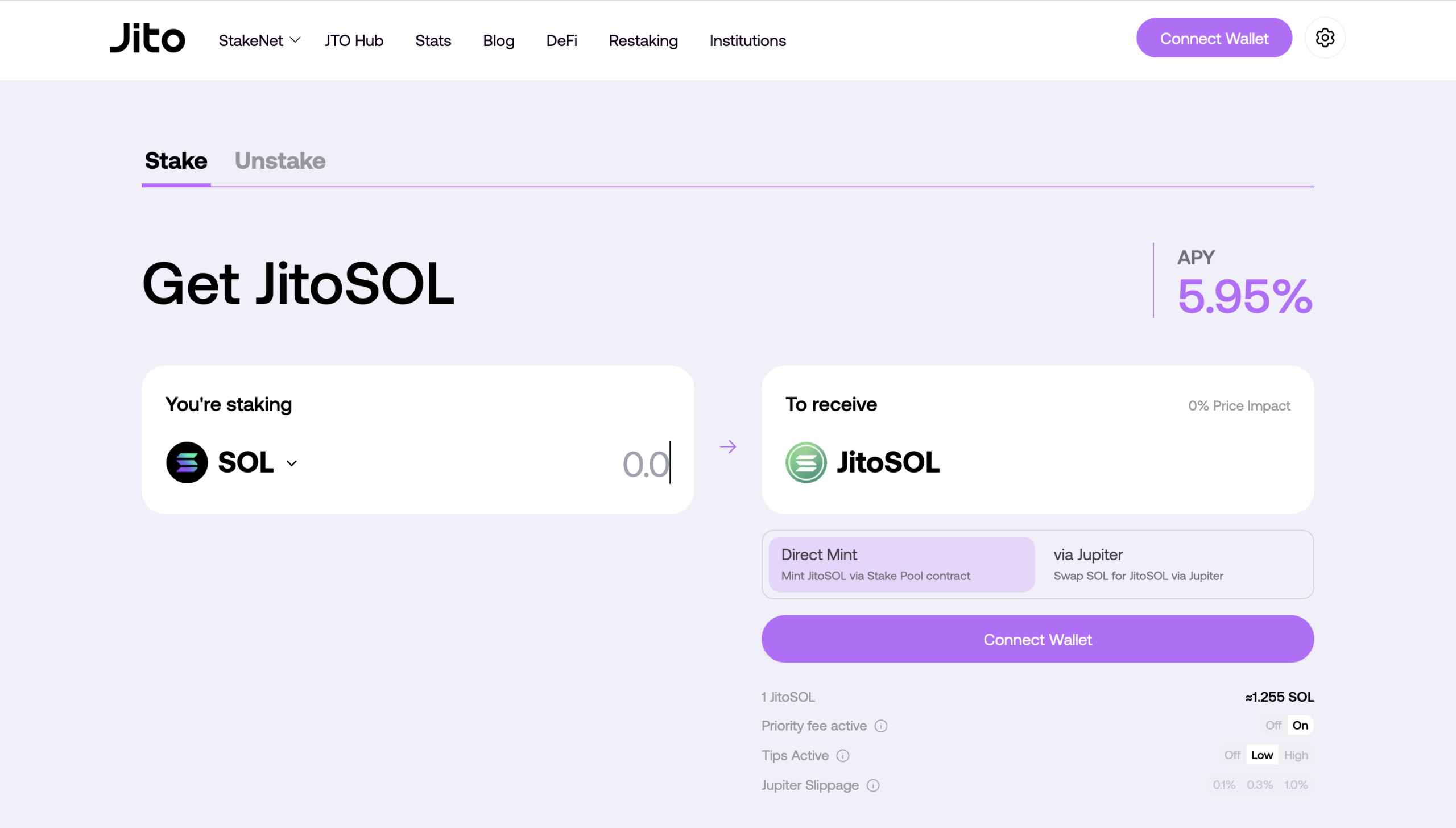

Jito (JTO)

Jito is a protocol on Solana that optimizes staking rewards for users. It’s done through redistributing maximal extractable value to users while maintaining liquidity through its staking token, JitoSOL.

It’s one of the best Solana projects focused on making staking more efficient and rewarding. Jito lets users stake SOL and receive JitoSOL, a liquid token that can be used across decentralized applications like liquidity pools and yield farming. This means users earn staking rewards while keeping their assets flexible. Jito also redistributes MEV rewards back to stakers instead of validators, boosting yields. For investors, Jito stands out thanks to its strong role in the Solana ecosystem, DAO-based governance with a native governance token (JTO) and a growing track record in Solana protocols.

Check out our Jito (JTO) price prediction.

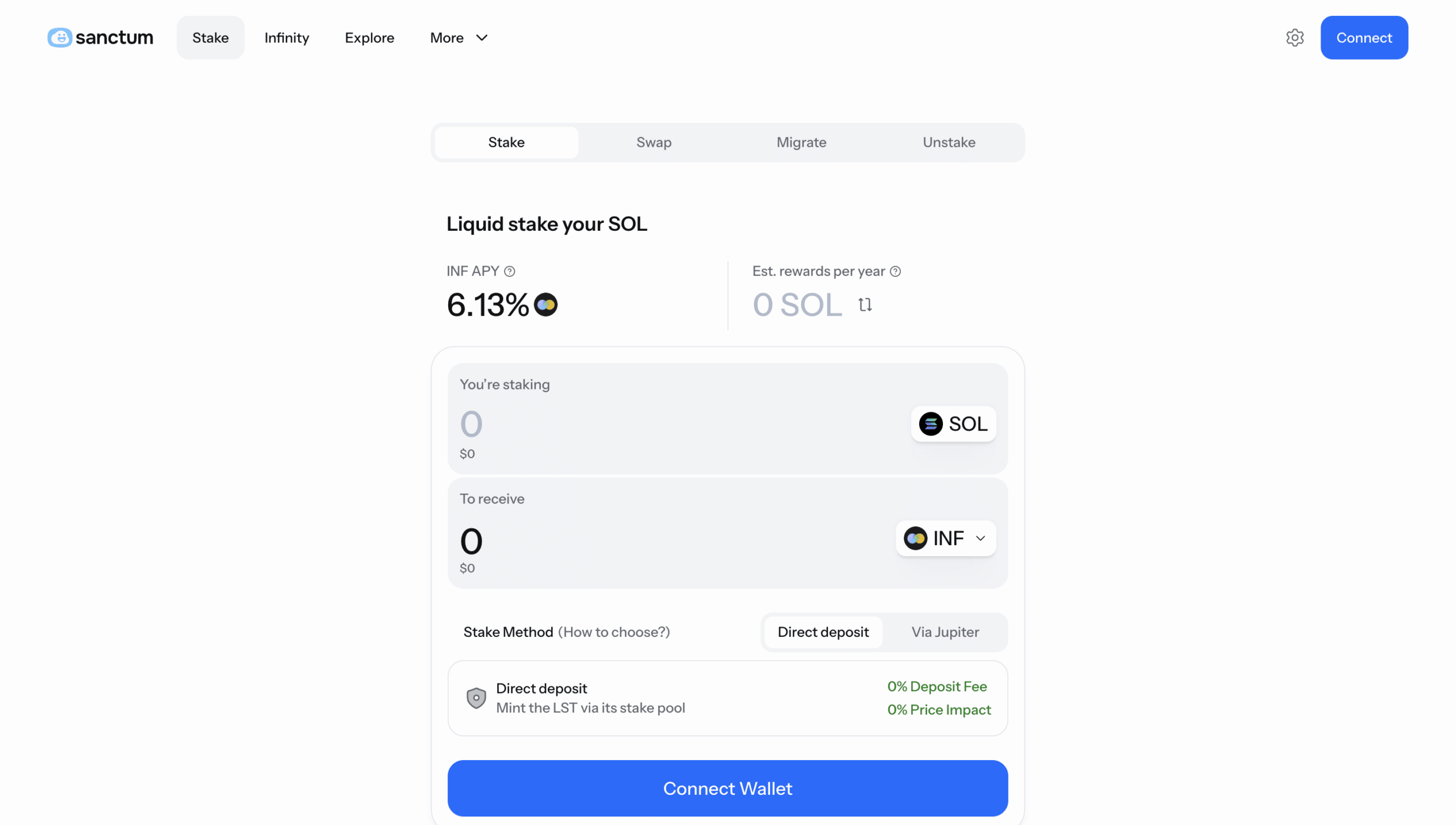

Sanctum (CLOUD)

Sanctum is a project that provides infrastructure for building liquid staking tokens (LSTs), making staking more flexible and user-friendly. Instead of locking SOL with a single validator, users receive LSTs that keep earning staking rewards while remaining usable across decentralized applications, liquidity pools, and token swaps. Sanctum powers LSTs for major Solana ecosystem projects like Bonk, Jupiter, and Drift, showing strong community support and real adoption. Its governance token, CLOUD, gives users a voice in protocol decisions and incentives. For investors, Sanctum is attractive due to Solana’s advantages over other chains and growing demand for staking rewards and DeFi protocols.

Top Solana Projects in Data & Infrastructure

The Data & Infrastructure layer on Solana supports the tools and systems that decentralized applications rely on to run smoothly. These projects provide fast data access, reliable indexing, analytics, and backend services that help the protocols, NFT marketplaces, and token swaps work at scale. This layer is attractive for enterprise solutions and new projects. Strong infrastructure improves security, supports high-frequency trading, and boosts overall platform development.

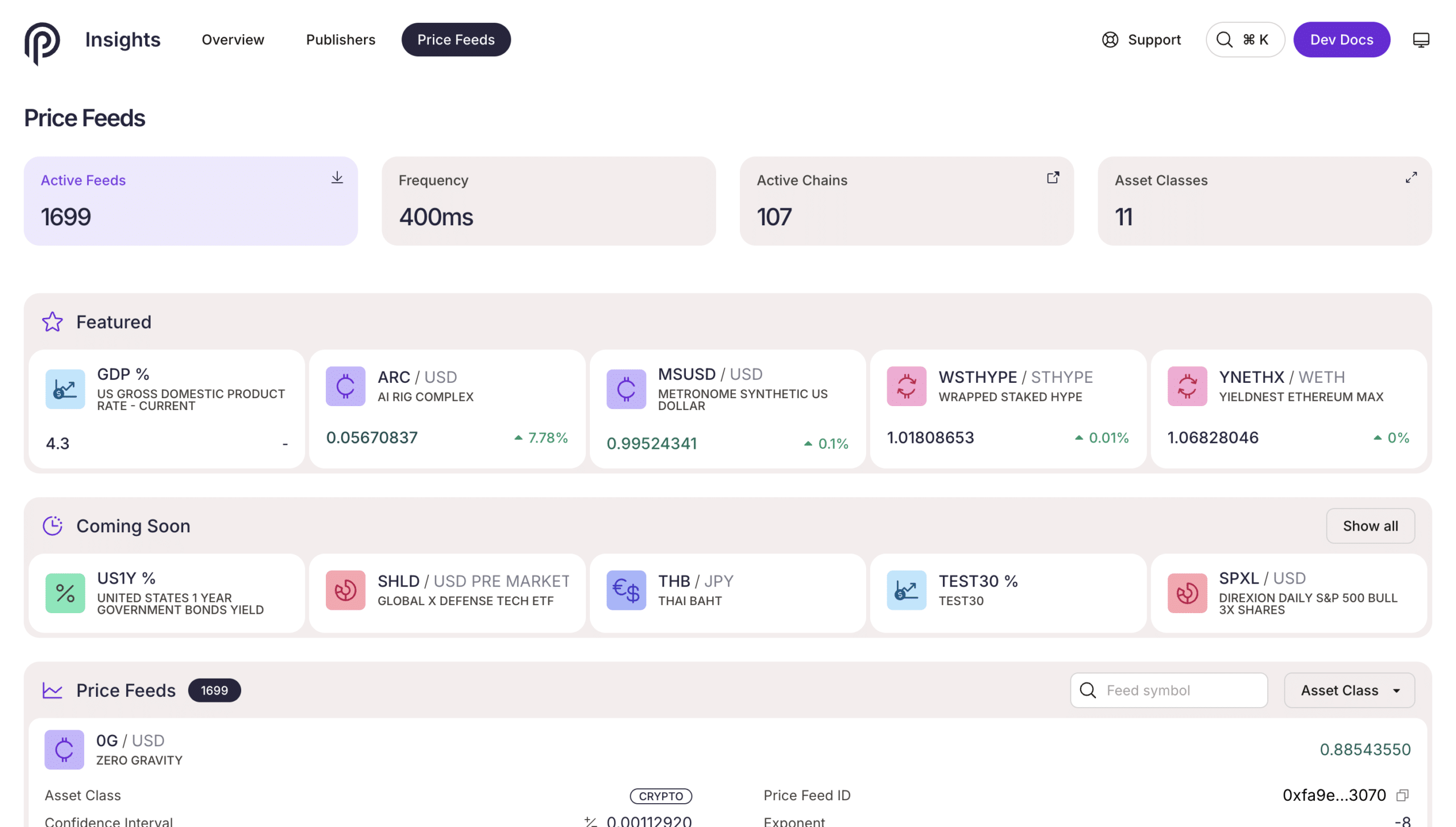

Pyth Network (PYTH)

Pyth is an oracle Solana project that delivers fast, reliable price data. It provides real-time market data for crypto, equities, and commodities, sourced directly from major trading firms and exchanges. This reduces delays and errors that can harm DeFi protocols. Pyth updates prices in near–real time and only uses resources when data is requested. For users, this means safer and more accurate DeFi apps. For investors, Pyth’s role as core infrastructure in the Solana ecosystem makes it an attractive long-term project.

Check out our Pyth Network (PYTH) price prediction.

Real-World & DePIN on Solana

The Real-World & DePIN layer connects blockchain technology with real-life infrastructure and services. Projects in this part of the ecosystem use the high-performance Solana blockchain to power decentralized networks for things like data, hardware, mobility, and physical services. These Solana projects can scale to real-world use cases while staying accessible to users and businesses. For investors, this layer is interesting because it expands decentralized finance beyond apps and tokens into tangible value. It also encourages strong community engagement and supports enterprise solutions built on Solana’s network.

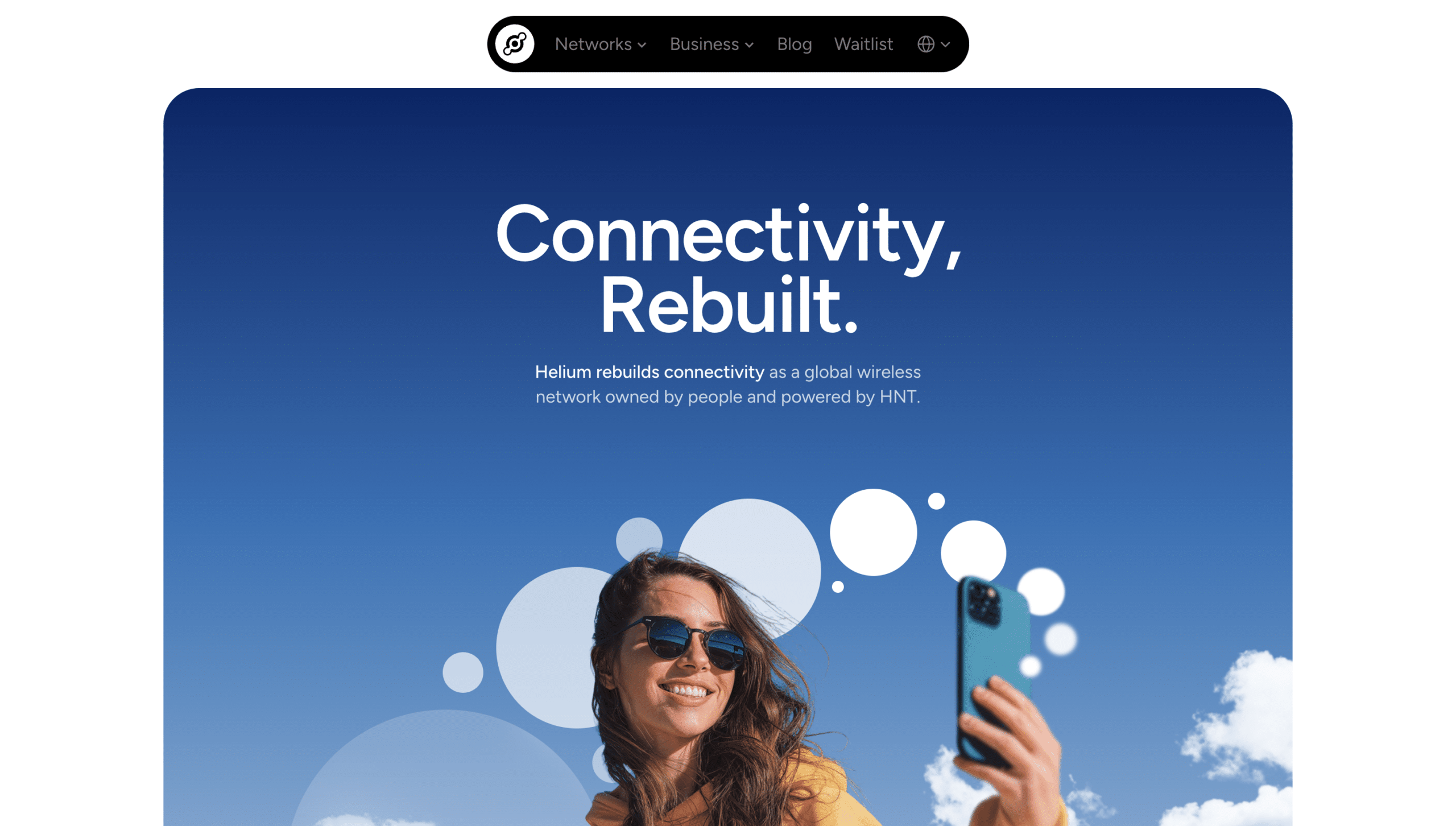

Helium (HNT)

Helium is a decentralized network that lets people build and run wireless infrastructure instead of relying on traditional telecom companies. Users set up Hotspots that provide coverage for IoT devices, 5G, and WiFi, and earn HNT tokens for supporting the network. After moving to the Solana network, Helium benefits from high throughput and low fees, making rewards faster and cheaper to distribute. Its proof-of-coverage system verifies real network usage, not just speculation. For users, Helium offers a way to earn tokens by contributing hardware. For investors, it’s interesting because it targets real-world connectivity with clear demand, strong community support, and long-term token supply limits.

Check out our Helium (HNT) price prediction.

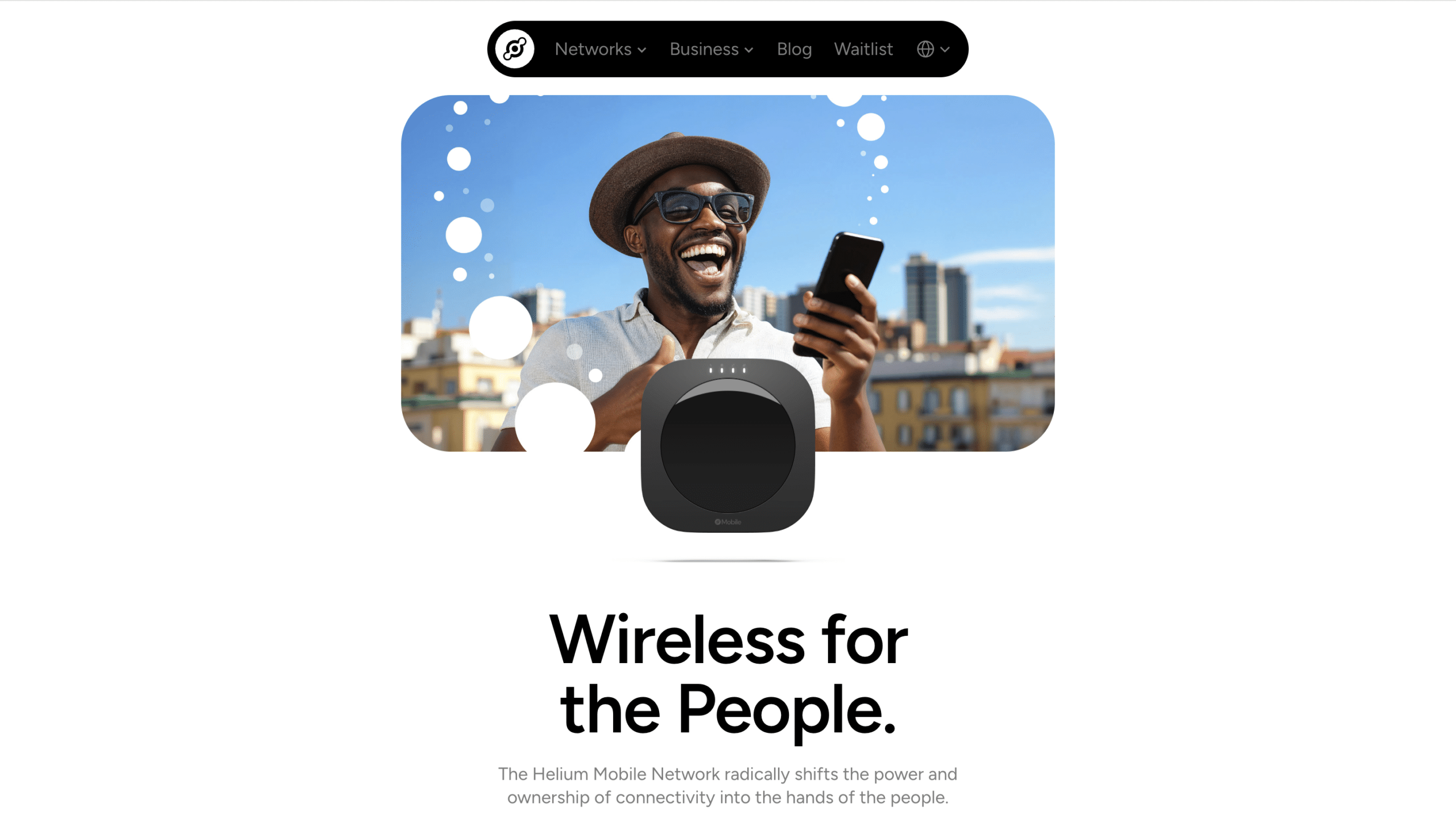

Helium Mobile (MOBILE)

Helium Mobile is a decentralized wireless network that lets people help build 5G coverage and earn MOBILE tokens in return. Users avoid big telecom companies by deploying Hotspots or validating coverage through an innovative consensus mechanism called proof-of-coverage. Helium Mobile makes rewards and data transfers efficient thanks to the advantages of the Solana network. The project aims to lower mobile costs for users while expanding coverage to underserved areas. For investors, Helium Mobile stands out by targeting real-world telecom demand, growing network usage, and a token model tied to actual data consumption rather than hype.

Check out our Helium Mobile (MOBILE) price prediction.

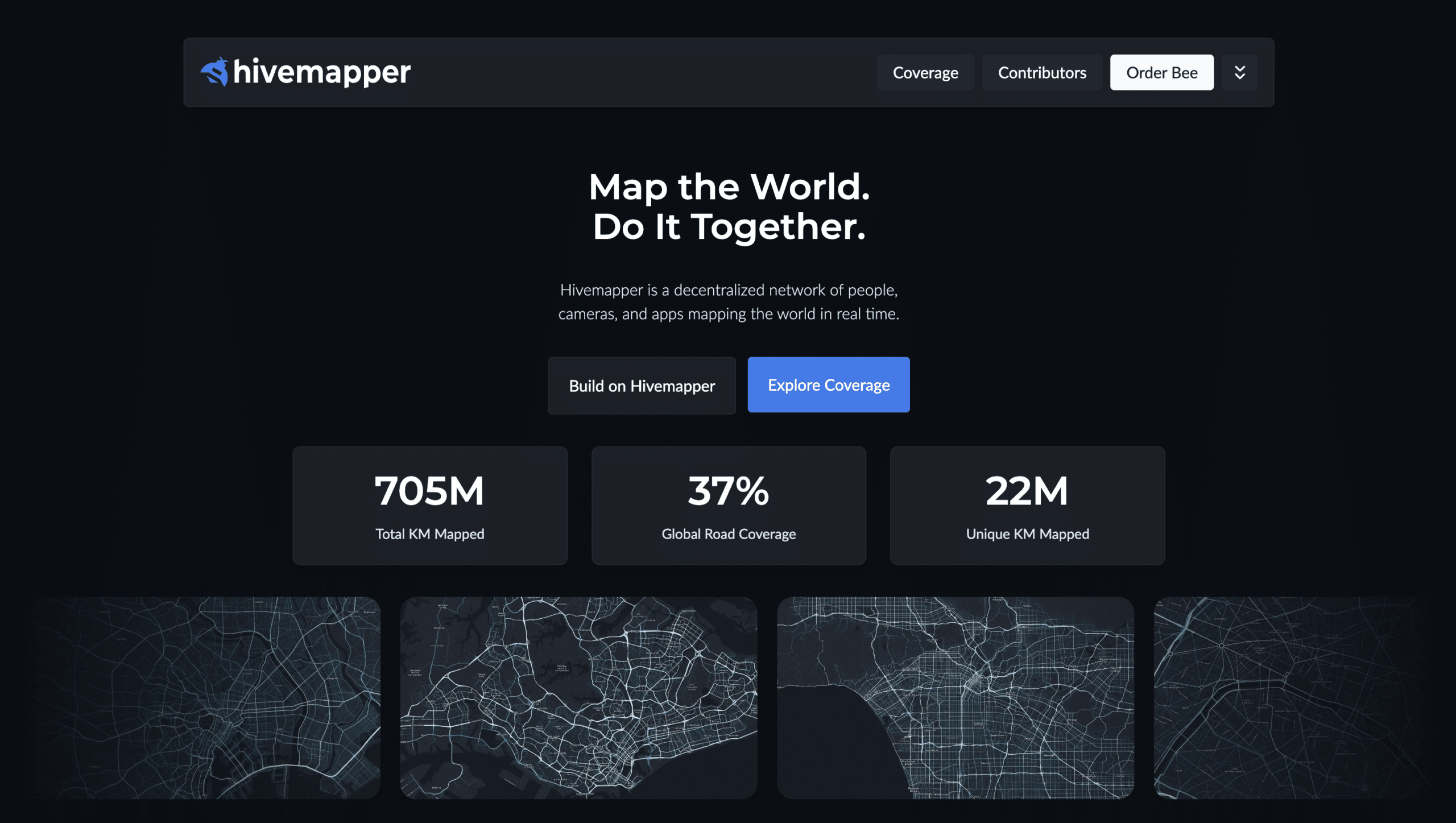

Hivemapper (HONEY)

Hivemapper is a decentralized mapping project that rewards users for collecting real-world road data. Contributors use AI-powered dashcams to capture images while driving and earn HONEY tokens for verified data. Hivemapper offers fast and efficient rewards. Companies burn HONEY tokens to access fresh, real-time maps, linking token demand to real usage. For users, it turns everyday driving into profit, while investors can take advantage from the token model being tied to enterprise demand and real-world utility.

Check out our Hivemapper (HONEY) price prediction.

Tokenized Real Estate within Solana

Tokenized Real Estate on Solana brings property ownership onto the blockchain by turning real estate into digital tokens or non-fungible tokens (NFTs). These projects let users buy, sell, or trade fractional property shares on attractive platforms with lower barriers than traditional real estate. Solana supports both high trading volume and smooth access, while tokenized real estate blends decentralized finance (DeFi) with real-world assets, offering various benefits like global access to those looking beyond digital art or in-game assets.

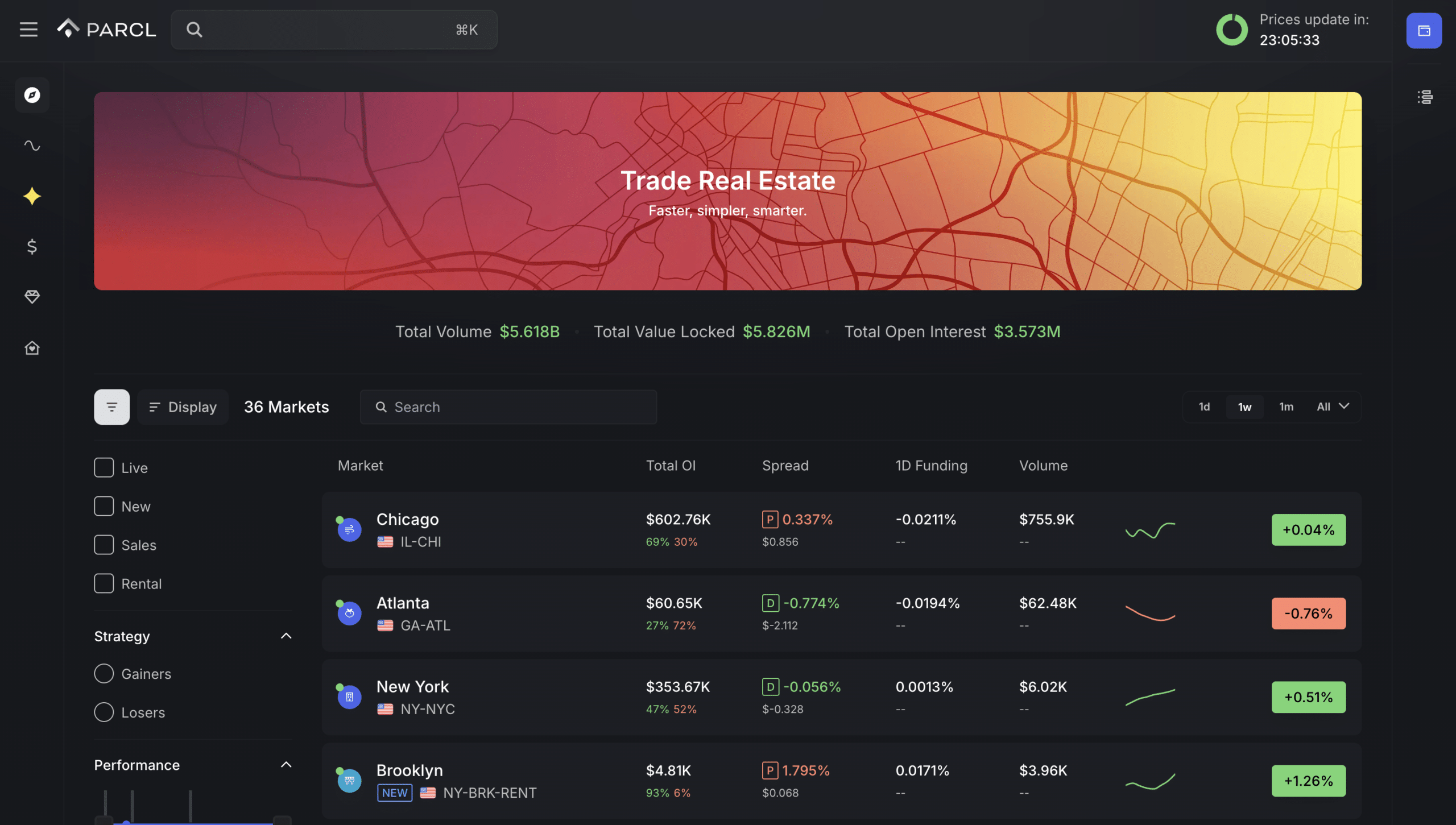

Parcl (PRCL)

Parcl is a decentralized finance (DeFi) project built on Solana where users trade synthetic assets that track real-world home prices in specific locations. It gives them on-chain exposure to real-estate markets without the need to buy property, which means lowering entry barriers, improving liquidity, and removing geographic limits. Parcl offers fast trades, liquidity pools, staking, and governance through the PRCL token. It’s a new way to access real estate trends for users, while for investors, Parcl is worth considering as it connects crypto markets with real-world assets and growing tokenized finance.

The Solana Ecosystem’s Culture & Speculation Layer

This layer covers projects driven by trends, memes, NFTs, and fast-moving markets. It includes NFT marketplaces like Magic Eden, new token launches, and highly traded assets where trading volume and market capitalization can change quickly. While this layer offers fun, creativity, and short-term opportunities, it also carries higher risk. For users, it’s about culture and community. For investors, careful research matters most.

Mad Lads NFTs

Mad Lads is one of the most popular NFT collections on the Solana blockchain, known for its close-knit culture, bold art, and a growing community. The collection includes 10,000 anime-inspired NFTs created by the team behind Backpack, a Solana-native crypto wallet. Mad Lads takes advantage of Solana’s low fees and delivers fast trading on major NFT marketplaces like Magic Eden. What makes it interesting for users is real utility: holder airdrops, strong community support, and brand visibility across Solana. For newcomers, Mad Lads shows how NFTs can combine art, identity, and long-term ecosystem value.

TRUMP Memecoin

TRUMP is a memecoin launched by Donald Trump on the Solana blockchain in January 2025, just before his second presidential inauguration. Built on a high-performance blockchain, the token quickly gained attention thanks to Trump’s direct promotion and strong trading volume across major exchanges. For users, TRUMP is mainly a speculative asset driven by hype, branding, and short-term momentum rather than utility. For observers and investors, it’s a case study in how political influence, token launches, and market capitalization can collide in crypto. Like most memecoins, TRUMP carries high risk and sharp volatility, so careful research is essential.

How We Picked These Projects

To choose the most promising projects on Solana, we focused on clear, practical criteria:

- We looked at market capitalization and trading volume to understand real user interest and liquidity.

- We reviewed key features, such as whether a project solves a real problem or improves core crypto functions like automated market maker swaps, limit orders, or NFT trading on platforms like Magic Eden.

- We also paid close attention to recent token launches and how teams communicated their goals.

All selections are based on our own research, with the main takeaways being usability, traction, and fit with Solana’s high-performance blockchain as the ecosystem continues to grow.

Final Thoughts

Solana continues to prove itself as one of the most versatile and forward-looking blockchains in the industry. As this list shows, the ecosystem now goes far beyond simple token transfers or DeFi experiments. Solana supports advanced trading platforms, scalable staking solutions, real-world infrastructure projects, tokenized assets, and fast-growing cultural layers like NFTs and memecoins. At the same time, ongoing improvements in blockchain validation and scalability keep transaction costs low while boosting speed and reliability.

Looking ahead, Solana is well positioned to power immersive blockchain gaming, decentralized music platforms with better artist royalties, real-world payment solutions with instant settlement, cross-chain interoperability tools, AI-driven decentralized networks, and creator platforms built around smart token models. Together, these developments show how Solana isn’t just keeping up with the industry, but actively pushing it forward into 2026 and beyond.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

![Top Solana Projects with Potential [2026]](https://patrolcrypto.com/wp-content/uploads/2026/01/screenshot_jupiter-1536x871.png)