- The U.K. Treasury identified multiple cases where cold calls were responsible for the loss of investors.

- The consultation closes on 27 September.

The U.K. Treasury has issued a consultation paper to gather evidence about the impact of banning finance-related cold calls on businesses. The ban would cover calls related to crypto investments too.

Andrew Griffith, the economic secretary to the Treasury, simply said,

“The government will not tolerate this behavior.”

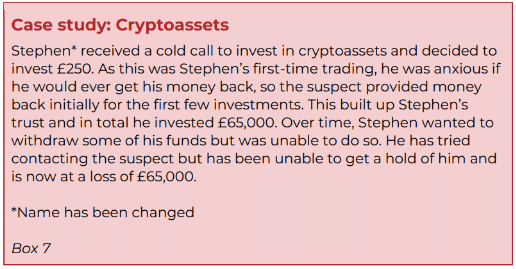

The Treasury identified multiple cases where cold calls were responsible for the loss of investors. One of such calls was related to cryptocurrency.

Source: HM Treasury, pg. 12

The Treasury has now sent 19 questions to stakeholders in order to guarantee that authorities can contain fraud without negatively impacting genuine businesses relying on cold calls. The consultation will close on 27 September.

The U.K. government had announced its plan to ban such cold calls in May itself. Prime Minister Rishi Sunak had remarked in his statement,

“Fraud now accounts for over 40% of crime. It costs us nearly £7 billion a year and we know these proceeds are funding organized crime and terror. We will ban cold calls on all financial products, so that anyone who receives calls trying to sell them products such as crypto currency schemes or insurance will know it’s a scam.”

Crypto promotions under the radar

Last month, the Financial Conduct Authority (FCA), the financial regulator of the U.K., proposed to bring crypto promotions within the ambit of advertising laws in the country.

The FCA said, virtual asset corporations can advertise crypto to retail investors at large. However, they must include risk warnings too. It also warned financial influencers that crypto promotions or advice, unless FCA-approved, could be an offense punishable by up to two years in jail, an unlimited fine or both.

According to the Office for National Statistics, crypto scams accounted for more than 40% of all the reported crimes in 2022. More than a third of crypto fraud losses for the year, £115.7 million ($146 million), occurred in November 2022. This is the same month when FTX had filed for bankruptcy.

Source: Action Fraud (Financial Times)