- Legal counsel suggested that the Ripple case with the SEC could end in trial.

- XRP could breakout as whales moved large amounts of tokens.

The unending Ripple [XRP] tussle with the SEC might end in another legal proceeding, according to Scott Chamberlain. The blockchain lawyer and founder of Evernode XRPL, stood this ground while responding to a tweet about the ruling on both parties to preclude expert testimonies.

After further thought, four key takeaways for me:

1. It seems more likely there will be a trial because this decision results in conflicting expert testimony that muddies a summary judgement application. So many facts at issue. There is a caveat, though…— Scott Chamberlain (@scotty2ten) March 7, 2023

Read Ripple’s [XRP] Price Prediction 2023-2024

Whales caught in the divide

Giving his reasons, Chamberlain pointed out some flaws in the cases presented by both Ripple and the regulator. Although he admitted that there were many facts at play, the entrepreneur said that a few pieces of evidence remained unclear. Chamberlain tweeted:

“The SEC’s expert had his testimony on why people bought XRP excluded. It’s unclear what if any evidence remains on record to support the SEC argument that anyone bought XRP expecting profits solely or substantially from Ripple’s efforts”

However, the legal practitioner’s opinion resulted in disagreement on the social media platform. Some mentioned that Chamberlain was in Ripple’s support; hence his biased view. Others did not align with the talk of a further trial.

Amid the divide, Whale Alert reported that large amounts of XRP moved wallets. According to the real-time capital movement tracker, about 112 million XRP was transferred from address to address in the last 24 hours.

???? 42,000,000 #XRP (16,098,744 USD) transferred from unknown wallet to #Bitstamphttps://t.co/RFvTG2uadX

— Whale Alert (@whale_alert) March 7, 2023

However, the wallet exchange had little impact on the XRP price. According to CoinMarketCap, XRP increased 4.05% in the last 24 hours. This was contrary to the sentiment shown by a much larger part of the crypto market.

XRP: The confinement is no more a home

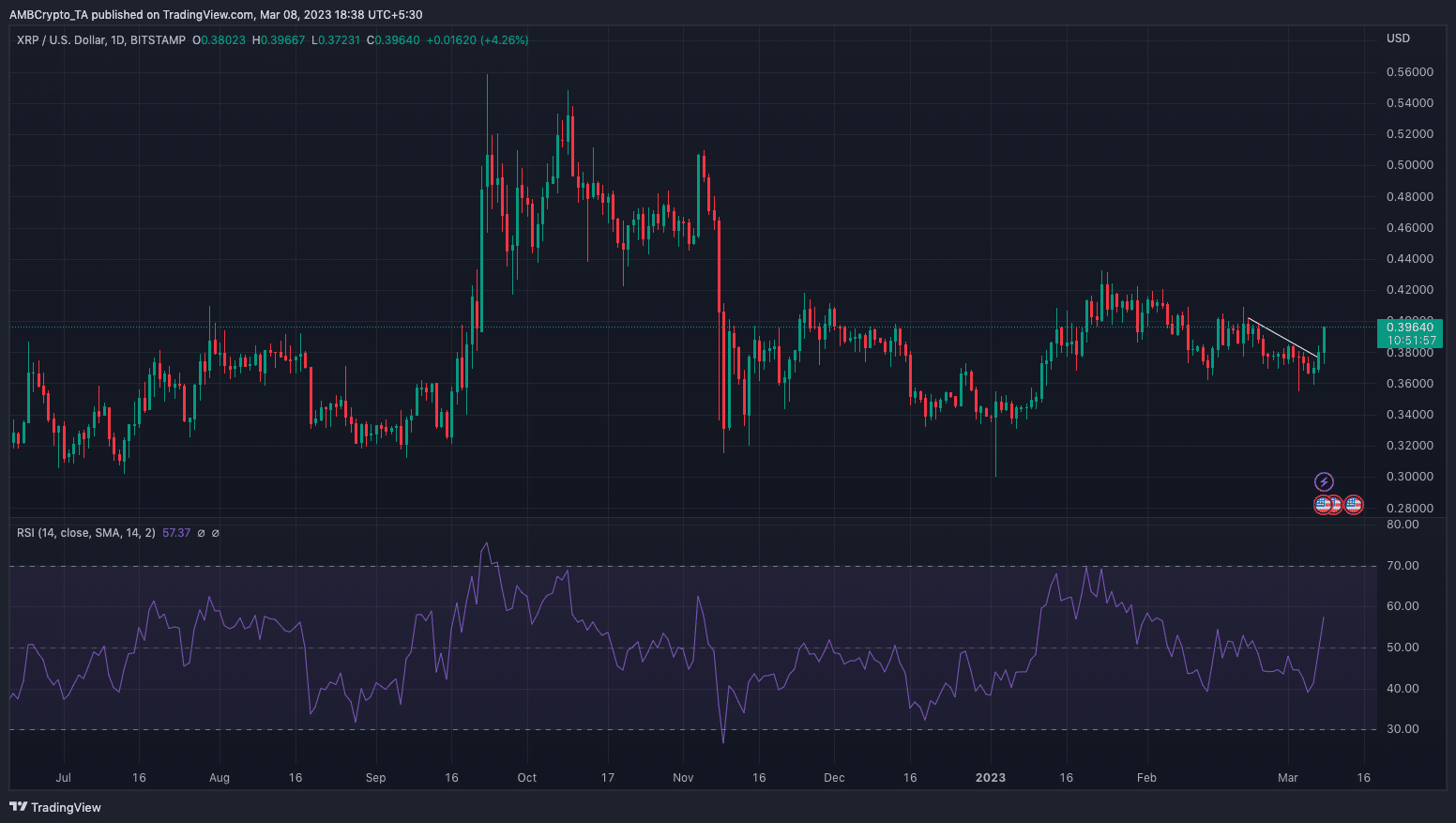

Based on the daily chart, XRP had the potential to breakout. This was because the price was already following a corrective pattern after its descending channel from 23 February to 7 March.

Realistic or not, here’s XRP’s market cap in BTC’s terms

Following the price surge, the Relative Strength Index (RSI) also left the oversold region. At press time, the RSI was 57.37. This means that the XRP buying power was strong and bullish momentum was in play.

Source: TradingView

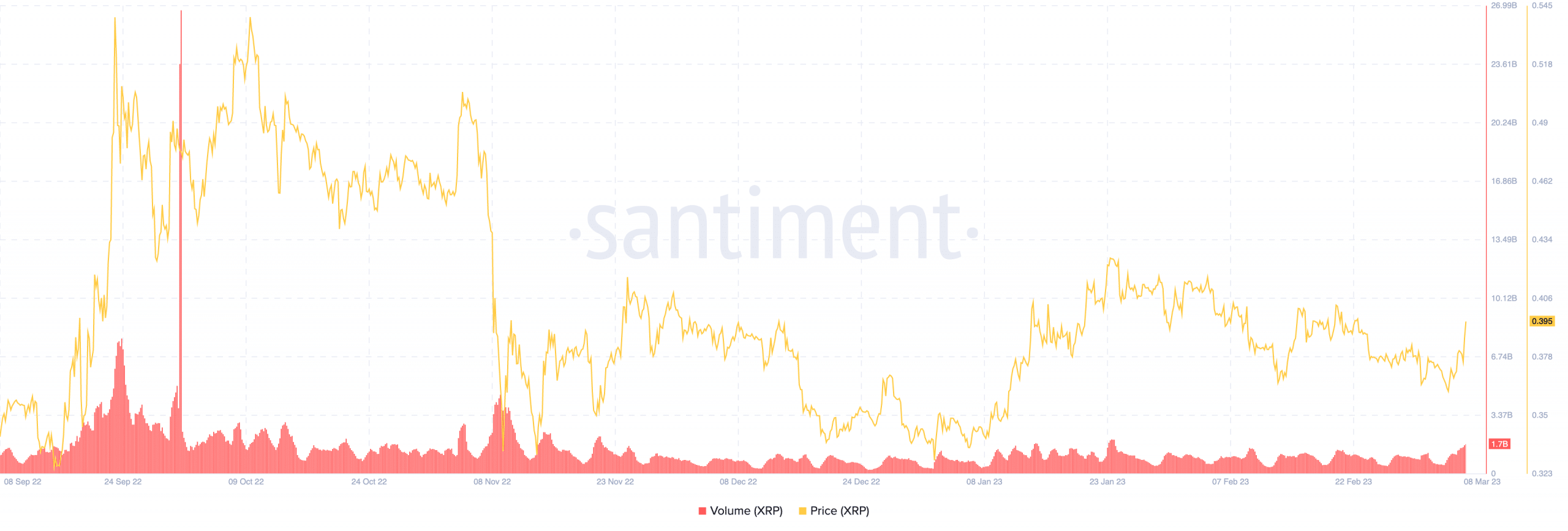

In addition to the price increase and whale transactions, the XRP volume rose to 1.68 billion. The metric indicates market strength and interest in a particular asset. Since the XRP price increase and its volume did the same, it implied that the current trend was gathering strength to the upside.

At the time of writing, XRP exchanged hands at $0.395. However, the broader market sentiment could still affect the token price in the short term.

Source: Santiment