NFT

Polygon has grown to be a popular option for businesses wishing to enter the Web3 area thanks to its low costs and quick transaction rates, including Reddit, Adidas, Robinhood, and Stripe.

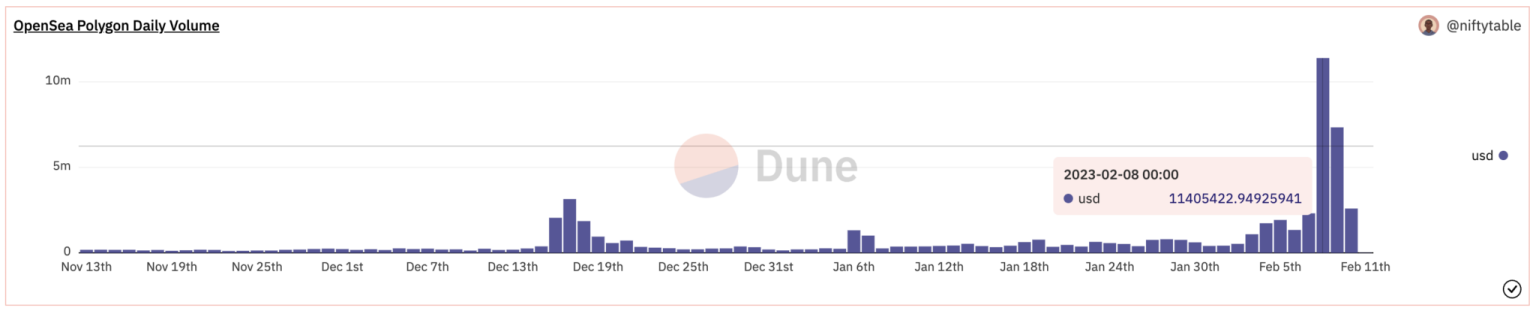

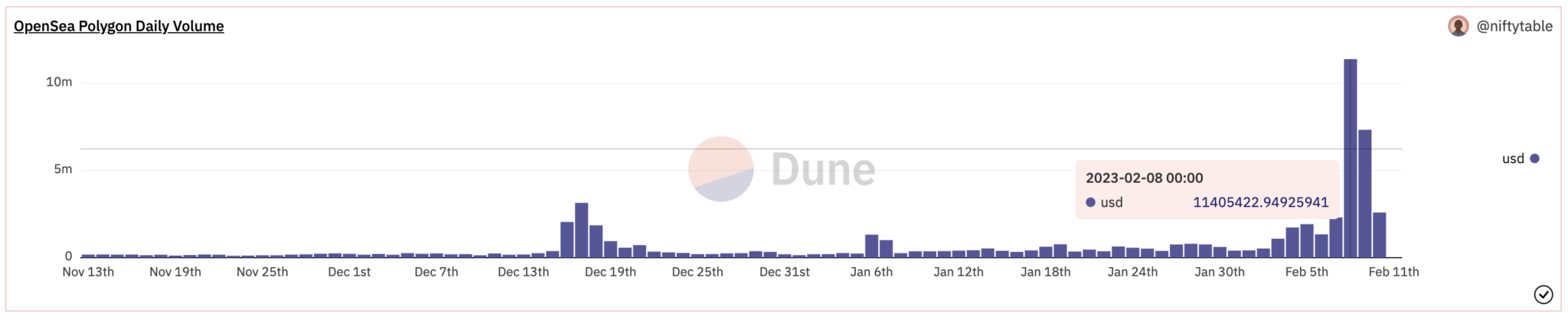

The most recent trade data clarifies the recent increase in Polygon NFT trading activity. On February 8, the OpenSea marketplace recorded a trading volume of $11,405,423, which is more than half of the $19,686,429 daily volume of Ethereum. The OpenSea NFT market has reached a 90-day high with this price.

The top media and entertainment company in India Shemaroo and Polygon Labs have partnered to create Virtasy.io, an NFT marketplace that is only available on the Polygon network. Fans have the chance to bring their favorite Bollywood characters into the metaverse and create their own NFT collections thanks to the marketplace’s selection of classic Bollywood film NFTs, which includes photos, movie clips, and avatars prepared for the metaverse.

This spike in trade activity might be related to Reddit and the NFL’s collaboration, which made it possible to produce Super Bowl Collectible Avatars for the Polygon network. The Polygon NFT market has grown significantly as a result of this relationship.

Recent internal events at Polygon have driven MATIC’s price upward, restoring the token’s November 2022 levels and boosting investor confidence.

Veteran cryptocurrency expert Ali Martinez recently observed the enormous demand that developed at the token’s most recent price of $1.11.

#Polygon has built a massive support level!

On-chain data reveals that 49,500 addresses purchased 4.65 billion $MATIC between $0.94 and $1.11. This important demand wall may have the strength to keep #MATIC at bay in the event of a correction and serve as a rebound point. pic.twitter.com/cFp1ASnRmB

— Ali (@ali_charts) February 9, 2023

This could be MATIC’s only hope because it is now encountering opposition. The token is now down nearly 3% on a daily basis, which may cause investors to get concerned.

MATIC daily chart. Source: TradingView

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.