- DOT’s daily chart turned green as its price increased by 1.3%.

- Most of the metrics were bearish on DOT, but a few indicators suggested otherwise.

Polkadot’s [DOT] price has been on a declining trend for quite a few weeks now. Despite the drop in its value, the blockchain’s staking ecosystem has witnessed substantial growth during that period. In fact, its staked token trend surged by more than 300% in just the last 24 hours.

The % trend in staked #DOT over the last 24h, compared to the average staked tokens over the last 30 days…

= +365.41% ????

Explore staking on #Polkadot ⬇️https://t.co/W7Tc2WGzUw pic.twitter.com/O0cEnzWs8p

— Staking Rewards | Staking Summit ???????? (@StakingRewards) August 11, 2023

How much are 1,10,100 DOTs worth today?

Not only that, but the total amount of DOT staked has also risen, reflecting stakers’ confidence. As DOT’s price continues to remain somewhat under bears’ influence, will the growth in staking have any positive impact on the token’s value?

Polkadot’s staking ecosystem is growing well

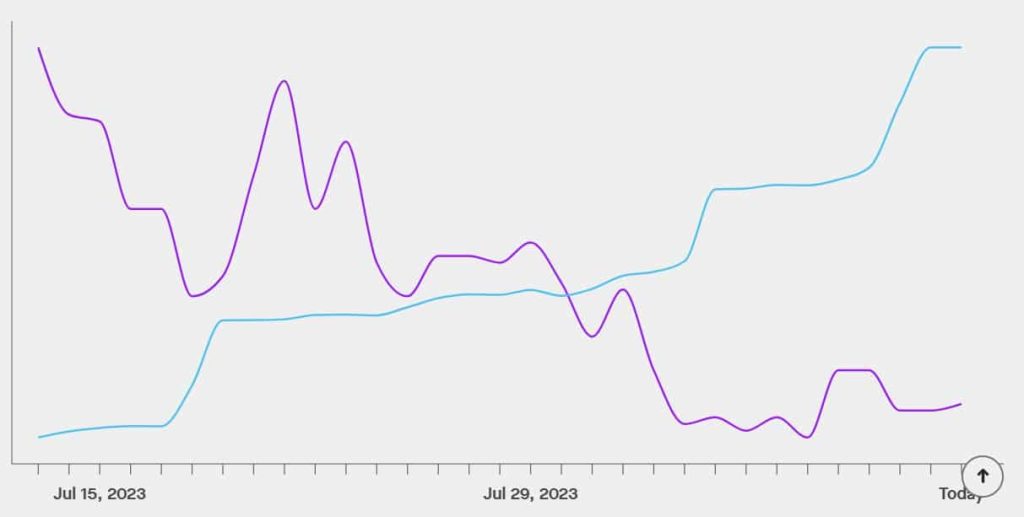

Despite the drop in price, Staking Rewards’ data pointed out that Polkadot’s staking ecosystem has been growing since July 2023. This was evident from the rise in the total amount of staked DOT.

At press time, Polkadot had nearly 39k staking wallets with more than 615 million staked tokens.

Moreover, there was a rise noted in terms of the number of DOT stakers over the last month. While writing. Polkadot had a staking ratio of 45.8% and a staking market capitalization of $3.08 billion.

Source: Staking Rewards

Growth was not only noted in terms of staking but also in the blockchain’s DeFi space. DeFiLlama’s data pointed out that the blockchain’s TVL has been on the rise since the beginning of the year, which looked encouraging.

TVL represents the number of assets that are being staked under a specific protocol at the moment. Therefore, a rise in the metric reflects an expansion in the DeFi space.

Source: DeFiLlama

Polkadot turns green

After a long wait, DOT finally showed signs of recovery as its chart turned green. According to CoinMarketCap, DOT’s price increased by nearly 1.3% in the last 24 hours. At press time, it was trading at $5.02 with a market cap of over $6.1 billion.

However, the uptrend might not last long, as its price uptick was accompanied by a decline in its trading volume. Additionally, negative sentiment around DOT was dominant in the market, as evident from its weighted sentiment.

Crypto prices tend to move in the opposite direction from their funding rate. In this case, DOT’s Binance funding rate was green, increasing the chances of a price decline.

Source: Santiment

Read Polkadot’s [DOT] Price Prediction 2023-24

Nonetheless, a few of the market indicators were bullish. DOT’s MACD displayed the possibility of a bullish crossover. Its Money Flow Index (MFI) was just near the oversold zone, which can increase buying pressure.

Moreover, Polkadot’s Chaikin Money Flow (CMF) was resting above the neutral mark, which was bullish.

Source: TradingView