- BTC receives the spotlight after the reveal of the Ordinal NFTs.

- The derivatives market sends mixed signs as volatility slows.

We recently looked at how a JPEG NFT constituted the largest block on the Bitcoin blockchain network. Now it has emerged that roughly 13,000 Ordinal NFTs have been launched on the Bitcoin network.

Read Bitcoin’s price prediction 2023-2024

The Ordinal NFTs have received mixed reactions in the crypto community. Some feel that this exploration of the Bitcoin network is a step in the right direction that may offer more opportunities in the future.

Others claim that the move goes beyond what Bitcoin stands for. Nevertheless, the floor price for those NFTs has been rising.

Ordinal Punks are popping off on Bitcoin. ????

The floor price has risen to 2.2 BTC ($50K) with a new ATH sale of 9.5 BTC ($215K) today. pic.twitter.com/mHZ1MUqGnz

— nft now (@nftnow) February 9, 2023

The potential impact of having NFTs on the network is perhaps the biggest concern. Will it slow down the network or make it more congested? The Ethereum network has experienced such challenges in the past which have impacted the price of ETH.

In most cases, network congestion is translated as high demand and this may send a positive feedback look for the native cryptocurrency. Is such a scenario plausible for Bitcoin? Let’s look at what we know so far. Bitcoin’s mean transaction size is currently at a 4-year high.

???? #Bitcoin $BTC Mean Transaction Size (7d MA) just reached a 4-year high of 894.524

Previous 4-year high of 892.529 was observed on 04 June 2021

View metric:https://t.co/PJ0bkLTuVs pic.twitter.com/rqgW5TOuZe

— glassnode alerts (@glassnodealerts) February 9, 2023

The state of the Bitcoin derivatives market

Bitcoin’s derivatives market has been a healthy indicator of the state of the market in the past. It might offer insights into BTC’s current position.

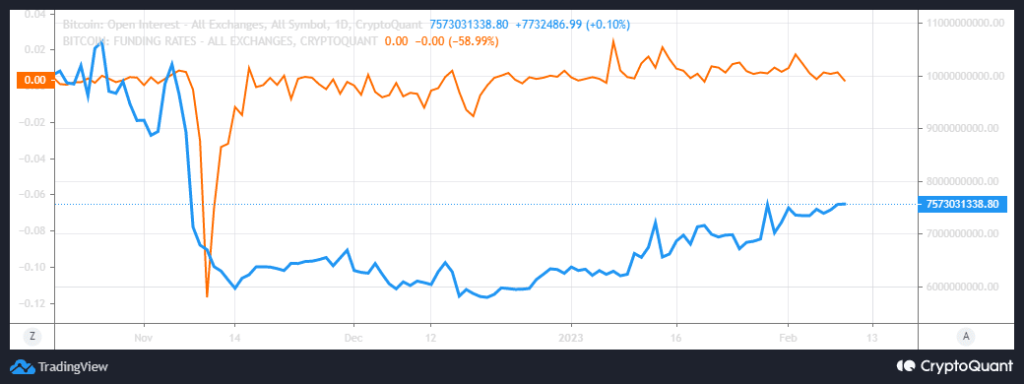

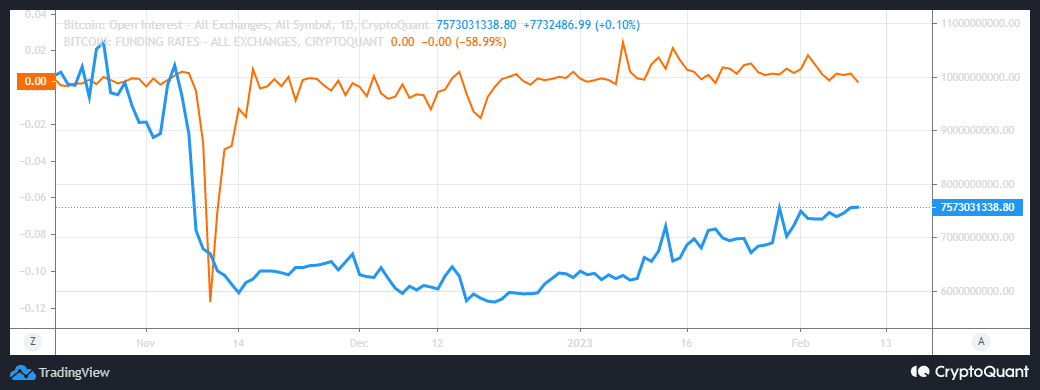

BTC’s open interest managed to maintain an upward trajectory, confirming that there is still some level of demand for BTC in the derivatives market.

Source: CryptoQuant

Bitcoin’s funding rates have dropped despite the higher open interest. This is a reflection of the market’s indecisiveness, especially with the declining volatility.

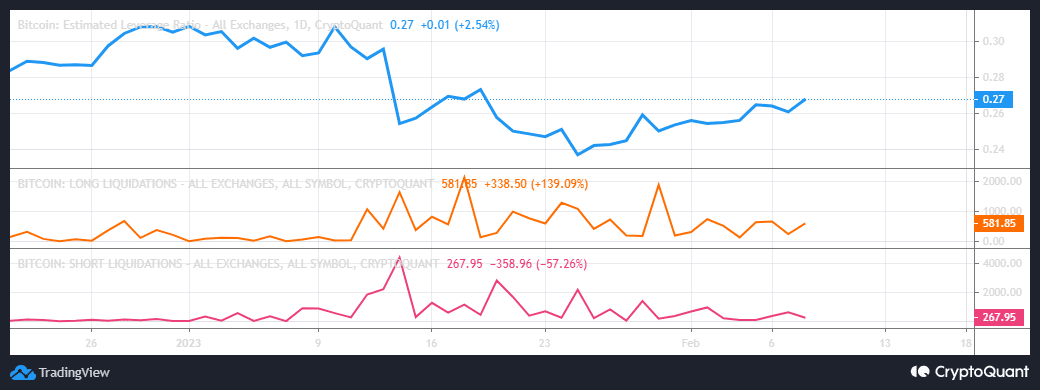

Meanwhile, market indicators reveal that the level of demand for leverage is gradually growing. This is likely because lower volatility has forced investors to look for other means of boosting their potential gains.

Source: CryptoQuant

Liquidations were still relatively low at press time, but there was a notable increase in long liquidations in the last 24 hours. Short liquidations decreased during the same time as the bears gained more dominance.

How many are 1,10,100 BTCs worth today?

The cryptocurrency has been stuck within a narrow range ($22,400 and $22,200). The market has experienced some downside in the last few days despite bullish signs such as a golden cross and lower relative strength.

Source: TradingView

The current projection is that an additional bearish outcome may send BTC as low as $22,500 which is within the closest support range. On the other hand, another rally may yield a retest of the $24,000 resistance range.