- Optimism’s revenue has been increasing since its launch.

- On-chain metrics and market indicators were bullish.

Optimism [OP] made a bold announcement on 23 February, as it revealed its plans to become a “Superchain.” According to the official announcement, rather than building multiple L2 chains, Optimism would instead focus on unifying them as it planned to become a platform for chains.

It’s time for Optimism to prepare for the next wave of adoption.

It’s time to build a unified network of chains—not just one.

It’s time to build together, not apart.https://t.co/3BvJqD5pPe pic.twitter.com/OSKe5FDs8J

— Optimism (✨????_????✨) (@optimismFND) February 23, 2023

The Superchain aimed to combine various siloed L2s into one cohesive and interoperable system. Moreover, Optimism stated that it needed to work toward a future when launching an L2 was as simple as deploying a smart contract on Ethereum [ETH].

While Optimism continued to step up its game, the network’s performance on the revenue front also looked promising. Token Terminal’s data pointed out that Optimism’s revenue has been increasing constantly since its launch in 2021, which was a positive trend.

Realistic or not, here’s OP market cap in BTC’s terms

Apart from this, Coinbase announced that it was developing Base on Optimism’s OP Stack with the goal of developing a standard, modular, rollup agnostic Superchain powered by Optimism in order to facilitate the path toward decentralization.

0/ ???? Hello world.

Meet Base, an Ethereum L2 that offers a secure, low-cost, developer-friendly way for anyone, anywhere, to build decentralized apps.

Our goal with Base is to make onchain the next online and onboard 1B+ users into the cryptoeconomy.https://t.co/Znuu3o3pJw

— Base (@BuildOnBase) February 23, 2023

OP’s response is apt!

OP’s price responded to these developments by painting its daily and weekly charts green. According to CoinMarketCap, OP’s price increased by over 8% in the last 24 hours, and at press time, it was trading at $3.09 with a market capitalization of over $725 million.

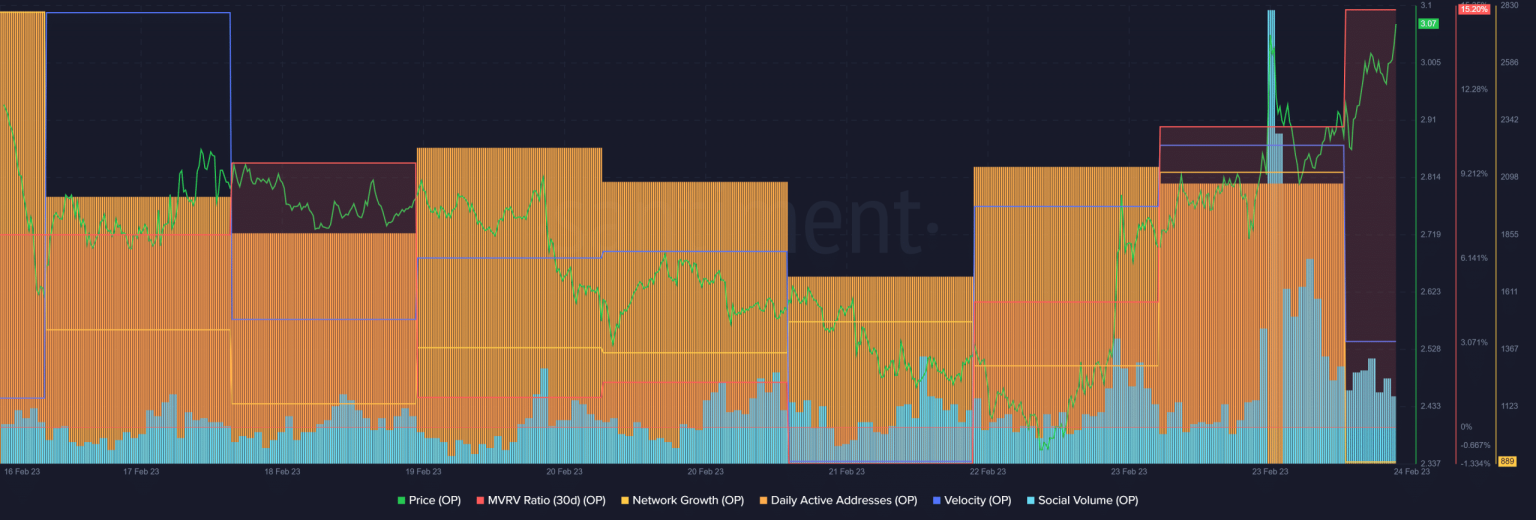

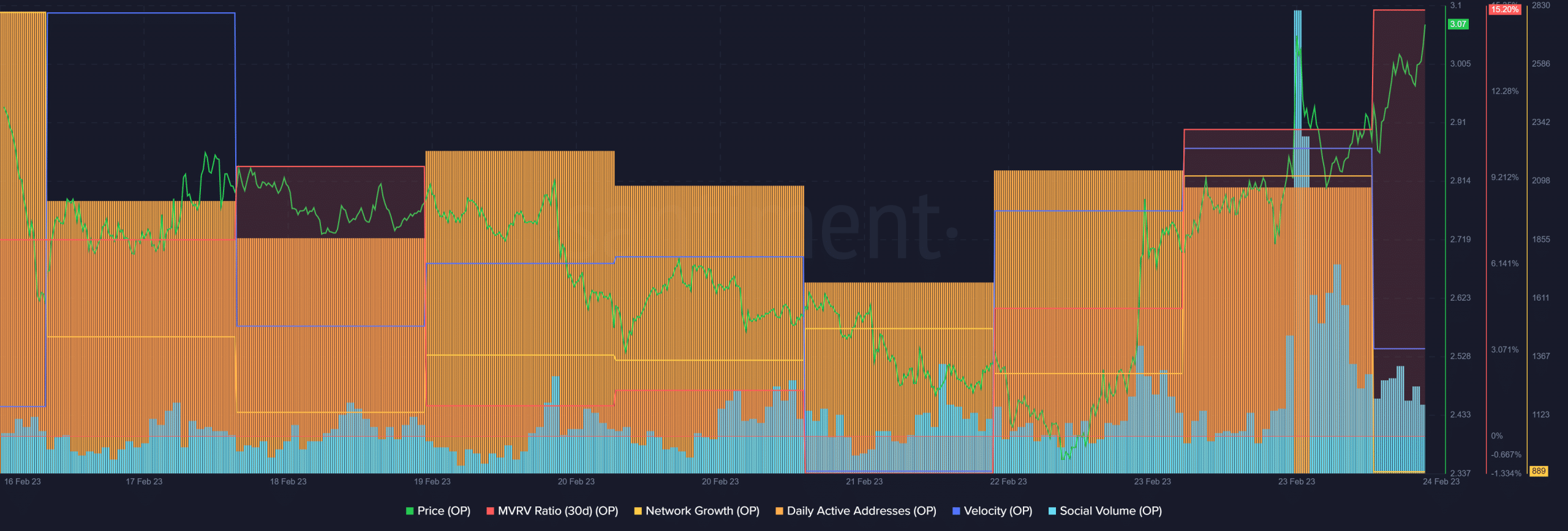

Moreover, OP’s on-chain performance supported this surge in price, increasing the chances of registering more gains in the coming days. For instance, the token’s MVRV Ratio went up considerably, which was a bullish signal.

OP’s network growth and velocity both registered upticks in the last few days, yet another positive development. The social volume has also spiked lately. However, OP’s daily active addresses declined over the last week, which indicated fewer users in the network.

Source: Santiment

How much are 1,10,100 OPs worth today?

Investors can sit back and relax

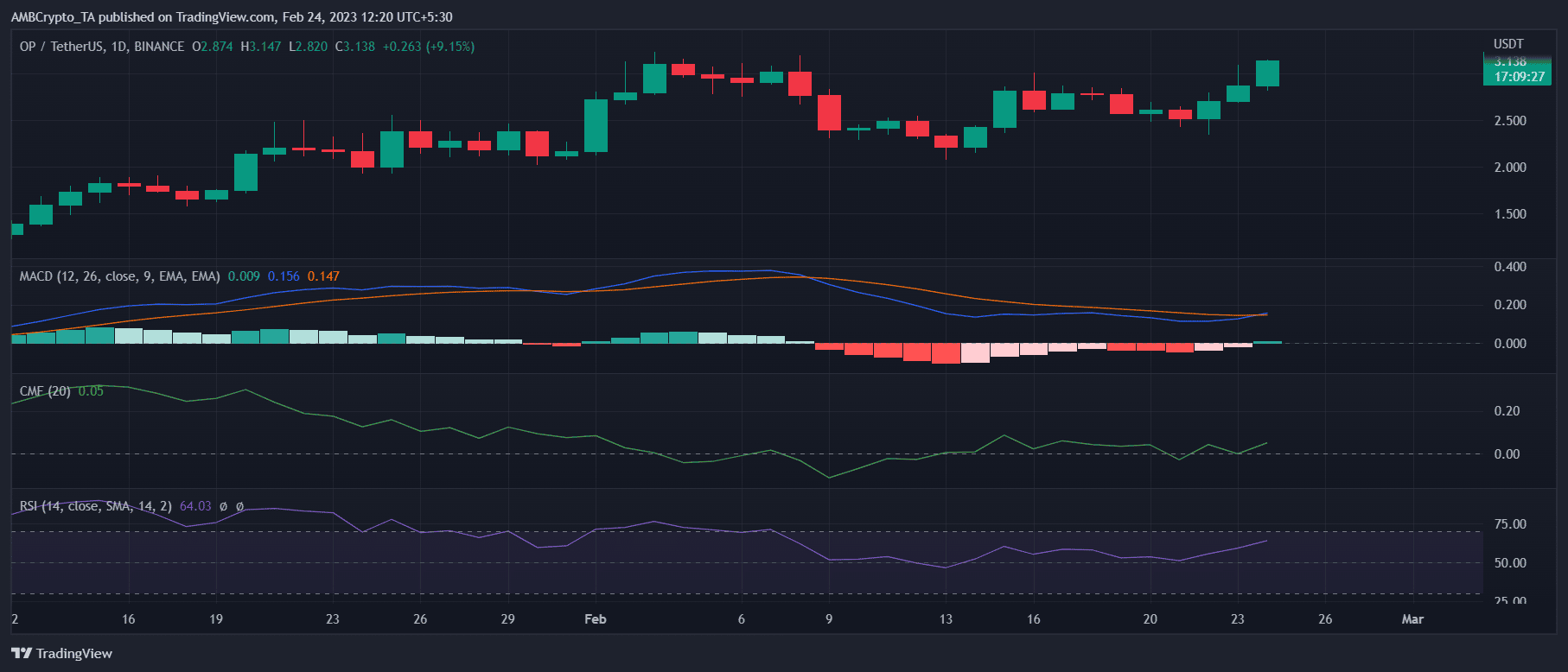

Like the on-chain metrics, several of the market indicators were also in favor of the investors. OP’s MACD displayed a bullish crossover, suggesting a further price hike. The Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both registered upticks, which was also a development in the buyers’ favor.

Furthermore, the Exponential Moving Average (EMA) Ribbon painted a bullish picture as the 20-day EMA was well above the 55-day EMA.

Source: TradingView