NFT

As reported by CryptoSlam, NFT purchases fell by roughly 31% in March.

According to the information provided by CryptoSlam, non-fungible token transactions in March decreased by 31.42% month on month, going from $1.03 billion in February to $882.89 million on April 3.

The Ethereum network was responsible for the settlement of $537.89 million worth of those transactions in March, which accounted for more than sixty percent of total sales. Following Solana in March’s sales rankings are Polygon ($36.16 million), Immutable X ($28.82 million), and Cardano ($10.08 million), with NFT transactions in Solana accounting for 10.57% of total sales and reaching $93.36 million.

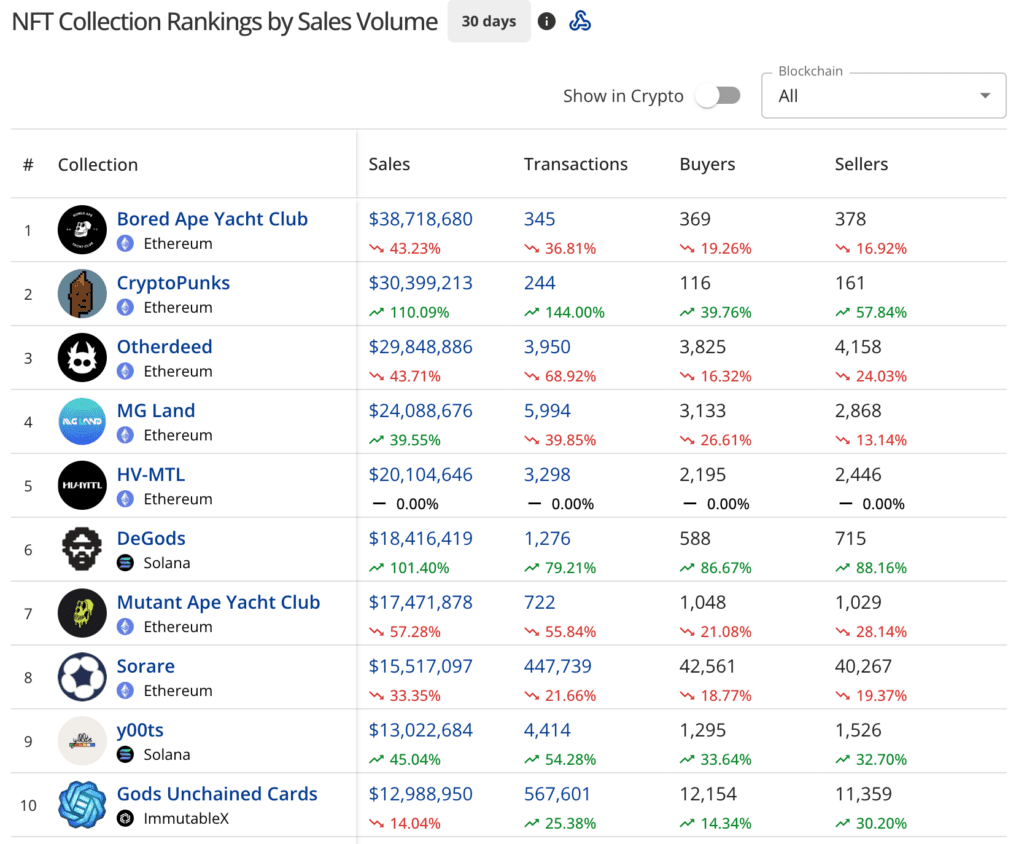

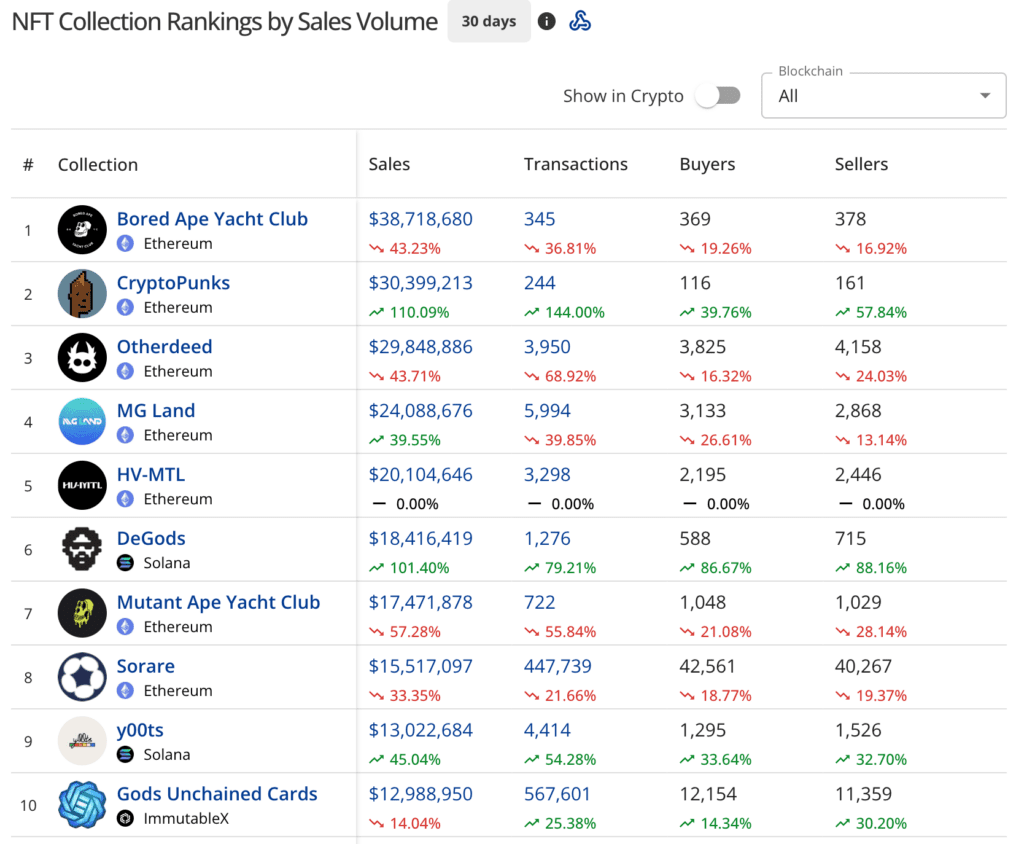

In March, the Bored Ape Yacht Club (BAYC) collection was the top-selling product, with sales of $35.81 million. This figure represents a 48.19% reduction from the previous month’s sales. The month of February saw Cryptopunks’ sales increase by 87.95%, bringing the total to $30.11 million, making it the second-largest NFT compilation in terms of revenue.

While this may appear to be a substantial decline, keep in mind that NFTs are still a relatively new occurrence in the world of digital art and souvenirs, with their prevalence increasing rapidly in the last year. Furthermore, the market is still changing, with new platforms and markets springing up to meet the demand for NFTs.

As a result, fluctuations in sales numbers are likely to persist in the coming months as the industry finds its foothold and matures. Nonetheless, the fact that NFTs have already produced nearly a billion dollars in sales in just one month demonstrates the technology’s strength and potential. As the NFT space becomes more mainstream and available to a broader population, we can anticipate to see ongoing development and innovation.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.