- Monero enjoys healthy social volume which may aid in attracting back investors.

- XMR conforms to the market conditions this week despite previous resilience.

Monero achieved some level of success in overcoming sell pressure towards the end of February and briefly in the first week of March. However, the bears have finally caught up with it this week triggering significant price slippage.

How many are 1,10,100 XMRs worth today?

Monero’s price fell by roughly 14% courtesy of the prevailing bearish market conditions this week.

It danced around the 200-day moving average prior to that, before eventually yielding to the bears. It hovered around the $132 support line at the time of writing, while almost dipping into oversold territory on the RSI.

Source: TradingView

Monero is still enjoying some healthy visibility

That said, however, Monero still managed to secure a win in the social ranking despite the losses suffered in its price action.

LunarCrush’s latest ranking picked Monero as the coin of the day in terms of social ranking. This was a sign that it was receiving a lot of social attention which is a good thing especially now that it is at a discount.

Today’s Coin of the Day according to the social ranking by @LunarCrush is $XMR (@monero)⚡️

Top influencers are @halomancer1 @100xShaman @CrypttoManiac_ @fluffypony✨???? pic.twitter.com/rRySSFIuiE

— BlockTalks (@HiBlockTalks) March 9, 2023

The favorable social ranking suggests that Monero might be in a position to sum up robust volumes for a sizable comeback if need be.

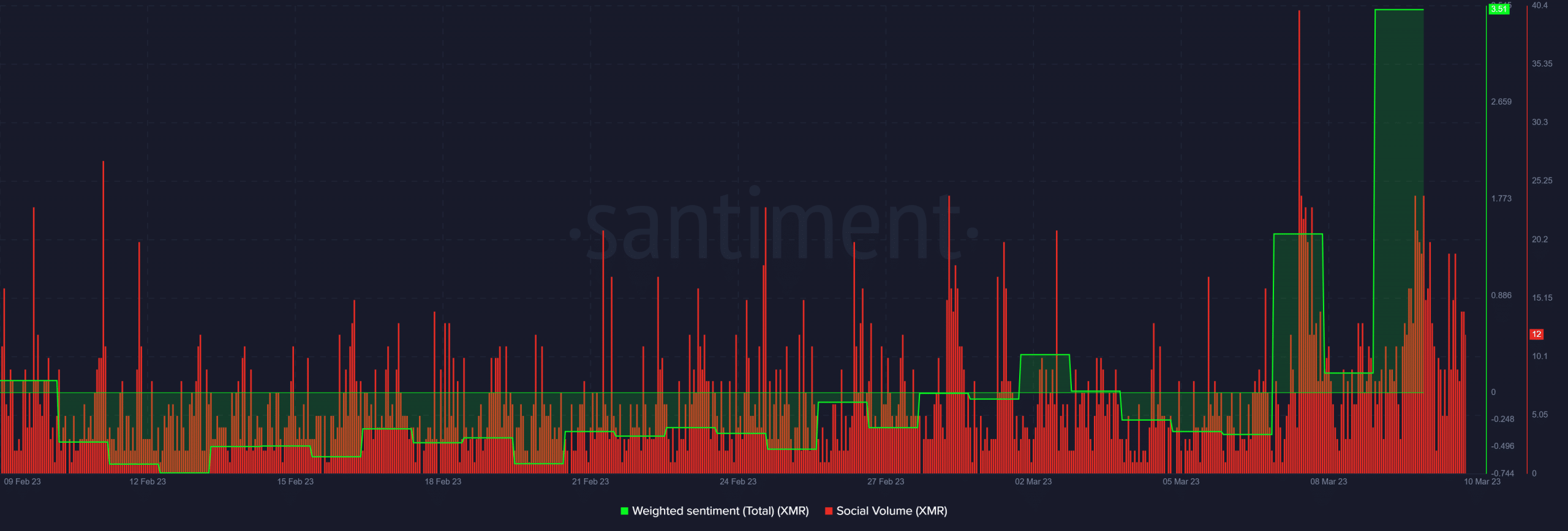

The ranking reflects the surge observed in social volume this week, leading to a new monthly peak on Tuesday. It also registered another sizable surge in the last 24 hours, at press time.

Source: Santiment

A surge in Monero’s weighted sentiment accompanied the robust social volume activity. Its weighted sentiment highlighted an inverse correlation with the price movement. But the dynamics of XMR holders offered a more interesting outlook.

Realistic or not, here’s XMR market cap in BTC’s terms

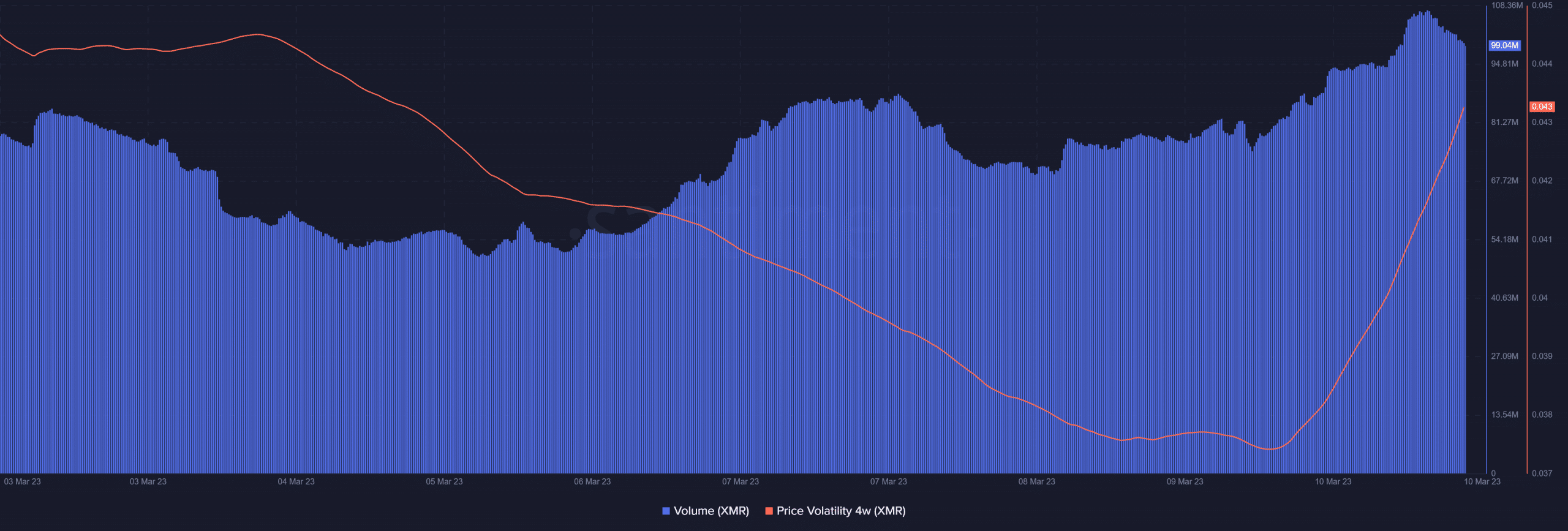

Monero’s on-chain volume achieved a new monthly high in the last 24 hours at press time. At the same time that its price registered its largest single-day move in the last two weeks.

Source: Santiment

XMR volume has since demonstrated signs of slowing down, after its peak on Friday.

A potential sign of bearish exhaustion. Interestingly, the price volatility metric pivoted on the same day after previously slowing down.

Nevertheless, it remains unclear whether this volatility may represent a strong wave of accumulation especially now that the price is trading at a discount.

Conclusion

There are multiple signs so far that highlight the chances of a pivot, such as the support retest and interaction with oversold conditions.

However, this does not necessarily guarantee that Monero bears are done. We may still witness more downside if the FUD prevails but the extensive pullback also means a bullish pivot might be just around the corner.