- Litecoin retested four-month support line, and sell pressure showed signs of bearish exhaustion.

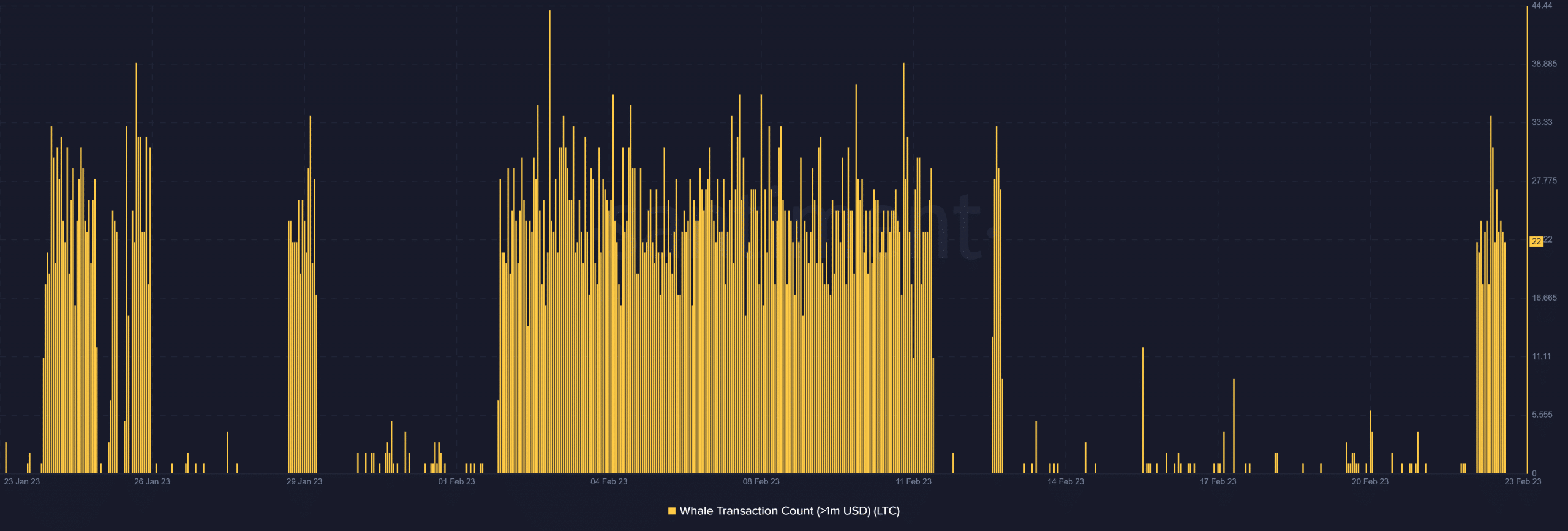

- Whale transactions surged in the last 24 hours.

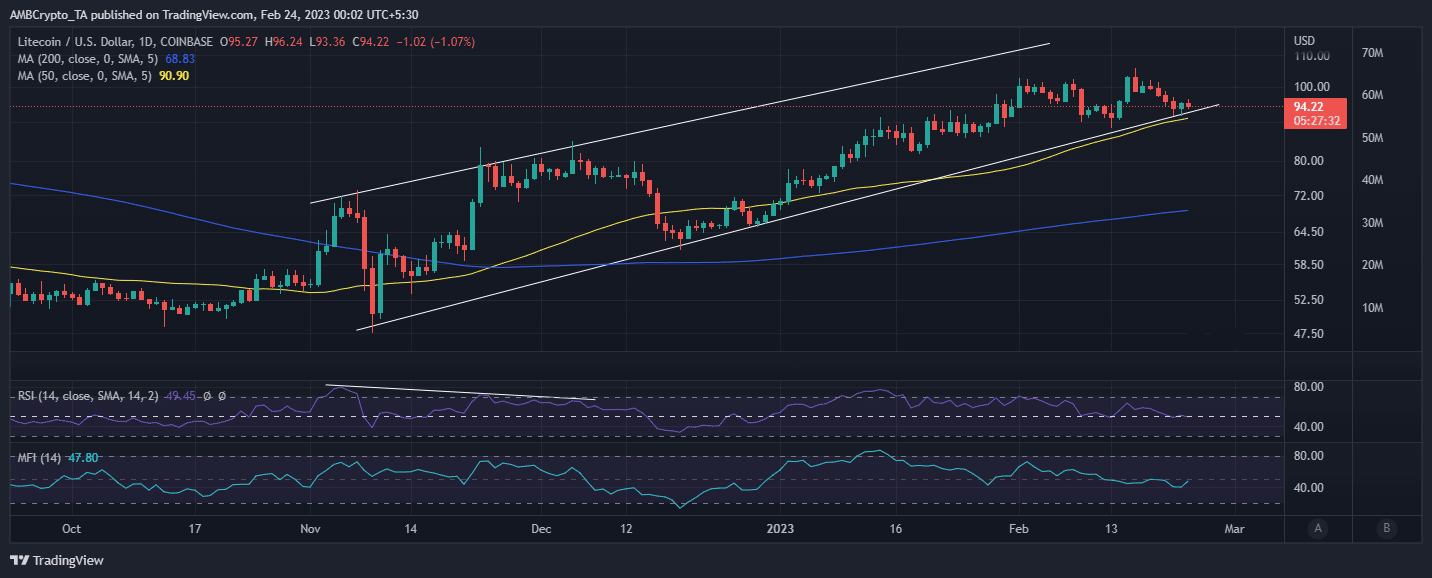

Litecoin’s [LTC] price action was moving in an overall ascending pattern in the last few months. More specifically, its price was restricted within a support and resistance channel since November 2022. Its performance in the next few days might be headed for a pivot, and here’s why.

Litecoin bears have dominated since mid-February, and the subsequent pullback resulted in a retest of its four-month support line. This was the fourth time that the price had retested the same support level – previous times resulted in a sizable rally.

Source: TradingView

The bearish performance put the price within the RSI’s 50% level at press time. This meant that the chances of a pivot were significantly higher with these two signs. At this time, Litecoin’s MFI was already showing signs of liquidity inflows. This was also evidence of increased whale activity within the support range.

LTC’s whale transaction count demonstrated a strong surge in the last 24 hours at the time of writing. In contrast, the same metric confirmed low transaction activity in the last few days since mid-February.

Source: Santiment

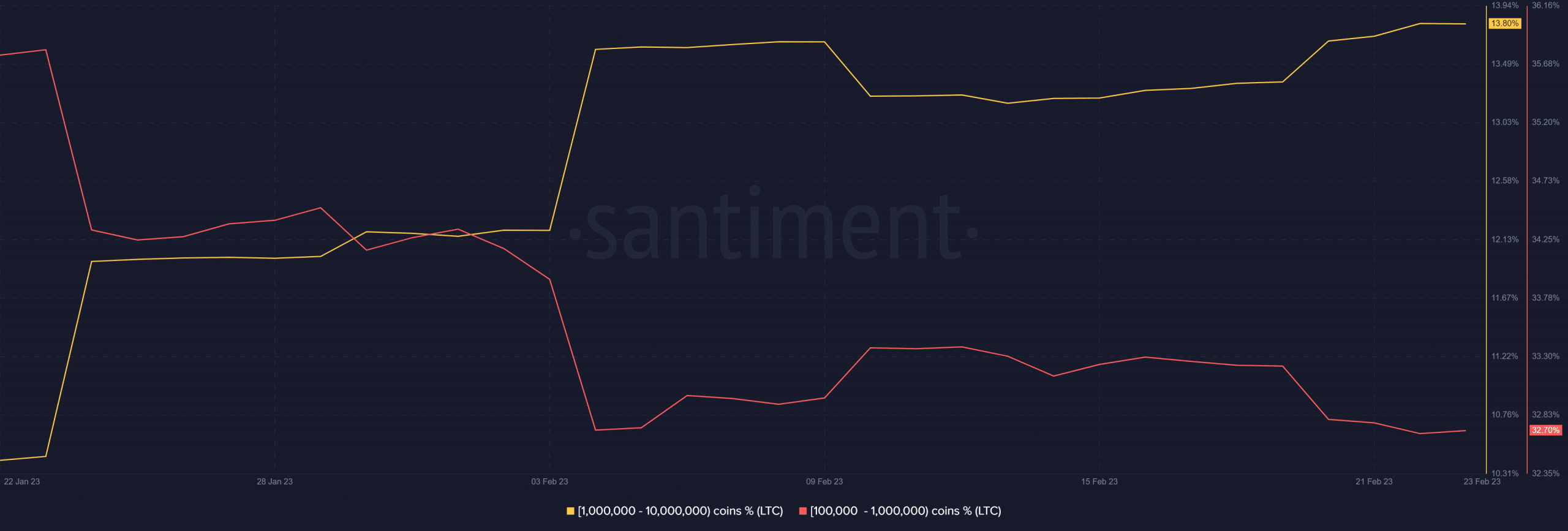

A supply distribution analysis confirmed the directional momentum of this whale activity. Addresses holding between 100,000 – 1 million LTC coins ceased contributing to sell pressure. This was an important observation, as this category controlled the largest share of Litecoin in circulation.

Source: Santiment

In addition, addresses holding over one million coins have increased their balances in the last few days. This meant that top whales were contributing to an increase in buying pressure in the last few days. Traders could thus expect a bullish pivot if the buying pressure intensified.

Realistic or not, here’s Litecoin’s market cap in BTC’s terms

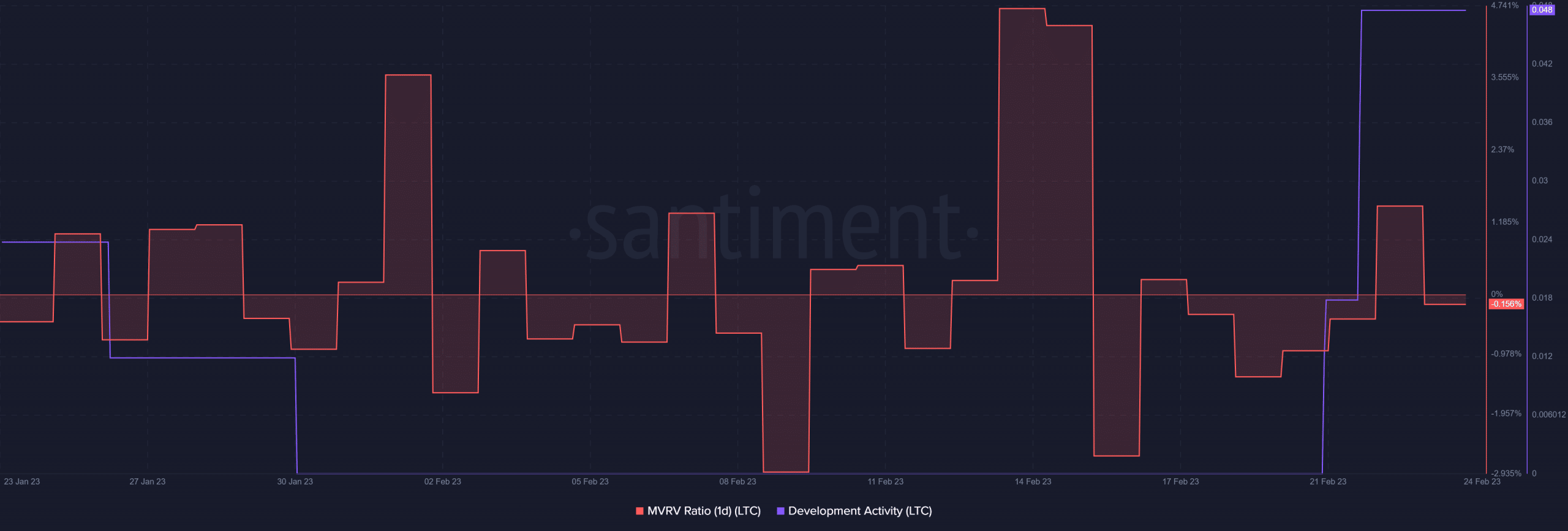

There was already a surge in the MVRV ratio from its lowest monthly range on 18 February. This confirmed the return of some buying pressure, as indicated by the supply distribution. It was worth noting that the same MVRV ratio dropped significantly between 22 and 23 February because of the bearish market conditions during this period.

Source: Santiment

Litecoin investors and enthusiasts should also note the recent surge in development activity. This outcome may provide a bigger investor confidence boost, along with all the other previously mentioned factors. But there is still a possibility that Litecoin bears might maintain dominance if the market conditions allowed.

![Litecoin [LTC] retests support after bearish cycle: Will bulls emerge victorious?](https://patrolcrypto.com/wp-content/uploads/2023/02/LTCUSD_2023-02-23_21-32-28-1024x413.png)