- High hash rate and no network outages were indicative of a secured network.

- LTC dropped by 3.15% at press time, sparking fears of a strong pullback.

Few other cryptocurrencies have performed as well as Litecoin [LTC] in 2022’s bear market. Since hitting the lows of June 2022, both the price and market cap have more than doubled in value at press time, data from CoinMarketCap showed.

A large part of this could be attributed to Litecoin’s reputation as an efficient and secure network. As per a post shared on Twitter, LTC claimed it had never been down since its launch in 2011, a factor which could increase its utility as a payment option.

#Litecoin has zero downtime in over 11 years of existence. The longest uninterrupted uptime in #crypto. pic.twitter.com/JYqpyAVd2q

— Litecoin (@litecoin) January 29, 2023

Read Litecoin’s [LTC] Price Prediction 2023-24

Moreover, the network’s hash rate hit an ATH recently. This is generally regarded as a positive sign with regards to a network’s security as unscrupulous attacks become difficult to execute on networks with high hash rate.

Whales pose a challenge

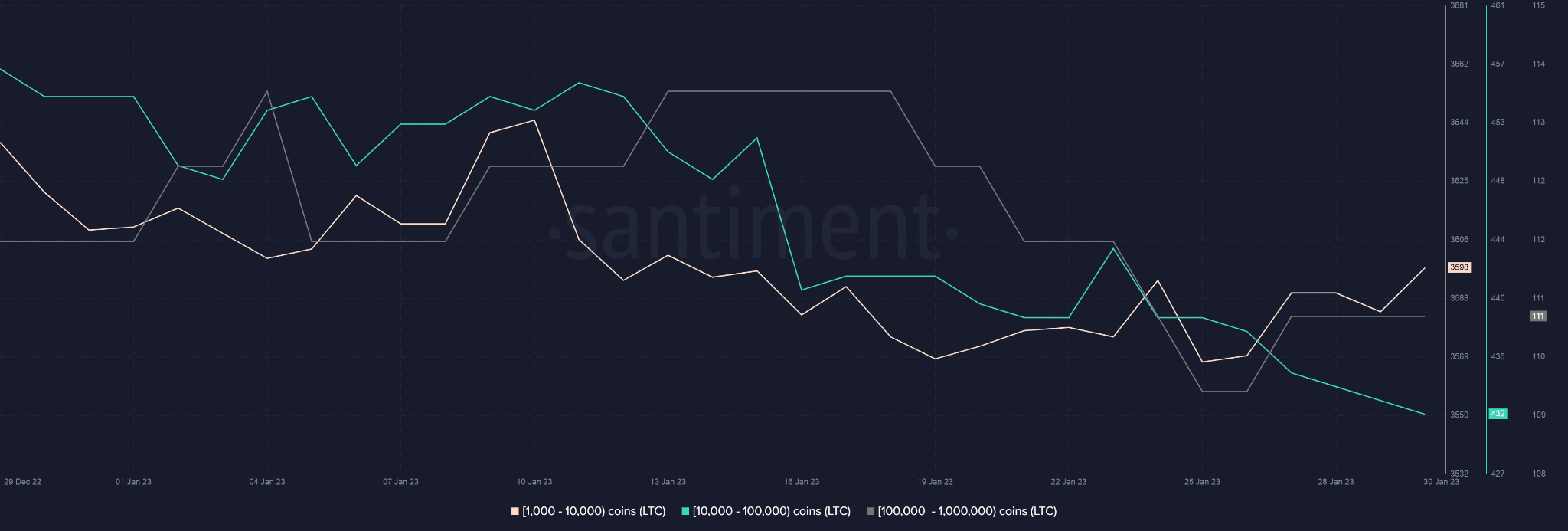

However, the holdings of small and large Litecoin whales narrated a different story. As per data provided by Santiment, the number of addresses with more than 1000 LTC coins has been on a falling slope in the last 12 days.

Source: Santiment

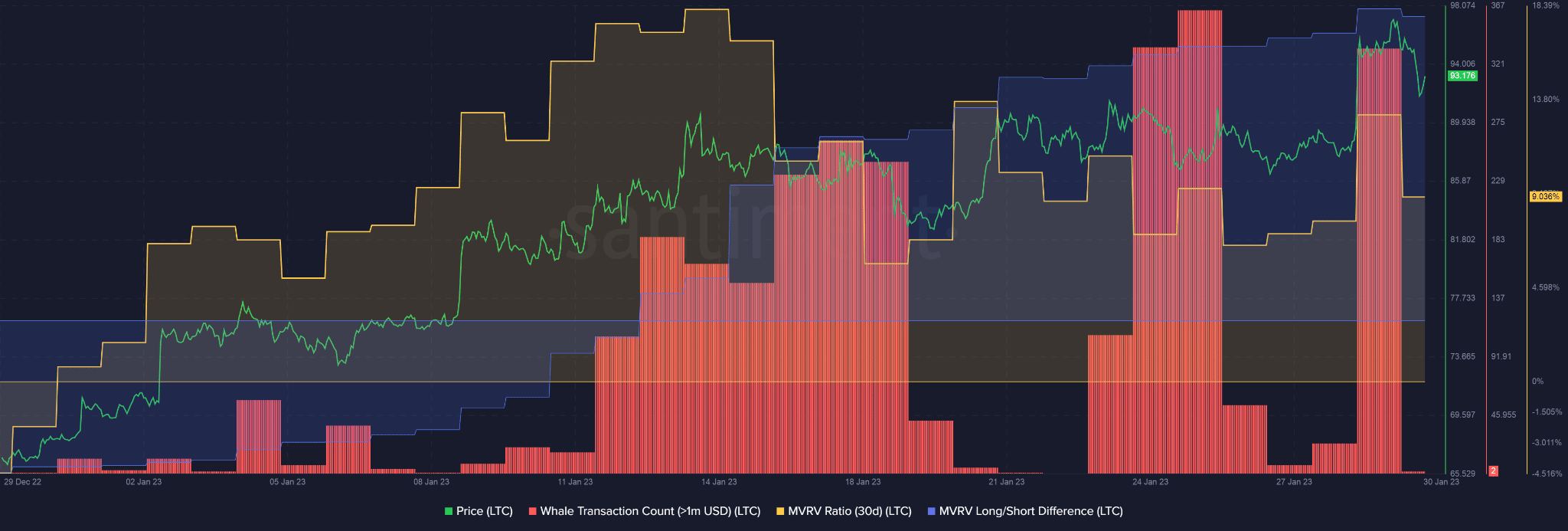

Furthermore, after remaining subdued for the last three days, LTC witnessed a sharp jump in whale transaction count at press time. This meant that large addresses indulged in profit-taking by liquidating their positions.

This could also be explained by looking at MVRV Ratio. The network was overvalued and hence in profit. The increasing MVRV Long/Short Difference incentivized profit-taking by LTC hodlers, which could lead to prices going south.

Source: Santiment

Santiment had in fact issued a warning to investors that LTC could drop in the coming days due to an increase in selling activity among whales.

What’s next for LTC?

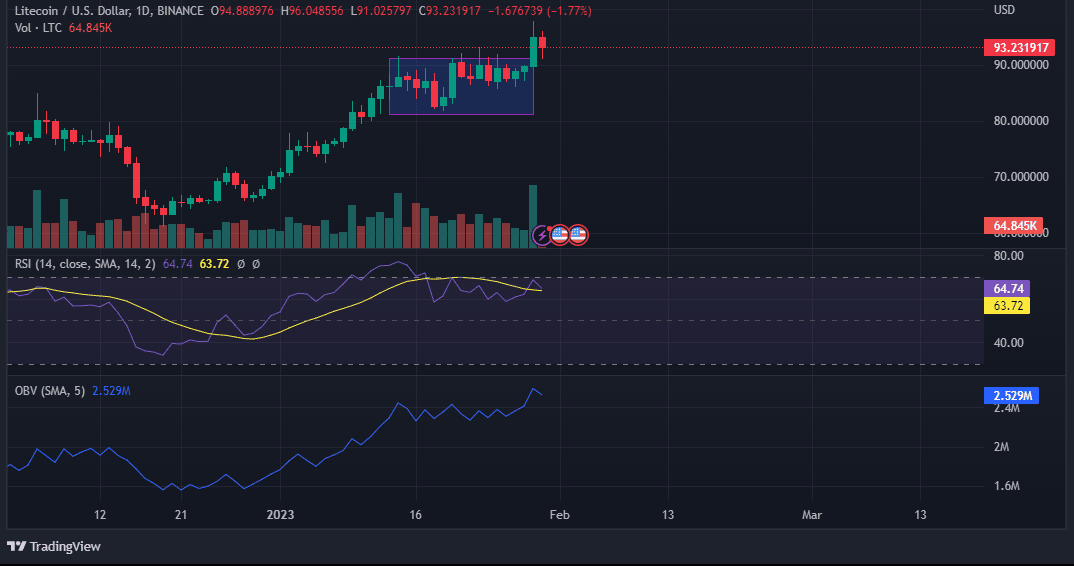

Litecoin holders have locked in gains of over 30% since the commencement of the bullish rally at the beginning of the year. The price broke out of the mid-term range with a sharp move upward on 29 January. However, at the time of writing, it fell by 3.15%, giving an early indication of a pullback.

Is your portfolio green? Check out the LTC Profit Calculator

The Relative Strength Index (RSI) started to descend, which meant reduced buying pressure. The On Balance Volume (OBV) followed a similar trajectory, validating the idea of whales’ profit-taking highlighted above.

Source: TradingView LTC/USD

Litecoin’s halving event is about six months away which will be its third after 2015 and 2019. Historically, LTC prices have soared in the aftermath of the event. It remains to be seen how the silver to Bitcoin’s [BTC] gold will perform, leading up to the halving.

![Litecoin [LTC] is ready to celebrate, but here’s why whales could spoil the party](https://patrolcrypto.com/wp-content/uploads/2023/01/aniket-green-brown-1536x520.png)