- Liquid staking protocols offered one of the most stable fee streams in the Web3 industry.

- Lido captured a 74% market share in the liquid staking market.

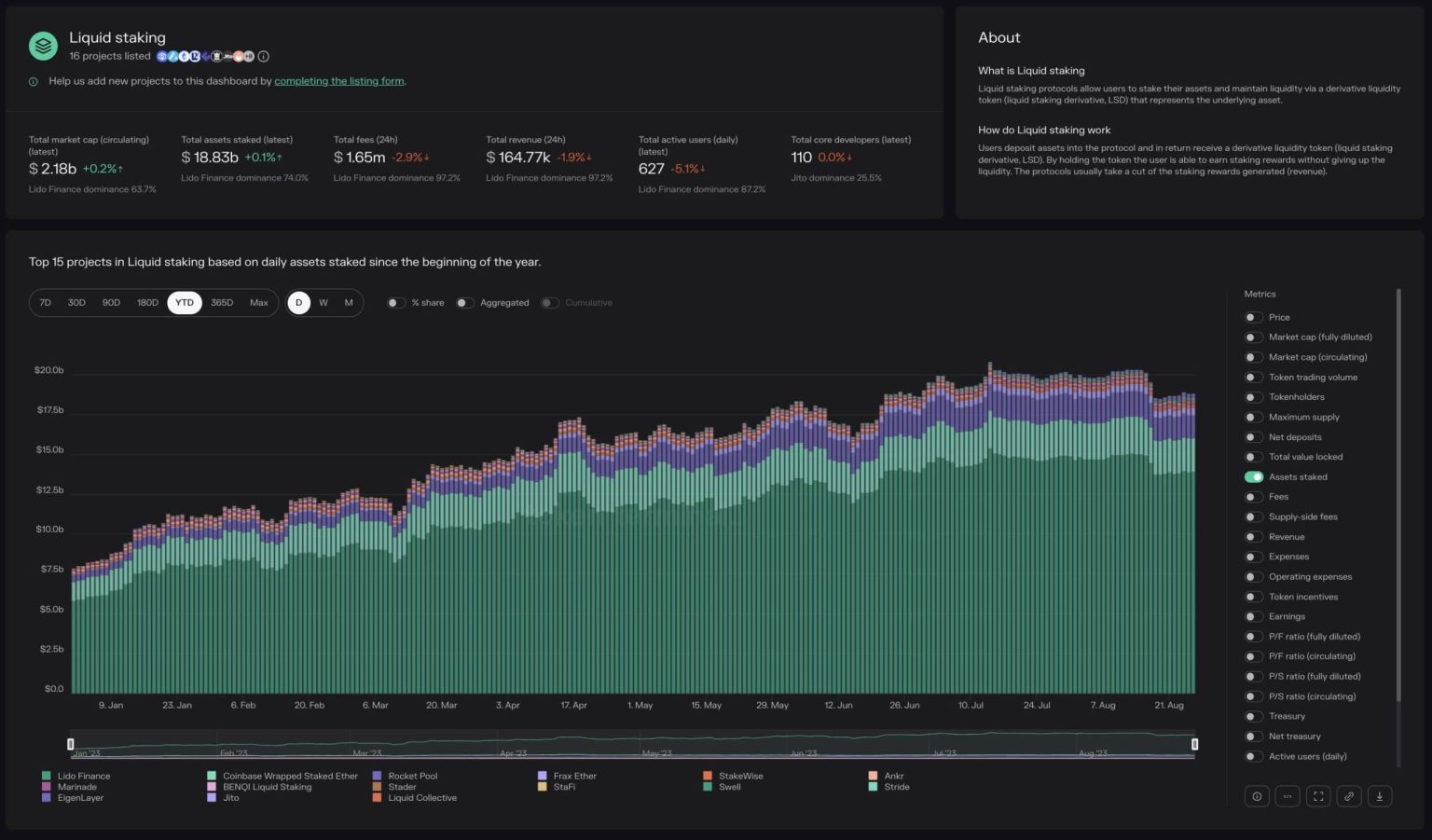

The Liquid staking market witnessed parabolic growth in 2023, outpacing all other competitors to emerge as the largest sub-sector in the DeFi economy.

Realistic or not, here’s LDO’s market cap in BTC’s terms

The total value of crypto assets staked through liquid staking protocols increased from $7.9 billion to $18.8 billion, according to an analyst from Token Terminal, more than doubling on a year-to-date (YTD) basis.

Source: Token Terminal

The stakes are high!

Liquid staking protocols arose to fill shortcomings in the conventional Ethereum [ETH] staking mechanism. These entities allow users to directly participate in staking while also maintaining the ability to use them elsewhere in DeFi for higher yield opportunities. The prospect of amplifying their rewards drove many users to the disruptive world of liquid staking.

Moreover, liquid staking protocols offered one of the most stable fee streams in the Web3 industry, as per the Token Terminal analyst. Note that fees in this case is nothing but the rewards which accrue to stakers.

Source: Token Terminal

As a result, liquid staking has steadily evolved to become the largest sub-sector in the DeFi landscape. In the process, these projects surpassed the previously dominant decentralized exchanges (DEXs) and lending protocols.

As per DeFiLlama, Liquid staking alone constituted 32% of the total assets locked in DeFi at the time of publication.

Source: DeFiLlama

State of the sector

Lido Finance [LDO] remained head and shoulders above its competitors in the burgeoning landscape, capturing a mammoth 74% market share. Notably, the largest liquid staking protocol increased its market share in 2023. The execution of Ethereum’s Shapella hard fork potentially played a significant role.

Staking, which was once considered a risky proposition, got a boost after the Shapella Upgrade enabled users to withdraw their ETH.

Is your portfolio green? Check out the Lido Profit Calculator

Shapella upgrade also catalyzed demand for newer market entrants. Projects like Liquid Collective and Swell, which launched their own liquid staking tokens (LSt) earlier in the year, saw their staked assets value balloon to the $100 million mark as of this writing.

At the time of publication, the aggregated market capitalization of all LSTs was $16.3 billion, representing an increased of 16% over the past two months, data from CoinGecko revealed. Volume worth more than $28 million was recorded due to the sale and purchase of these tokens in the last 24 hours.