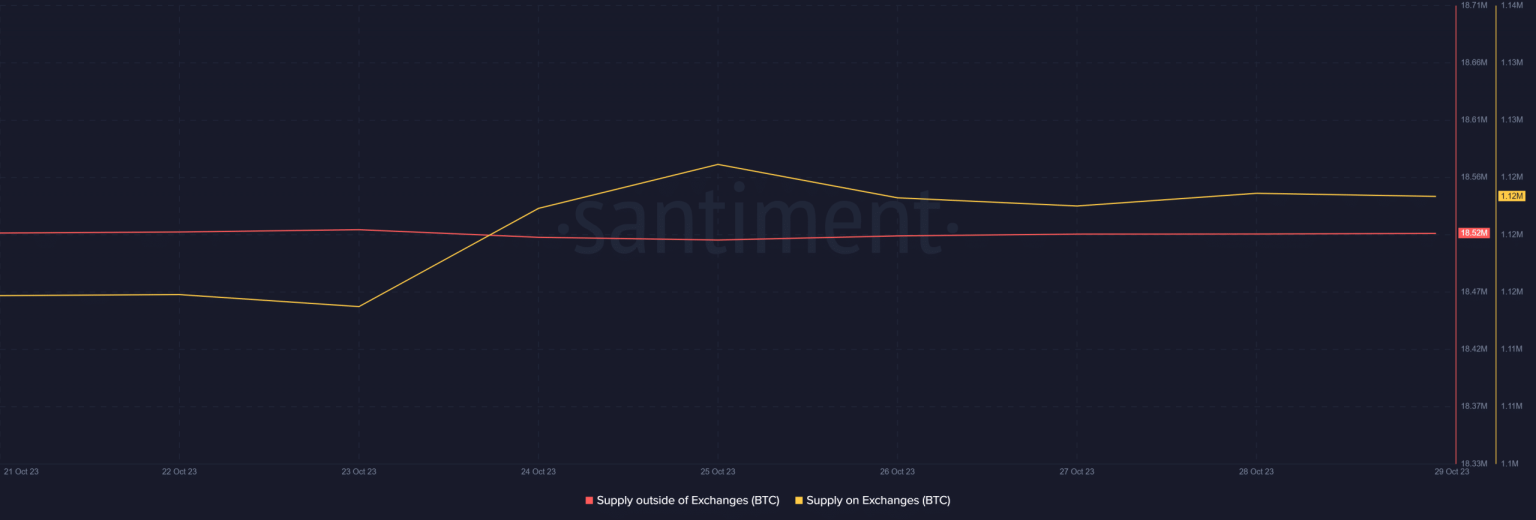

- BTC’s exchange reserve was increasing at press time.

- Bitcoin’s derivatives metrics also gave a bearish notion.

After a comfortable week-long bull rally, Bitcoin’s [BTC] growth momentum declined. This was evident from the fact that BTC’s price only moved marginally over the last 24 hours. However, the whales showcased immense confidence in BTC as they continued to stockpile coins.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Bitcoin whales are confident

According to CoinMarketCap, Bitcoin managed to increase its price by more than 13% over the last seven days. This gave investors hope for a further rise in its price. However, the reality turned out to be different, as in the last 24 hours, BTC’s growth rate declined.

In fact, BTC’s price moved by less than 1% over the past day. At the time of writing, it was trading at $34,096.52 with a market capitalization of over $665 billion.

Though BTC’s growth slowed down, the whales had faith in the king of cryptos. Ali, a popular crypto analyst, recently posted a tweet revealing how whales were behaving in the past.

As per the tweet, whales bought BTC worth more than $1 billion in just the last five days, reflecting their confidence in the coin.

#Bitcoin whales have purchased over 30,000 $BTC within the last five days, worth nearly $1 billion! pic.twitter.com/oclJBY5j6a

— Ali (@ali_charts) October 28, 2023

Looking at the bigger picture

While the whales’ confidence in BTC was high, the border market seemed to have a different opinion. This was evident from the fact that BTC’s Supply on Exchanges went above its supply outside of exchanges.

Additionally, its exchange reserve was also increasing, meaning that the coin was under selling pressure at press time.

Source: Santiment

It was surprising to note that despite clear evidence of an increase in selling pressure, BTC’s liquidation remained pretty normal. As per Hyblock Capital’s chart, BTC’s liquidation level did not rise to a concerning level over the last few days.

Source: Hyblock Capital

A look at Bitcoin’s social metrics revealed that negative sentiment around the coin has increased in the recent past. As per LunarCrush, BTC’s social mentions and bullish sentiment dropped substantially over the last seven days.

Another bearish metric of BTC’s Altrank, which increased by 31 over the last week.

Not only that, but Bitcoin’s trading volume plummeted, reflecting that investors were unwilling to trade the coin. Because of the recent halt in BTC’s value uptrend, its Price Volatility 1w also registered a decline.

Its MVRV ratio also dropped, further increasing the chances of a price decline in the days to follow.

Source: Santiment

Is your portfolio green? Check the Bitcoin Profit Calculator

The derivatives market metrics also looked pretty bearish. According to Coinglass, BTC’s open interest increased while its price plateaued, suggesting that this trend would continue.

On top of that, BTC’s Taker Buy – Sell ratio and Funding Rate were green, meaning that investors in the futures market were buying BTC at a time when its price trajectory slowed down.

Source: CryptoQuant