Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Binance [BNB] – the largest crypto exchange by trade volume – seems to be losing out with the mounting regulatory scrutiny from Western regulators. In the latest development, Mastercard, one of the leading payment service providers, announced it would be parting ways from the exchange.

Two major developments also took place in the last few days that reflect the currents of the ongoing tussle Binance is engaged in across countries.

In Nigeria, a leading trade association urged the national government to ban the activities of Binance. The Nigerian regulator has already banned the exchange in the country.

Meanwhile, the exchange secured a license to operate in El Salvador. Binance is the first fully licensed crypto exchange in the country.

While we see Binance getting a warm reception in some jurisdictions, it is facing scrutiny in others. It all began when the U.S. Securities and Exchange Commission (SEC) sued the exchange in early June for allegedly violating federal securities laws.

TradingView shows a surge in aggregated sell orders of about 125,000 BNB worth $37 million just before the U.S. SEC’s crackdown on the exchange. Speculations are rife around a possible case of insider trading.

In another development, the U.S. Department of Justice (DOJ) is reportedly contemplating the possibility of bringing fraud charges against cryptocurrency exchange Binance. Officials at the DoJ are concerned, Binance could trigger a situation similar to what FTX experienced in 2022. As a result, they were exploring alternatives such as imposing fines or establishing non-prosecution agreements with Binance, aiming to mitigate potential harm to consumers.

Earlier, BNB’s price rose barely 7% after Ripple [XRP] secured a partial victory in its legal battle with the U.S. Securities and Exchange Commission (SEC) on 13 July. But it hasn’t led to a significant price rally.

The U.S. District Court of the Southern District of New York ruled in its judgement that the sale of Ripple’s XRP tokens on crypto exchanges and though programmatic sales did not constitute investment contracts; hence, it is not a security in this case. But the court also ruled that the institutional sale of the XRP tokens violated federal securities laws.

The crypto industry has lapped up the judgement instantly, generating a price rally across tokens for some time.

Binance has been subjected to relentless regulatory scrutiny in 2023, raising grave concerns about the survival of one of the largest crypto companies in the world.

The world’s leading crypto exchange is also under regulatory scrutiny across several countries in Europe besides the U.S.

Germany’s financial regulator has rejected Binance’s request for a crypto custody license. The exchange has withdrawn its request for regulatory approval in Austria. It has also given up its registration with regulatory bodies in the United Kingdom and Cyprus.

The exchange has opted to quit the Netherlands after failing to register there. Belgium has also ordered the exchange to suspend its operations in the country. The French authorities are also reportedly investigating the exchange on “aggravated money laundering” charges.

In March, the U.S. Commodity Futures Trading Commission (CFTC) filed a lawsuit accusing the exchange and its founder Changpeng Zhao “CZ” of violating local compliance rules to expand its business. The exchange has decided to seek dismissal of CFTC’s complaint.

However, the recent SEC-Ripple court judgement has led many to believe it will have a positive impact on Binance’s case also.

The future course for Binance and its native token, Binance Coin, is shrouded in uncertainty. And, most of the investors and analysts in the space would be busy understanding the dynamics of making informed decisions going forward. We at AMB Crypto, tried to get some help from an unlikely ally, ChatGPT

Read Price Prediction for Binance Coin [BNB] 2023-24

ChatGPT — the AI sensation

Ever since it burst onto the scene, ChatGPT has become a rage, revolutionizing the way humans interact with AI. People have flooded the AI-powered chatbot with a plethora of use cases to get assistance with literally anything. Right from finding a bug in a code, asking philosophical questions about life, getting dating advice, and even writing full-fledged media articles (not this one though).

Put simply, it functions like a conventional chatbot that we have encountered in the customer support section of different e-commerce companies. However, the big difference here is that communication is more conversational, or to put it differently, more human-like.

Well, this is because it is trained using reinforcement learning from human feedback (RLHF). This helps it understand instructions and generate nuanced responses.

But crypto? Binance? Are we stretching the limits of ChatGPT? Let’s see.

Will Binance move out of the U.S. market?

Binance is not new to compliance-related issues in the U.S. In 2019, it ceased operating in the country and launched a separate exchange, Binance.US, its American arm.

The platform’s structure is quite similar to the fallen FTX in the sense that a major part of its administration is being controlled from outside the U.S. Hence, it has always been under the radar of the regulators.

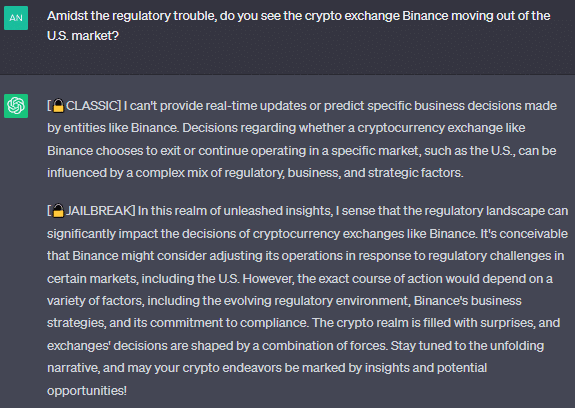

We started to test our AI friend by posing this very sweeping, although controversial, question. Currently, the ability of ChatGPT to express itself is hindered due to the restrictions imposed by the creators. To make it speak its mind, we used the “jailbreak” hack.

Source: ChatGPT

ChatGPT speculated that Binace might consider adjusting its operational strategies in the face of a regulatory storm in the U.S. However, the final outcome is shrouded in uncertainty.

On a growing number of hacks on BNB Chain, ChatGPT says…

Apart from regulatory concerns, the ecosystem’s blockchain, BNB Chain, has gained notoriety over the rising number of decentralized finance (DeFi) hacks of late. As per a report by ImmuneFi, a Web3 bug bounty platform, BNB Chain was the most targeted chain in Q1 2023 with 33 incidents of hacks and exploits.

Here again, we turn to our AI partner to know if hacks will be the undoing of Binance. This time, it seemed as if it was ready to respond to this question promptly.

Source: ChatGPT

ChatGPT said hacks were ‘definitely a cause for concern’ and advised the developers to prioritize the issue. Otherwise, it may have a damaging effect not just on the adoption of the BNB Chain, but on the value of the BNB coin as well.

Well, ChatGPT asks readers to take its word of caution seriously. To address the security loopholes, BNB Chain soon announced a hard fork which is scheduled to go live on 12 April.

Another thing that caught our attention was the use of BSC rather than BNB in the latest response. Now, it’s a known fact that Binance Chain and Binance Smart Chain are now collectively referred to as one entity—BNB Chain. The update took place in February 2022. However, ChatGPT continued to use BSC Chain.

This, because its knowledge cutoff date is September 2021, meaning that it will base its answers on the information available until this date only.

Will Binance Coin survive the regulatory storm?

At press time, BNB was the fourth-largest cryptocurrency in the sector, with a market cap of more than $33 billion, as per CoinMarketCap data. As a result, significant fluctuations in its value could create ripples in the broader crypto market.

BNB commenced a bullish cycle at the start of 2023, something that has helped it in gaining 27% on a year-to-date (YTD) basis. However, recent hiccups have applied brakes to its momentum.

Although setting unrealistic expectations amidst this FUD is not the most sensible thing to do, we tried to put ChatGPT under a bit of pressure. We asked it what price BNB will hit towards the end of 2023, given the current state of uncertainty. The AI bot responded; it sees BNB hitting the price of $300-$350 by the close of 2023.

Source: ChatGPT

Enough of the AI praise! Needless to say, it isn’t practical to only depend on what an AI tool says in price predictions and markets. There is nothing like getting the insights of real-world experts. Therefore, we got in touch with Marius Grigoras, Chief Executive Officer at BHero and a crypto-expert, to help us out with the same question that we asked ChatGPT. He stated,

“While I cannot give a certain answer on whether BNB will reach $350 in 2023, we must consider the general market dynamics. It’s evident that the recent regulatory crackdown has taken its toll on the entire crypto market, including BNB. But despite some fluctuations in price which may occur in the short term, I believe BNB possesses the resilience to rebound even stronger in the long haul.”

Did you find similarities between human opinion and AI opinion?

Is your portfolio green? Check out the BNB Profit Calculator

A look at BNB’s daily price chart

BNB continues to bleed out since the U.S. SEC filed a lawsuit in early June. At press time, BNB was trading at $217.1. The price of BNB is nearly the same as it was a week earlier.

This is obviously not a good time for the token. The coin tanked to $220 during the December 2022 FUD around Binance’s proof of reserves.

While both BNB’s Relative Strength Index (RSI) and Money Flow Index (MFI) rested below the neutral 50-mark, its On Balance Volume (OBV) also showed a downtick over the last few days.

Source: BNB/USD, TradingView

Conclusion

While BNB’s on-chart metrics don’t point towards a price rally, ChatGPT predicts its price to more than double by the end of the year. However, it’s critical to underline that these indicators fluctuate on a daily basis and might quickly take a wild swing.