Non-fungible tokens, commonly known simply as NFTs, are a unique type of digital asset enabled by blockchain technology. Essentially, NFTs are digital tokens with unique identifiers, and they are commonly used to represent both digital and physical objects.

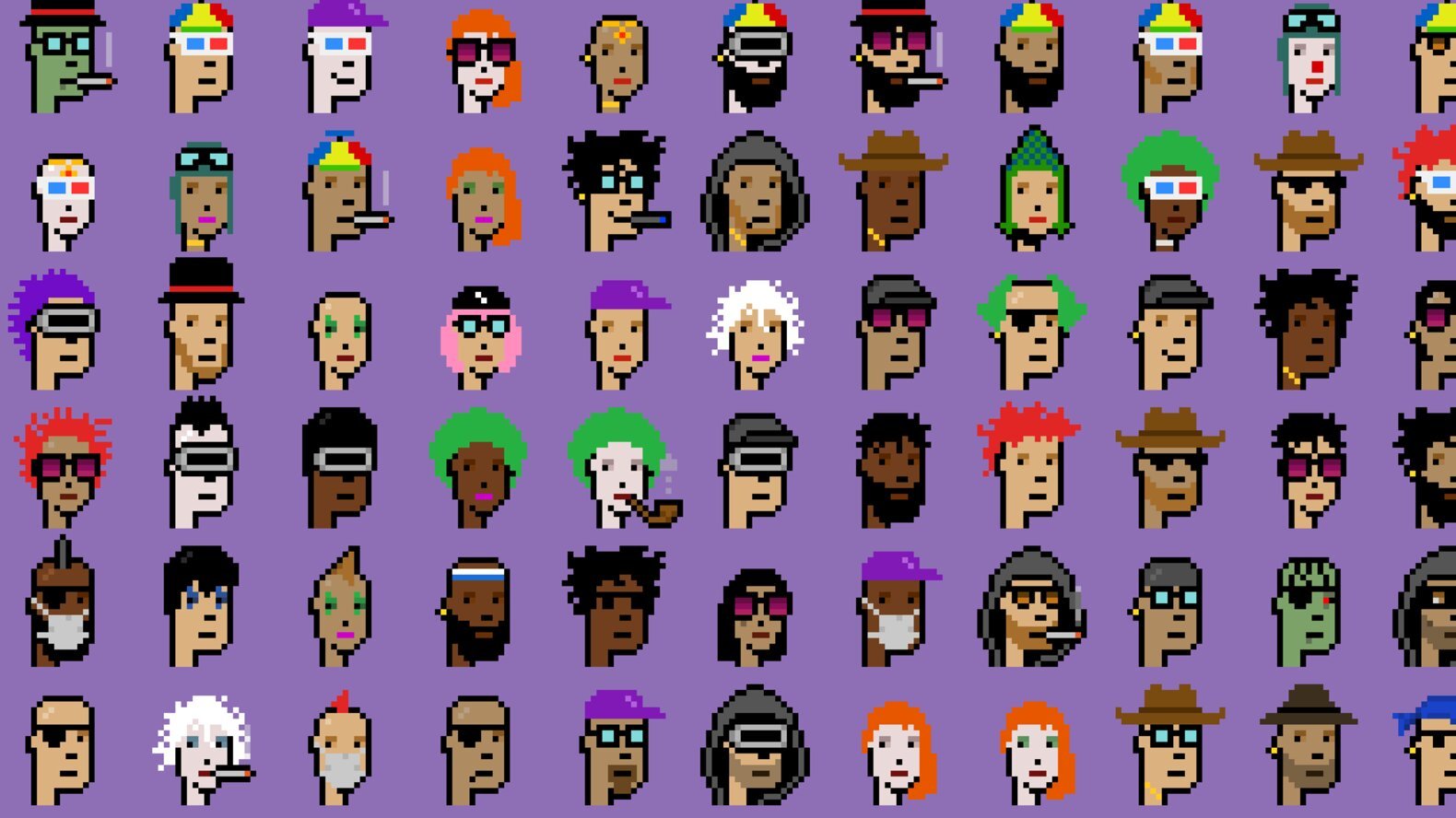

In practice, NFTs are most often used to represent digital artworks, for example avatars that can be used as profile pictures on social media networks. Since they are issued on blockchains, NFTs can be transacted with on a 24/7 basis anywhere in the world. This has allowed a flourishing NFT market to develop, and some NFTs have sold for millions of dollars.

If you want to learn how to make money with NFTs as a beginner, there’s quite a few different avenues you can explore. You could create your own NFTs, trade existing NFTs, mint NFTs from upcoming projects, and more.

How to make money with NFTs?

Let’s go through some of the main ways in which you can make money with NFTs. Of course, we should point out that investing in NFTs is a high-risk activity, and you could lose the entirety of your investment. Make sure to consider your financial situation and do your own research before deciding to buy any NFTs.

Create your own NFTs

One of the most straightforward ways of making money with NFTs is to create your own NFTs and sell them. The infrastructure for this is developed very well, as most NFT marketplaces allow anyone to publish NFTs and offer them to a global audience.

Of course, creating NFTs that people will actually want to buy is anything but easy. There’s a few considerations that need to be taken into account before starting.

NFTs have a wide range of applications. While the most popular NFTs can broadly be classified as art NFTs, some NFTs are meant to have utility as well. For example, an NFT could provide access to an exclusive communications channel, such as a private Discord server. There’s also NFTs that grant holders access to exclusive experiences, such as meet-and-greet sessions with celebrities.

However, most people who are looking to launch their own NFTs will likely be creating NFTs that are meant to be visually appealing. If you want to know how to make money with NFT art, there’s several options available.

If you’re an artist and already have your own portfolio, consider minting some of your best pieces as NFTs and offering them for sale as 1:1 NFTs. While the 1:1 NFT market is significantly smaller than the market for NFT collections, you might be able to find interested buyers if your work is of high quality.

If you’re looking to launch a collection of NFTs, the most popular genres are profile picture (PFP) NFTs and generative art NFTs. PFP NFTs are especially popular, but the market is already highly saturated, making it difficult for new entrants to succeed.

If you have both coding skills and artistic talent, you can consider creating a collection of generative art and sell it in the form of NFTs. If you want to explore this route, we recommend checking out platforms like ArtBlocks and fxhash. The market for generative art NFTs is less saturated, so it’s a bit easier for new entrants to get noticed, provided their work is of high quality.

You also have to choose which blockchain platform you want to publish your NFTs on. Ethereum is the most widely supported platform across different NFT marketplaces, but also has the highest transaction fees. If you’d like your NFTs to have lower transaction fees, consider using Polygon or Solana.

An NFT by itself is just a token on the blockchain that points to the location where the media associated with the NFT is stored. Instead of using centralized storage solutions, consider using decentralized storage solutions like IPFS and Arweave. Not only will this make your NFTs more robust, it will also be appreciated by the community of NFT collectors.

Trade NFTs

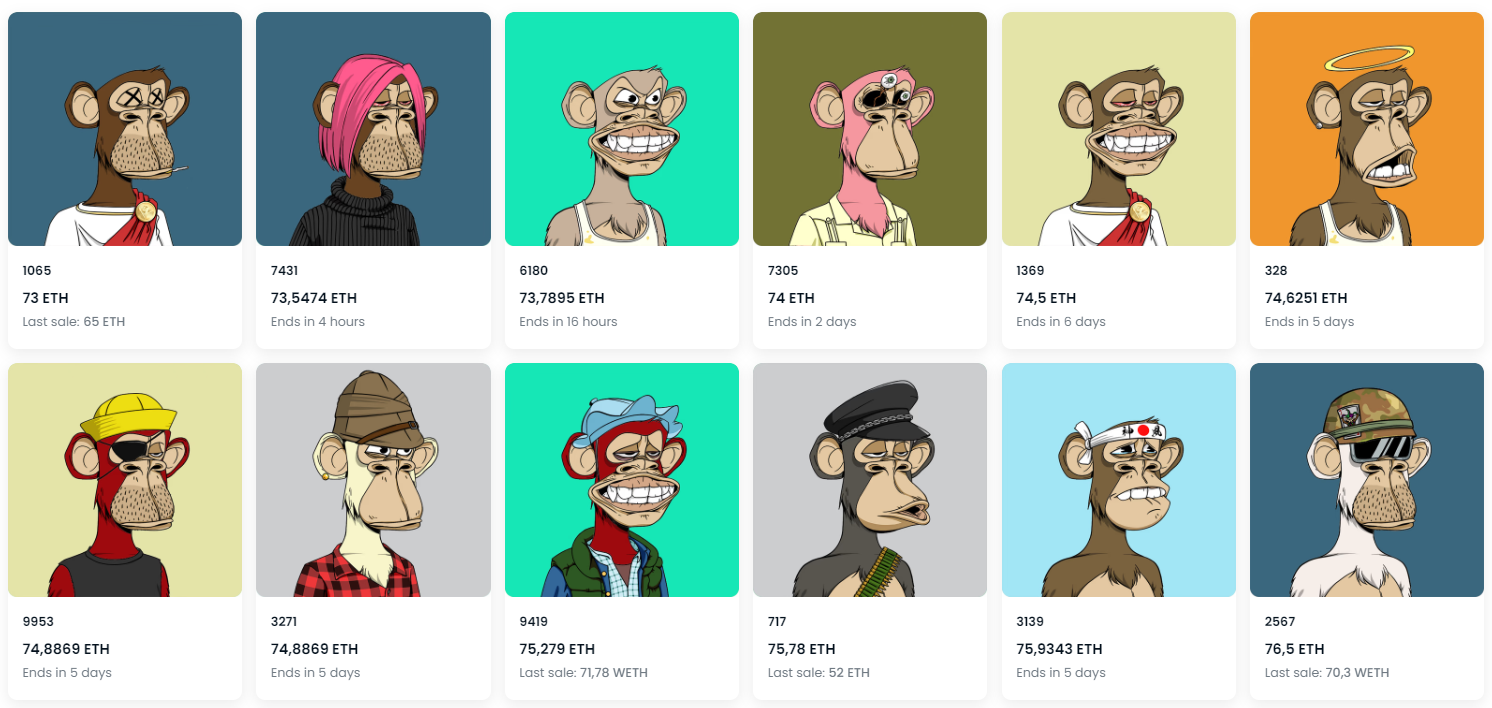

Another common way of making money with NFTs is to trade them. This is most commonly done on NFT marketplaces such as OpenSea. The basic principle is the same as with trading any other asset – you want to buy low and sell high. Of course, this is easier said than done.

In order to succeed with trading NFTs, it’s very important to have your finger on the pulse of the NFT community so you understand which collections are currently trending and which collections are falling out of favor. You can do so through Twitter and Discord servers where you can chat with other NFT traders and get a feel for where the market is heading.

You should be aware that the NFT market is less liquid than the market for fungible crypto assets like BTC and ETH. This means it will take longer for you to sell your NFTs, and you might have to adjust your asking price often in order to find a buyer.

If you hold NFTs from an obscure collection that there isn’t a lot of interest for, these problems will be exacerbated and you might not even be able to find a buyer at all.

Another difficulty in trading NFTs is that the most liquid NFT collections tend to have a high floor price, which means that you need to commit a significant amount of capital to get started. Of course, you could opt to trade NFT collections with a lower price floor, but those collections tend to have less liquidity and a shorter track record.

Rather than actively trading NFTs, it might be a better idea to simply buy an NFT from a collection you believe has long-term promise, and hold it for a longer period of time. NFTs are an emerging type of asset and are highly risky, so never invest more than you’re willing to lose.

Mint NFTs from promising projects

If you’re wondering how to make money on NFT projects, you could look to secure a minting spot from projects that are yet to launch. Typically, projects will allow users to mint NFTs at a fixed price, but some projects also launch free NFT drops.

When it comes to PFP NFT collections, you don’t know exactly which NFT from the collection you’re going to get at the time of the mint, as the minting is randomized. This means that you could potentially get an NFT with rare traits.

Many projects have abandoned open minting in order to prevent bots from snagging up all the spots in the minting process. Typically, users need to get on a whitelist or allowlist in order to mint NFTs. Each project will have different criteria for getting onto their whitelist, so make sure to do your research beforehand.

Participating in NFT mints can be lucrative, but you need to be careful about the projects you choose. Some NFT collections might never gain traction, which will leave you with NFTs that will be difficult or impossible to sell. Minting NFTs from new projects is similar to participating in token sales – the upside is big, but you won’t be left with much if the project doesn’t succeed.

You also need to be aware of rug pulls, which are projects that collect funds from investors but never actually release the product. In some cases, projects will release NFTs, but then quickly abandon their roadmap and disappear.

Play-to-Earn games

Many play-to-earn games incorporate NFTs, which are required to play the game and earn tokens. This includes games such as Axie Infinity and Splinterlands. In addition to the tokens you receive through play-to-earn mechanics, you can also sell your NFTs to potentially make a profit.

Depending on the game, your earning potential in play-to-earn games might depend on your skill level and the amount of money you’re willing to invest to get started. For example, purchasing more powerful items might allow you to earn more tokens.

There’s a wide variety of play-to-earn games available on the market. Ideally, you should choose a game that has compelling gameplay in addition to play-to-earn rewards – nobody likes “grinding” a boring game just to earn rewards.

The downside of play-to-earn games is that it’s difficult to create a sustainable model for tokenomics. If a play-to-earn game sees a sudden spike in popularity, the supply of its rewards token could inflate, resulting in lower prices and less valuable rewards.

You can find some of the games that are worth exploring by checking out our list of the best metaverse NFT projects.

Invest in blockchains that are used for NFTs

An indirect way of gaining exposure to NFTs is to invest in blockchain platforms that are commonly used for issuing and trading NFTs. This includes platforms such as Ethereum, Polygon, Solana and Flow.

The simplest way to do so is to simply purchase the platform’s native token, for example ETH. These crypto assets are much easier to sell compared to NFTs, and you can also access tools such as futures and

Investing in blockchains used for NFTs is probably a safer way of benefiting from the potential growth of the NFT sector compared to investing in specific NFT projects. However, the upside is also lower than finding a hidden gem NFT project that proceeds to explode in value.

The bottom line – There’s many ways to make money with NFTs, but you need to be careful

If you’re wondering how to make money with NFTs as a beginner, we hopefully showed you some of the most promising avenues to explore. For most people, trading NFTs will be the most accessible way of making money with NFTs. However, if you can dedicate a significant amount of time to researching and scanning the NFT scene for promising projects, it’s also possible to make money by participating in NFT mints.

If you have artistic talent, you could mint your artworks as 1:1 NFTs and sell them. Who knows – your NFT could even end up on the list of the most expensive NFTs ever sold!

Meanwhile, if you’re looking to launch an NFT collection, you will also likely need a team to help you and provide additional incentives to holders of your NFTs. The market for NFT collections is highly saturated and participants are usually looking for more than just cool-looking avatars.