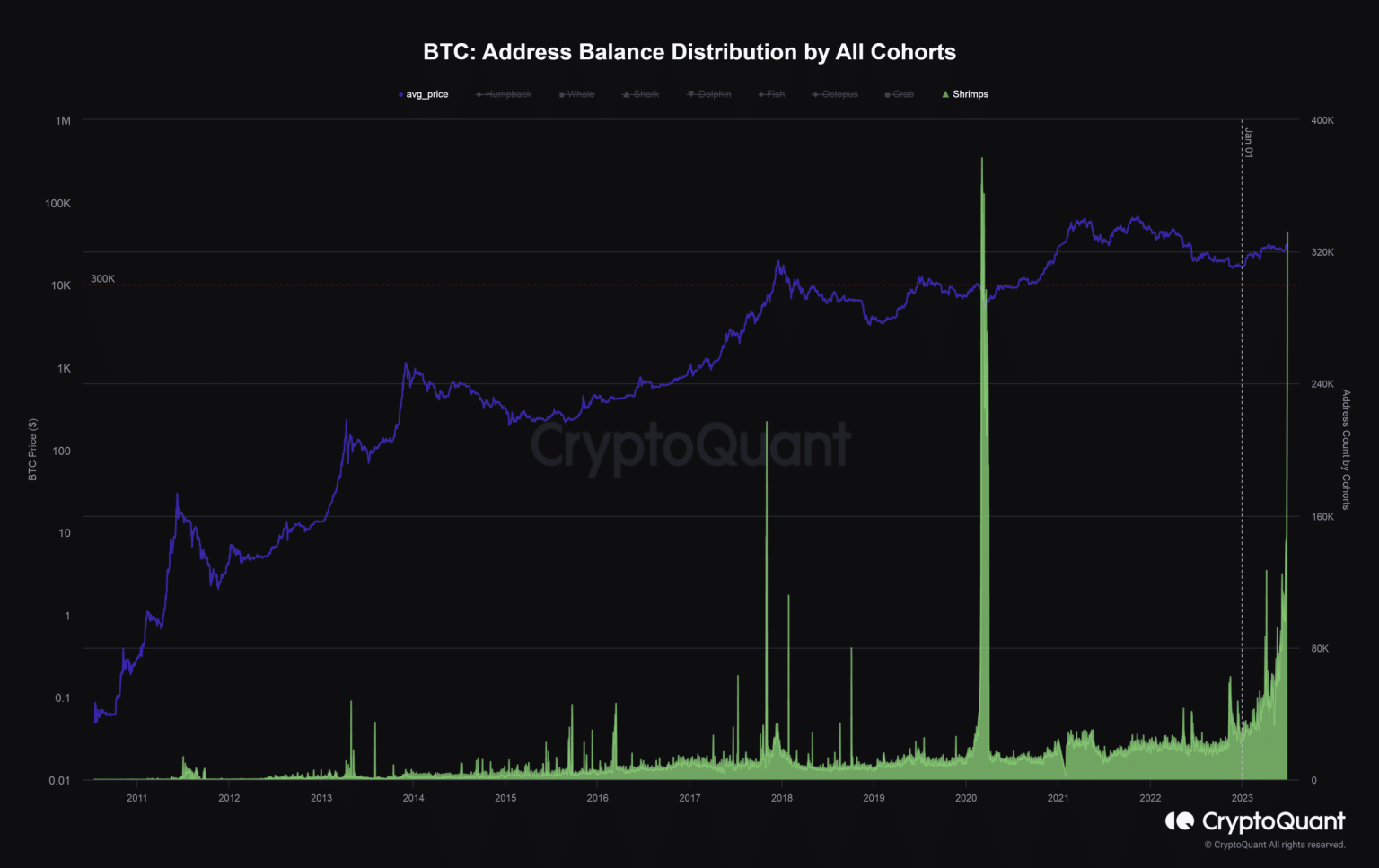

- Addresses holding less than 1 BTC have surged exponentially since the rally began last week.

- The accumulation activity by old addresses was outpacing creation of new addresses on the network.

Bitcoin [BTC] briefly pushed over $31,000 before retreating to $30,904 at the time of writing, as the interest shown by TradFi giants continues to inject momentum and volatility into the king of digital assets. The market rally, coming after a protracted stagnation in BTC’s price, prompted many investors to lock in profits.

Are your BTC holdings flashing green? Check the Profit Calculator

However, many of BTC’s retail investors have bucked this trend. According to an analyst from blockchain research firm CryptoQuant, addresses holding less than 1 BTC, also known as “Shrimps”, have surged exponentially since the rally began last week.

Shrimps, Crabs lead the way

As per the data, the number of addresses in the above-mentioned cohort have shot up by almost three times since 20 June. The total count at the time of writing was more than 331k, the highest ever.

Source: CryptoQuant

Moreover, ‘Crabs’, the investor cohort holding between 1-10 BTC, saw a threefold increase in the number of addresses.

Source: CryptoQuant

However, the surge was decisively driven by old addresses i.e., addresses that were active but not participating in transactions.

An observation made earlier by the same analyst showed a notable increase in the number of old addresses, and at a rate which was faster than the creation of new addresses on the network. This basically meant that a greater number of long-term holders were engaged in accumulation, anticipating further price growth of BTC.

Combining the above two observations, it became evident that retail investors were actually leading the accumulation trend among long-term holders of the coin.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Transaction activity stays low

Barring few instances of profit-taking, the transaction activity continued to remain tepid on the Bitcoin network. According to Glassnode, the total amount of coins transferred on the chain dropped after the initial frenzy of the rally.

On similar lines, the supply going out of centralized exchanges (CEX) continued to increase. This provided additional support to the narrative that, despite being enticed to lock in short-term gains, most seasoned Bitcoin investors showed a stronger desire to accumulate and HODL.

Source: Glassnode