- Following a period of downtime, Hedera has resumed operations.

- HBAR suffers a liquidity exit that has driven its price down.

Following several hours of downtime on 10 March due to an exploit of the Smart Contract Service code of its mainnet, Hedera network has resumed operations.

Aaaaaand we’re back! https://t.co/sUahtuSoA4 – thank you all so much @hedera community. Blog post incoming.

— Christian Hasker (@chasker) March 11, 2023

On 10 March, an attack targeted the Smart Contract Service code of Hedera Hashgraph, transferring Hedera Token Service tokens from victims’ accounts to the attacker’s account. When the attack was detected, Hedera decided to turn off mainnet proxies to prevent further theft.

According to data from DefiLlama, the total value of assets locked (TVL) on DeFi protocols on Hedera plummeted during the approximately 24-hour period that the network was offline.

Is your portfolio green? Check out the Hedera Profit Calculator

However, since operations have resumed, the TVL has risen by 7% in the last 24 hours. At press time, the network’s TVL stood at $28.06 million.

While Twitter user KungensSlott complained of low transactions per second rate on the network soon after it returned online, Hedera has since seen an uptick in the number of transactions per second processed on the chain. As of this writing, 791 transactions were processed per second on Hedera.

Why TPS so low Christian? ???? pic.twitter.com/W5GsK4nUGK

— Valhalla.ℏ (EN/FR/ES) (@KungensSlott) March 11, 2023

HBAR faces a gloomy future

Similar to the overall increase in the cryptocurrency market at the start of the year, the price of HBAR also rose to a high of $0.088 on 20 February and has since experienced a decline.

Trading at $0.05795 at press time, HBAR’s price has dropped by 34% in the past 20 days, data from CoinMarketCap revealed.

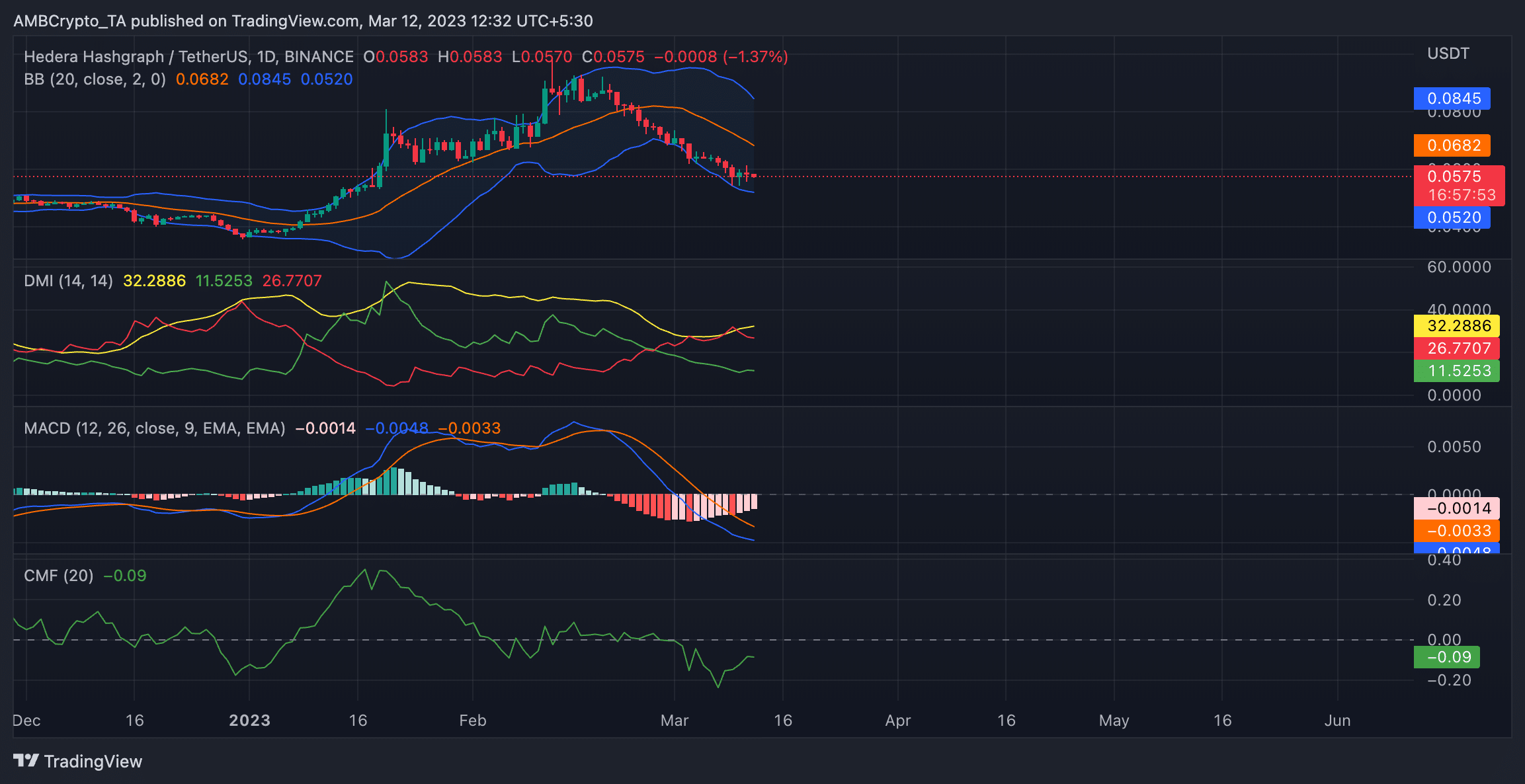

As observed on a daily chart, the decline in HBAR’s value since 20 February ushered in a new bear run. A look at the alt’s Moving average convergence/divergence (MACD) indicator showed the intersection of the MACD line with the trend line in a downtrend on 20 February and has since been so positioned.

As HBAR’s price fell, the bears regained their strength, causing them to take control of the market. This position was proved by the alt’s Directional Movement Index (DMI).

Read Hedera [HBAR] price prediction 2023-2024

At press time, the sellers’ strength (red) at 26.77 was solidly above the buyers’ (green) at 11.52. Additionally, the Average Directional Index (ADX) at 32.28 showed that the sellers’ strength was a rock-hard one that buyers might find impossible to revoke in the short term.

HBAR’s price traded close to the lower band of its Bollinger Bands indicator at the time of writing. While this would typically suggest that the asset was oversold and may be due for a price increase, a look at the token’s Chaikin Money Flow (CMF) confirmed increased liquidity exit from the HBAR market.

At a negative -0.09 at press time, the CMF has to reclaim its spot above the centerline for HBAR’s price to log any significant price rally.

Source: HBAR/USDT on TradingView