- HBAR defied gravity to maintain an upside when the market turned bearish.

- Hedera’s NFT segment was heating up, with a special focus on the African market.

The crypto market has responded to the SEC’s latest push against crypto staking by lending favor to the bears. Most of the top cryptocurrencies were discounted in the last 24 hours. However, Hedera [HBAR] was among the few that somehow evaded this FUD-induced sell pressure.

Is your portfolio green? Check out the Hedera Profit Calculator

The global crypto market cap was down by 4.02% in the last 24 hours, confirming the bearish outcome courtesy of the SEC’s anti-staking sentiments. Meanwhile, HBAR managed a 7.2% rally during the same period.

Source: TradingView

Thus, HBAR might break above the press time resistance level, especially if the rest of the market recovered.

Hedra’s NFT future looks bright

Hedera has made multiple announcements this week, notably the launch of a new metaverse fund worth $1 million through the AfroFuture DAO.

We’re excited to announce the launch of @afrofutureai‘s $1 million Africa #Metaverse Fund, enabling Africa’s creative industry to enter #Web3 ????

The funds first project, Derived, is now live on the @Hedera mainnet with a curation of high profile artists leveraging #HBARNFTs ⚡️ pic.twitter.com/4dPub8HCM7

— HBAR Foundation (@HBAR_foundation) February 9, 2023

The fund, which primarily targeted the African market, would onboard more projects onto the Hedera network. It had already launched its first project at the time of writing, which would reportedly allow high-profile artists to take advantage of HBAR NFTs.

How did HBAR fare?

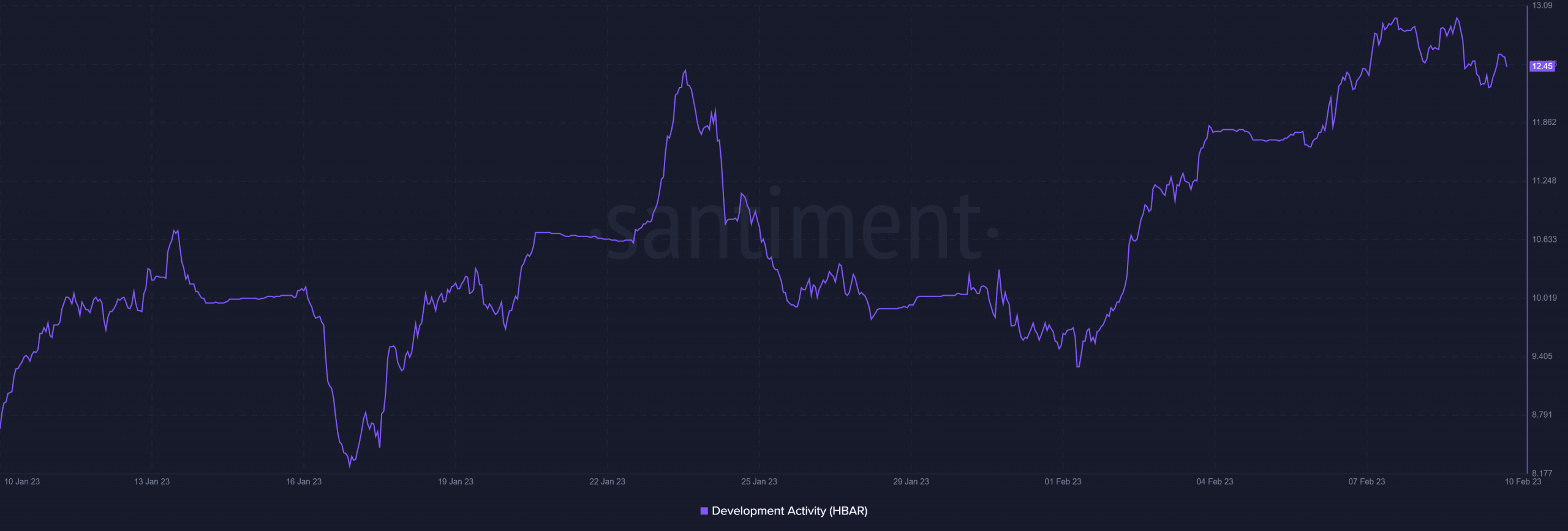

As a result of these announcements, Hedera maintained strong development activity in the last few weeks, peaking on 8 February.

Source: Santiment

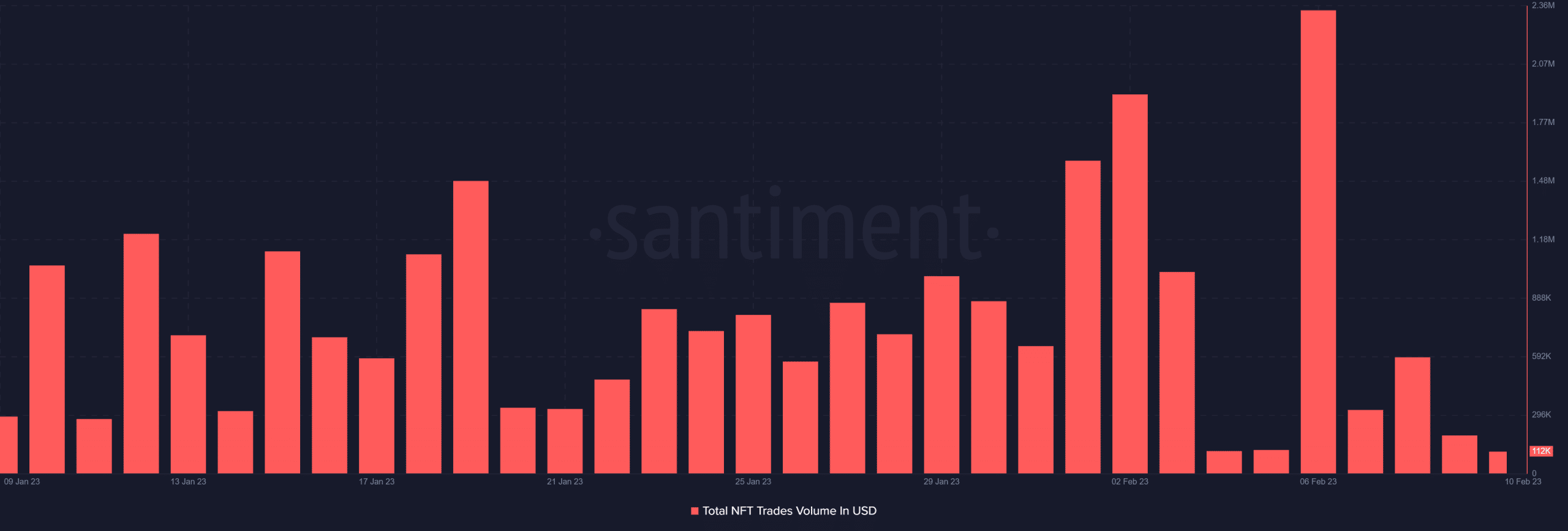

Most of Hedera’s growth came as a result of its NFT advancements. Therefore, unsurprisingly, the total NFT trades volume metric confirmed a significant increase on a YTD basis.

Source: Santiment

Realistic or not, here’s Hedera’s market cap in BTC’s terms

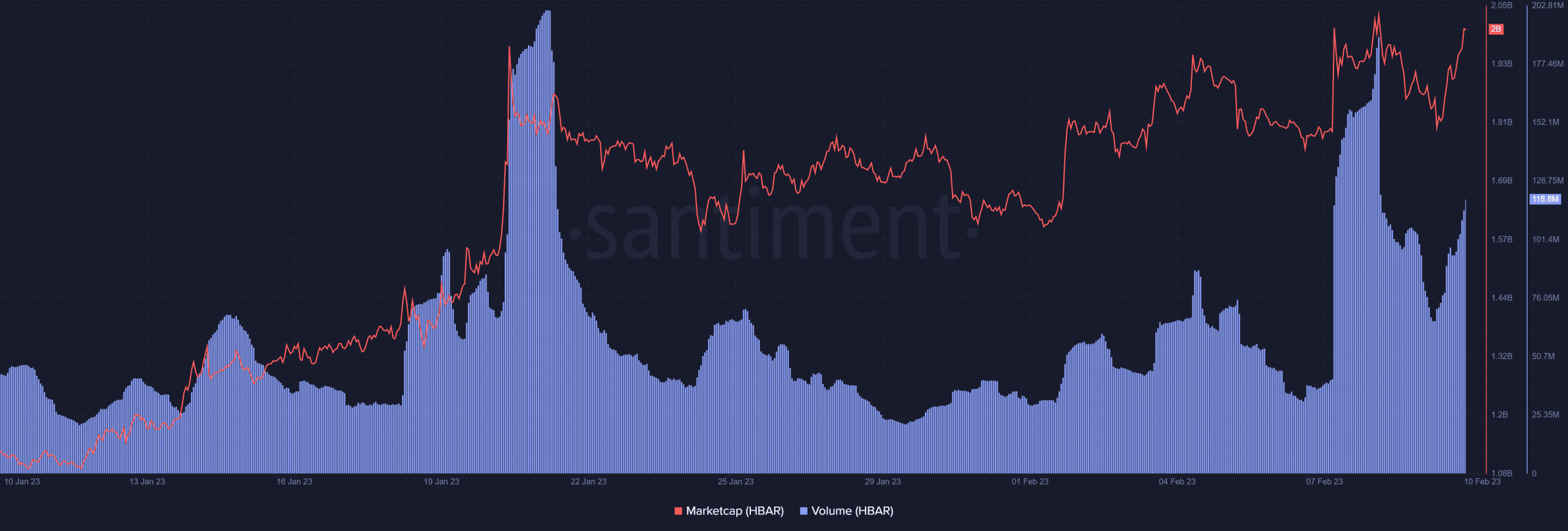

HBAR experienced a major volume surge in the last few days, with its weekly peak on 8 February. However, it slowed down since, until the last 24 hours, when it experienced another surge – albeit not as strong as it was formerly.

Source: Santiment

A look at HBAR’s market cap revealed that the above volume surge represented an influx of capital. Hedera’s market cap gained by slightly over $200 million in the last 24 hours alone. Thus, whether it would continue rallying or lend favor to the bears would largely depend on the market.