A recent study by Galaxy Digital has tipped the Bitcoin NFT marketplace to hit $4.5 billion in market cap in the next two years. This is due to the growing interest among the NFT community to inscribe/mint various types of data on Satoshis, the smallest unit of a Bitcoin.

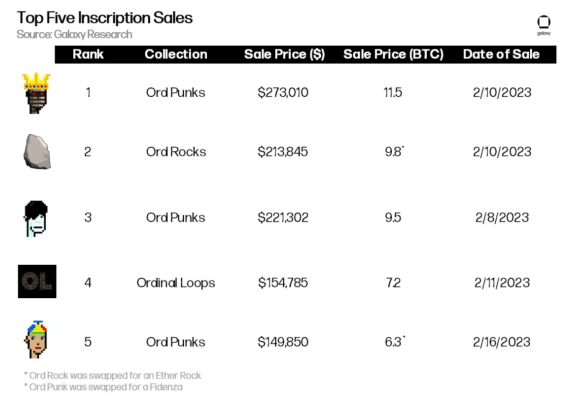

Data from Dune Analytics shows that there have been over 323,000 inscriptions so far. An impressive feat for Ordinals, a project that launched just over a month ago. The interest has been so strong for Bitcoin NFTs that Yuga Labs decided to launch its own collection on the network.

Now a report dated March 3 by Galaxy researchers makes conservative estimates based on various factors on how big this market could get. These estimates are based on the current size of Ethereum’s NFT market and its growth rate over the past few years.

In total, there are three predictions covering the bear, base, and bull case scenarios.

“While there are notable differences between inscriptions and NFTs, it’s fair to say that a native on-chain ecosystem for NFTs has emerged on Bitcoin in a way that was never before possible, and its usage has been exploding.”

Galaxy Digital Bitcoin NFT Predictions

On baseline analysis, Galaxy notes that if Bitcoin NFTs can infiltrate mainstream NFT cultures like PFPs (Profile Pictures), memes, and utility projects, the market cap can increase to $4.5 billion.

However, the researchers are quick to note that the projection is based on the “rapid development in inscription awareness coupled with the marketplace/wallet infrastructure already out today.”

In a bear scenario where these NFTs don’t enter the mainstream NFT market and pry market share away from Ethereum, Galaxy predicts they could still reach a market cap of $1.5 billion. This is based on the growing interest being witnessed now.

Finally, on the bullish side, the market could reach about $10 billion. However, this depends on whether these NFTs can provide strong competition to Ethereum NFTs and provide unique use cases.