- Bitcoin’s hashrate stood at 17% in January; it later grew to 27% in October.

- On another note, several public Bitcoin miners are aggressively expanding to adapt to the Bitcoin halving that takes place next year.

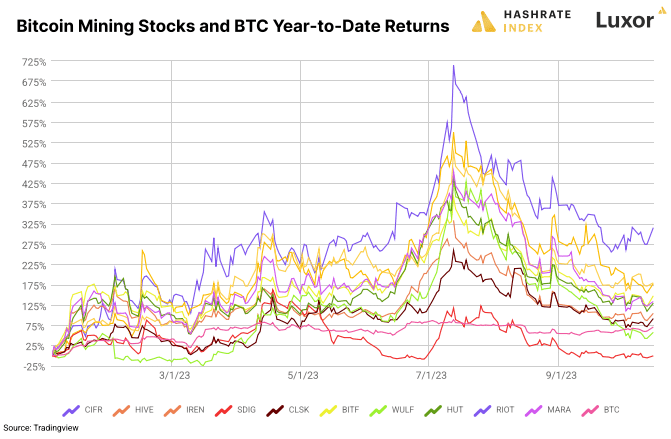

The recent bull run in the market has put the spotlight back on Bitcoin [BTC]. We decided to look at its relationship vis-à-vis the performance of the crypto mining sector.

Hashrate Index recently released its Q3 2023 Bitcoin mining report. The report shed light on the different aspects of crypto mining during July-September 2023.

The stocks of public Bitcoin mining firms started off on the right foot in July as BTC was trading north of $30K during most days in the month. But the moment it dropped to the price range of $25K-$26K, the performance of the stocks also began to deteriorate.

Source: Hashrate Index

As we can observe, the stock performance is closely correlated to the price movement of the king coin.

As per the report, Bitcoin’s seven-day average hashrate grew by 56% during the first five months of 2023. Then, during the months of June, July, and August, its hashrate fell by a modest 1.3%. In September, it suddenly increased by 12%. Ultimately, it reached an all-time high (ATH) in mid-October after growing 6% so far this month.

Source: Hashrate Index

The report’s authors write they are relatively certain that it is a seasonal pattern during the summer. US-based miners curtail their mining activities during these months. The country houses around 40% of Bitcoin’s global hashrate.

Texas, the mining hub of the US, is extremely hot in the summer. Miners operating in the region curtailed their activities during the season.

What production and hashrate growth tell us

The report also shed light on the Bitcoin production (units produced) and hashrate (EH/s) of the leading Bitcoin mining companies.

Marathon Digital grew its operational hashrate from 7.3 EH/s to over 19.1 EH/s year-to-date (YTD). It has the largest active hashrate among the public Bitcoin miners operating in North America. The report commented that the firm could achieve its target of 23 EH/s if it deploys its existing stock of S19 XP rigs to replace their S19j Pros.

Source: Hashrate Index

Riot Platforms saw a significant drop in its Bitcoin production. The hashrate of the firm also didn’t grow as expected. The main reason for this modest performance was the facility curtailing its operations during the month.

Source: Hashrate Index

Iris Energy dramatically increased its hashrate from 1.57 EH/s to over 5.55 EH/s this year. The reason behind this growth is the mining firm procuring new machines to replace the ASICs. However, its Bitcoin production dwindled during the last few months.

Source: Hashrate Index

Core Scientific saw a significant drop in its hashrate capacity due to its restructuring during its Chapter 11 bankruptcy. During the bankruptcy proceedings, it sold all of its BTC to pay creditors and cover operational and bankruptcy costs. Its Bitcoin production was, however, not so disappointing.

Source: Hashrate Index

Jaran Mellerud, one of the report’s contributors, drew our attention to the growing share of public Bitcoin miners to Bitcoin’s hashrate over months. In January, public miners contributed 17% of the total hashrate; it grew to 27% in October.

The public miners account for 27% of #Bitcoin‘s hashrate, a tremendous growth from 17% in January 2022.

The public miners’ share of Bitcoin’s hashrate will keep growing as well-capitalized public miners purchase the assets of distressed private miners following the halving. pic.twitter.com/GLczGHZTad

— Jaran Mellerud ????⛏️ (@JMellerud) October 21, 2023

One thing to keep in mind is that the next Bitcoin halving is also nearing, scheduled to take place next year. A number of public Bitcoin mining companies are aggressively expanding in order to be prepared for the development.

The report concludes that the US still retains the most hashrate out of any country. North America alone retains roughly 45% of the global hashrate. Europe—particularly, the Nordic region—has also become a popular destination for public Bitcoin miners.

Source: Hashrate Index