Ethereum (ETH), the prominent altcoin, is presently holding a substantial market position as bullish forces have effectively rebounded its price from a crucial support level. As we approach the highly anticipated FOMC meeting, investors are keeping a close eye on Ethereum and the altcoin market due to potential implications. The expectation of a significant interest rate hike by the Fed has led analysts to predict considerable volatility in the price of ETH.

Expectations From Ethereum Following FOMC Meeting

As the financial and crypto markets eagerly await the upcoming Federal Open Market Committee (FOMC) meeting, speculation is rife about its potential impact on Bitcoin and the altcoin market. The FOMC is set to announce its decision on interest rates tomorrow, Wednesday, July 26th, at 2 pm EST, followed by a press conference with Federal Reserve (Fed) Chair Jerome Powell at 2:30 pm EST.

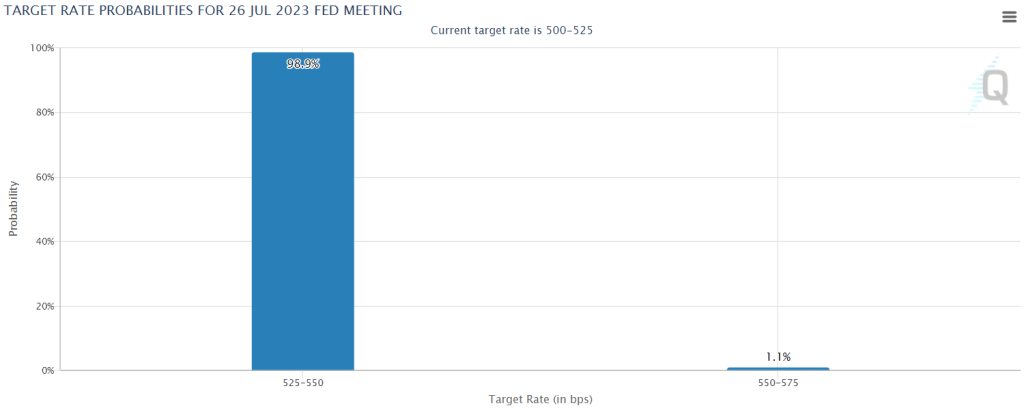

The CME FedWatch tool indicates that a vast majority of the market (98.9%) anticipates a 25 basis point hike. However, the real suspense lies in the aftermath of this decision and whether it signifies the end of the rate increase cycle.

Post tomorrow’s announcement, the market predicts that the Fed will hold the key interest rate high for an extended duration. The earliest possible rate cut is projected for March 2024, if not later in May.

Investors in Ethereum must maintain a balanced perspective. Ethereum has shown recovery against traditional economic events, but it’s not entirely immune to larger macroeconomic trends.

The upcoming FOMC interest rate decision and subsequent statements from Jerome Powell should be closely monitored by investors. Any hints about future rate hikes could have significant implications for Ethereum, possibly leading to further market adjustments.

What’s Next For ETH Price?

Ether’s price rebounded from the $1,830 level, with bulls attempting to drive the price beyond the 20-day Exponential Moving Average (EMA) at $1,865. However, bears are strongly defending a surge above as ETH met multiple rejections. As of writing, ETH price trades at $1,858, surging over 0.6% in the last 24 hours.

Currently, bearish traders are attempting to drag and maintain the price below $1,820, which will pave the way for severe negative movement. If sellers succeed, the ETH price might initiate a correction toward $1,740. This decline would suggest that the price could remain within the $1,650 to $1,750 range for a long period.

However, if the price continues to maintain its current surge and surpasses the 20-day EMA, it would indicate robust buying at lower levels, potentially paving the way for a rally toward $1,904. ETH price might climb toward the $2K level if it breaks above the crucial resistance at $1,978.