- ETH accumulation is on the rise- The number of addresses holding 0.01+ coins increased.

- Demand from the derivatives market also saw an uptick.

Ethereum [ETH] recently revealed in a blog that the Shapella (Shanghai+Capella) mainnet upgrade was entering the final pre-launch phase after extensive testing and development.

The new upgrade will include several new features, the most notable of which will be withdrawals for stakeholders and the consensus layer.

Exiting validators will be eligible for full withdrawals, while active validators with balances over 32 ETH will be qualified for partial withdrawals.

As the hype around the Shapella upgrade rose, investors’ expectations of ETH also increased. ETH accumulation was on the rise as the number of addresses holding 0.01+ coins reached a 6-month high of 22,907,244.

Furthermore, demand for ETH in the futures market was also going uphill as ETH’s open interest in perpetual futures contracts reached a 1-month high of $290,732,090 on Deribit.

Can this increased interest and accumulation be hinting toward a new bull run?

???? #Ethereum $ETH Number of Addresses Holding 0.01+ Coins just reached a 6-month high of 22,907,244

Previous 6-month high of 22,906,541 was observed on 10 February 2023

View metric:https://t.co/XXb0u19ouH pic.twitter.com/4bZlt6PMD1

— glassnode alerts (@glassnodealerts) February 11, 2023

Read Ethereum’s [ETH] Price Prediction 2023-24

Market’s response

ETH’s price action has not been in investors’ favor lately, as its weekly chart registered a decline. As per CoinMarketCap, ETH was down by over 8% in the last seven days, and at the time of writing, it was trading at $1,519.80 with a market capitalization of more than $186 billion.

However, as we get closer to the launch of Shapella, the possibility of a bull run cannot be ruled out. Interestingly, Messari also revealed the same as Ethereum’s moving averages materialized into golden crosses.

Has the Next Bull Cycle Begun for #Bitcoin and #Ethereum?

+$BTC and $ETH moving averages materialized into golden crosses

+Prep work begins in the UK for digital pound

+@WisdomTreeFunds positions itself as a leading digital asset managerFull macro/crypto recap ⬇️ pic.twitter.com/bG9iQLbzfw

— Messari (@MessariCrypto) February 10, 2023

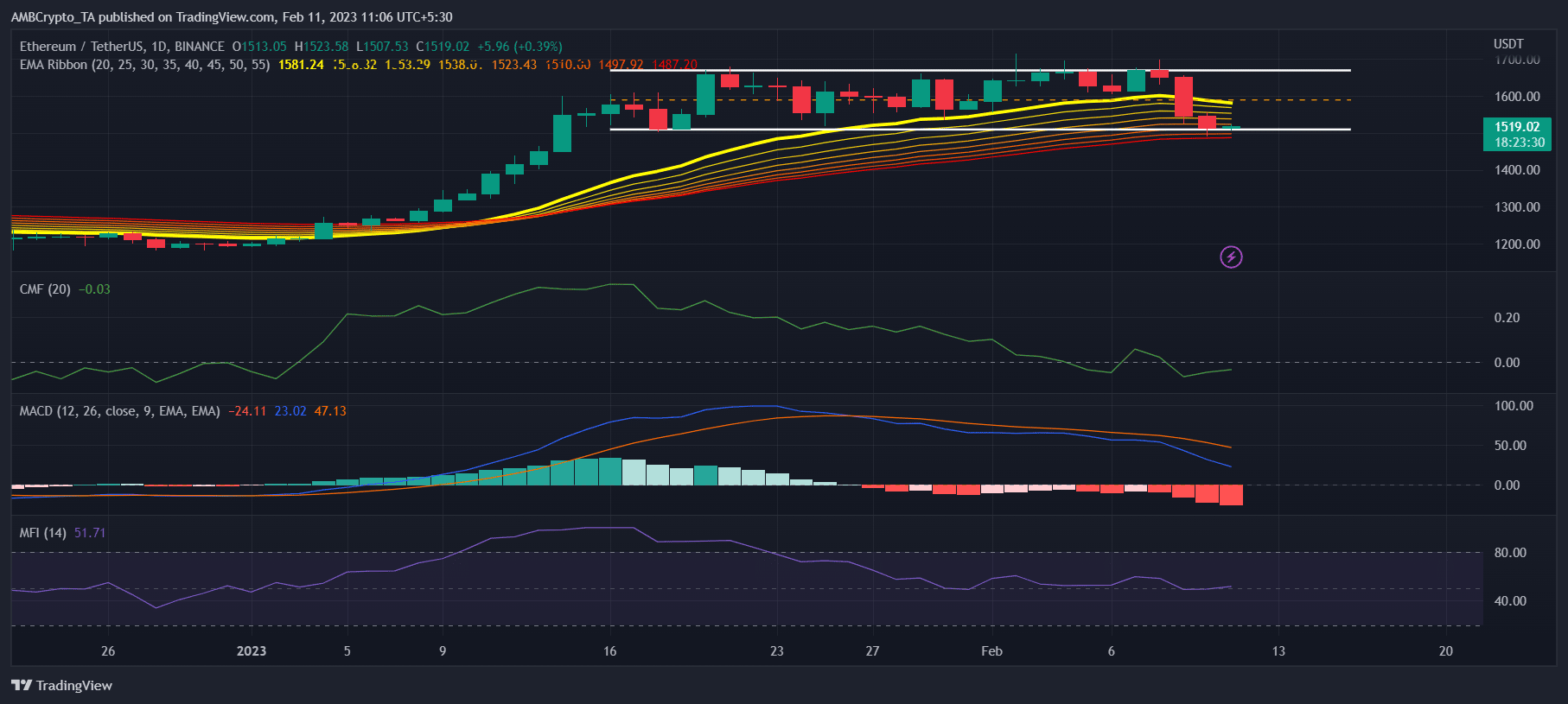

Furthermore, ETH’s daily chart revealed that the bulls had the upper hand in the market as the 20-day Exponential Moving Average (EMA) was above the 55-day EMA.

The Chaikin Money Flow (CMF), after registering a downtick, went up slightly towards the neutral mark, which was positive news. Ethereum’s Money Flow Index (MFI) was resting near the neutral mark, suggesting that the market could head in any direction. However, ETH’s MACD was concerning as it displayed a bearish crossover.

Source: TradingView

Is your portfolio green? Check the Ethereum Profit Calculator

Can the metrics save ETH?

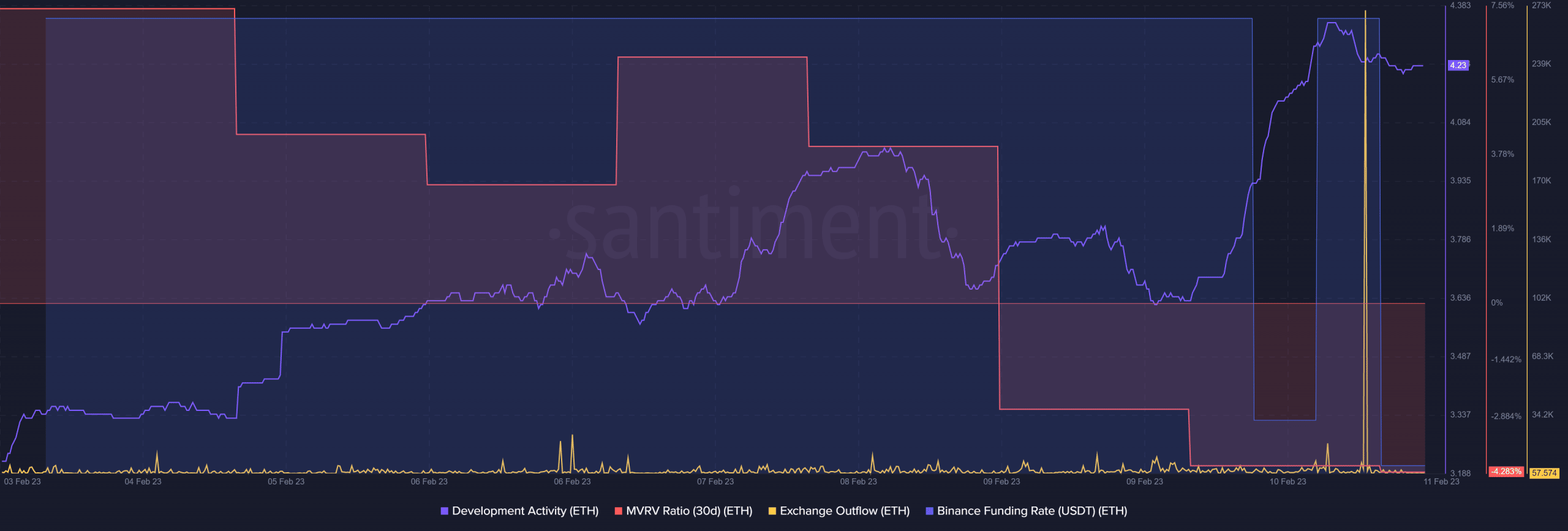

Similar to Glassnode’s data, several of the other metrics aligned with investors’ interests as they looked in ETH’s favor. For instance, ETH’s exchange outflow spiked considerably, which can be considered a bullish sign.

Moreover, ETH’s exchange reserve was decreasing, suggesting lower selling pressure. Apart from open interest, ETH’s Binance funding rate also remained high, which reflected its demand in the derivatives market.

Thanks to the planned upgrade, ETH’s development activity was up. Nonetheless, ETH’s MVRV Ratio registered a decline, which can bring trouble in the days to come.

Source: Santiment