Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

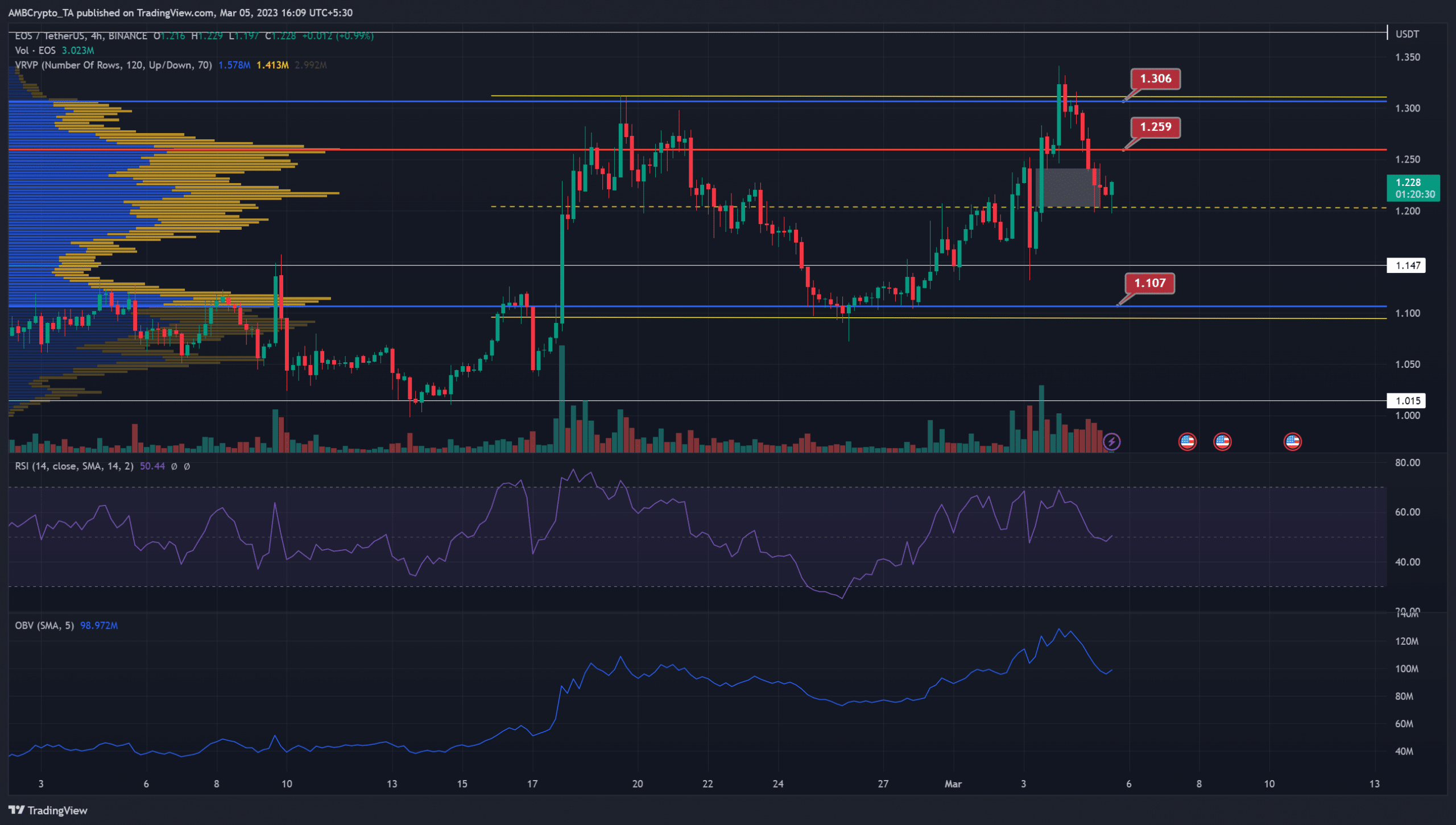

- The volume profile tool showed EOS has lost a critical support level.

- The filled imbalance showed demand could reverse the recent retracement.

EOS has performed well in the markets and maintained its upward trajectory despite uncertainty across the market. Even though Bitcoin has retraced a good portion of its gains over the past two weeks, EOS was quick to rebound.

Read EOS Price Prediction 2023-24

This was a show of strength. Coins resilient during a BTC dump, or the ones that are quick to recover, are generally strong coins for buyers and could outperform a good chunk of the other mid-cap coins. Apart from relative strength, technical reasons were also observed for EOS’s recent performance.

EOS showed signs of a rebound after filling the FVG

Source: EOS/USDT on TradingView

The Visible Range Volume Profile showed the Point of Control at $1.26. The Value Area High and Low sit at $1.3 and $1.1, and these three levels are key horizontal levels for EOS in the coming weeks.

In yellow, a range was plotted for the asset that extended from $1.1 to $1.31, with the mid-range mark at $1.2. The range values are quite close to the values highlighted by the VPVR tool, which reinforced their significance.

On the 4-hour chart, the RSI stood at 50 and has been above the neutral 50 mark since 28 February. This highlighted some bullish momentum in this period, and the trading volume was high relative to the preceding weeks.

The OBV has also trended upward throughout March, despite the drop in prices.

Is your portfolio green? Check the EOS Profit Calculator

Moreover, the market structure remained bullish on the daily timeframe, despite the volatility on H4. Furthermore, the price filled an imbalance (white) on the charts from the recent pump. This imbalance sat right atop a support level. Altogether, the inference was that more gains can follow for EOS.

Long positions are discouraged based on Open Interest data

Source: Coinalyze

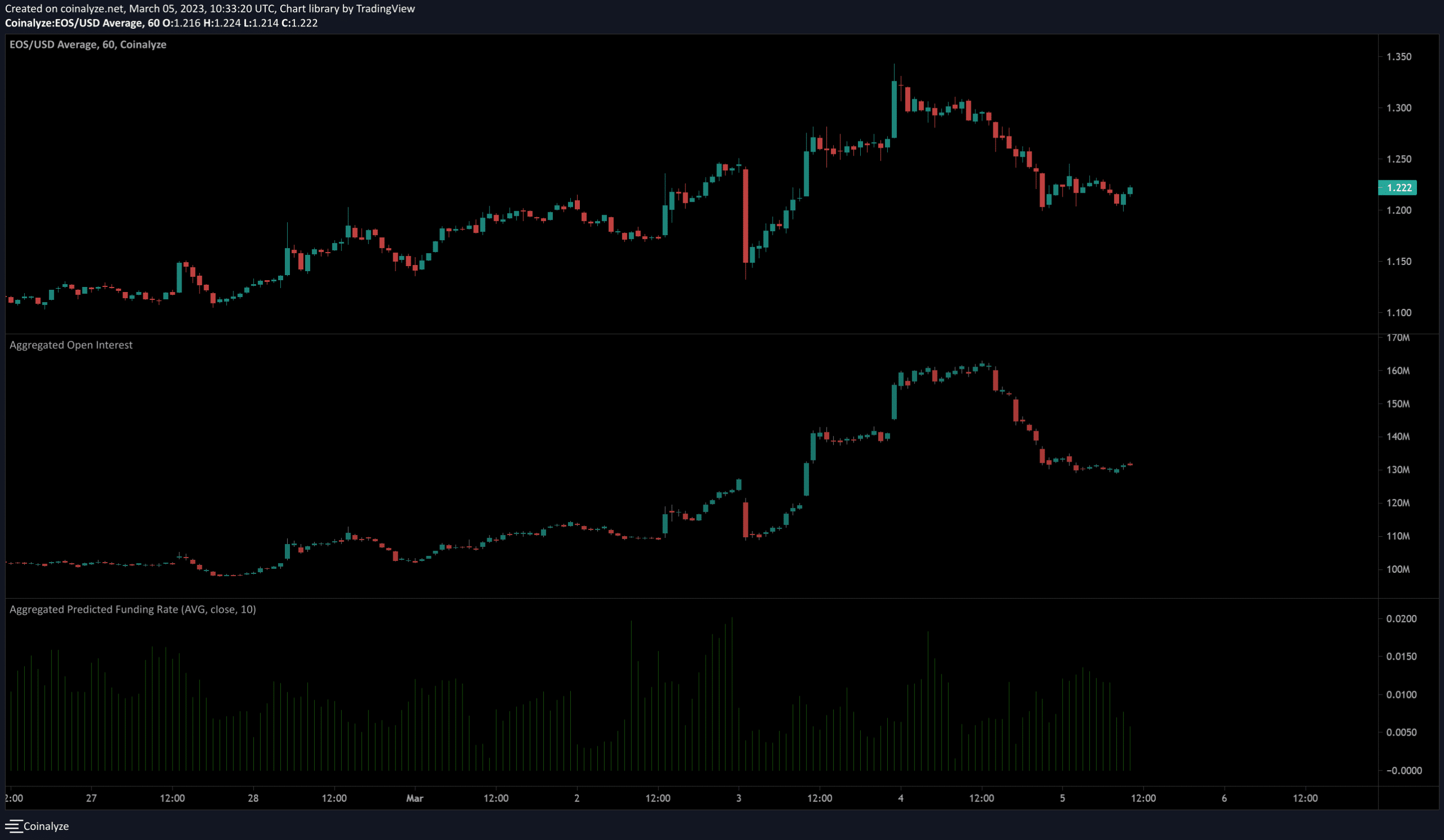

The futures data was optimistic for the bulls. The funding rate was positive which showed bullish sentiment in the market. The Open Interest saw a pullback when EOS faced rejection at the range highs.

This meant long positions were likely closed during the dump but the short sellers did not enter the market en masse, as that would have seen a rise in OI. Therefore, the buyers have some room to shift things in their favor.