Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The market structure remained bearish on a daily.

- A move above the breaker could embolden lower-timeframe buyers.

Dogecoin registered gains of 9.4% within the 12 hours preceding the time of writing. This was a trend across the crypto market, but this move brought many altcoins right into a zone of resistance. Dogecoin was one of them.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

In the short term, the bulls definitely have the upper hand- but their push could be exhausted. Bitcoin was also in a zone of resistance.

The fear around USDC and stablecoins after the SVB collapse might or might not incite further panic, but the technical analysis of Dogecoin painted a bearish picture on the higher timeframes.

The imbalance was filled but the breaker stood firm so far

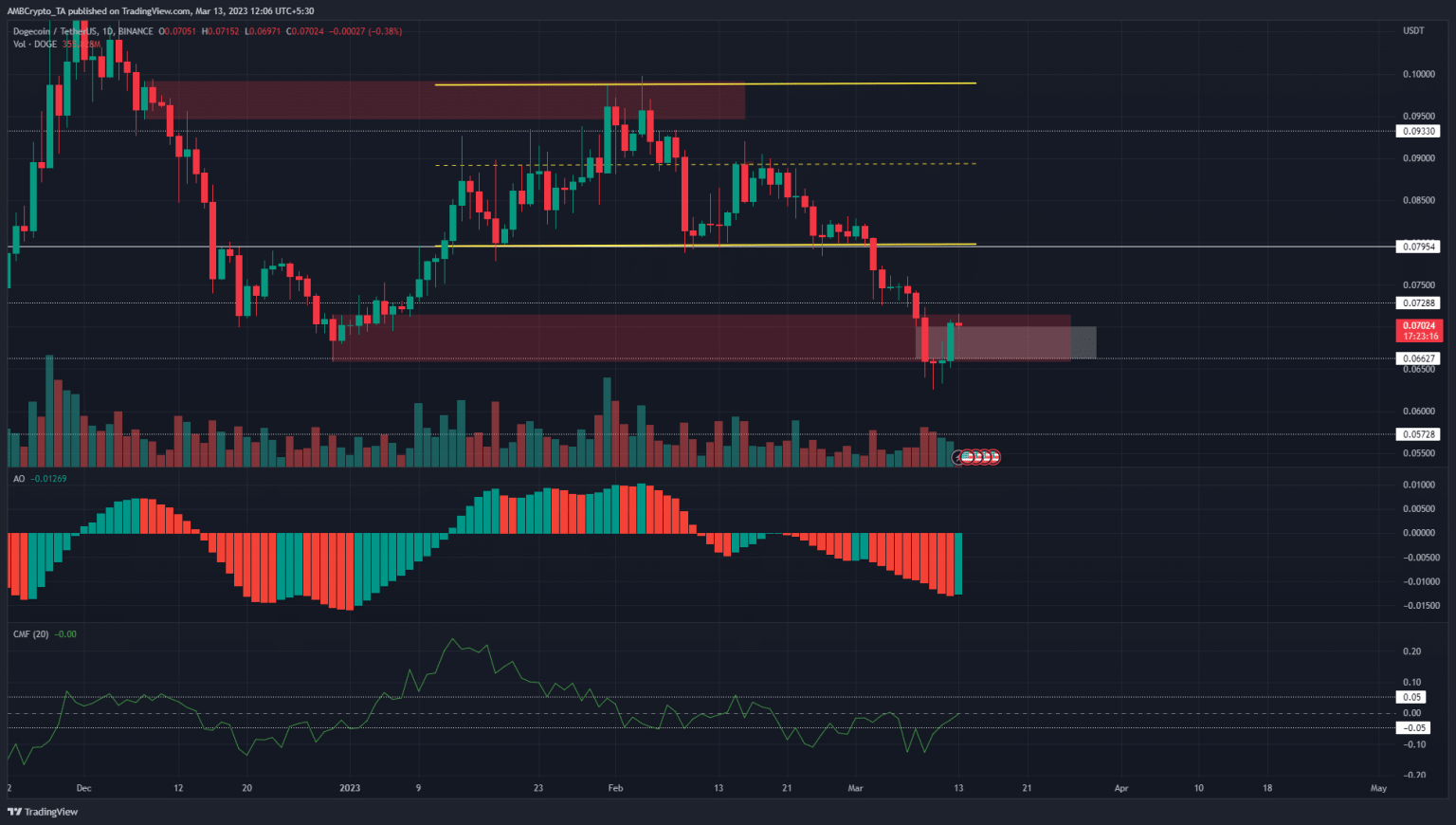

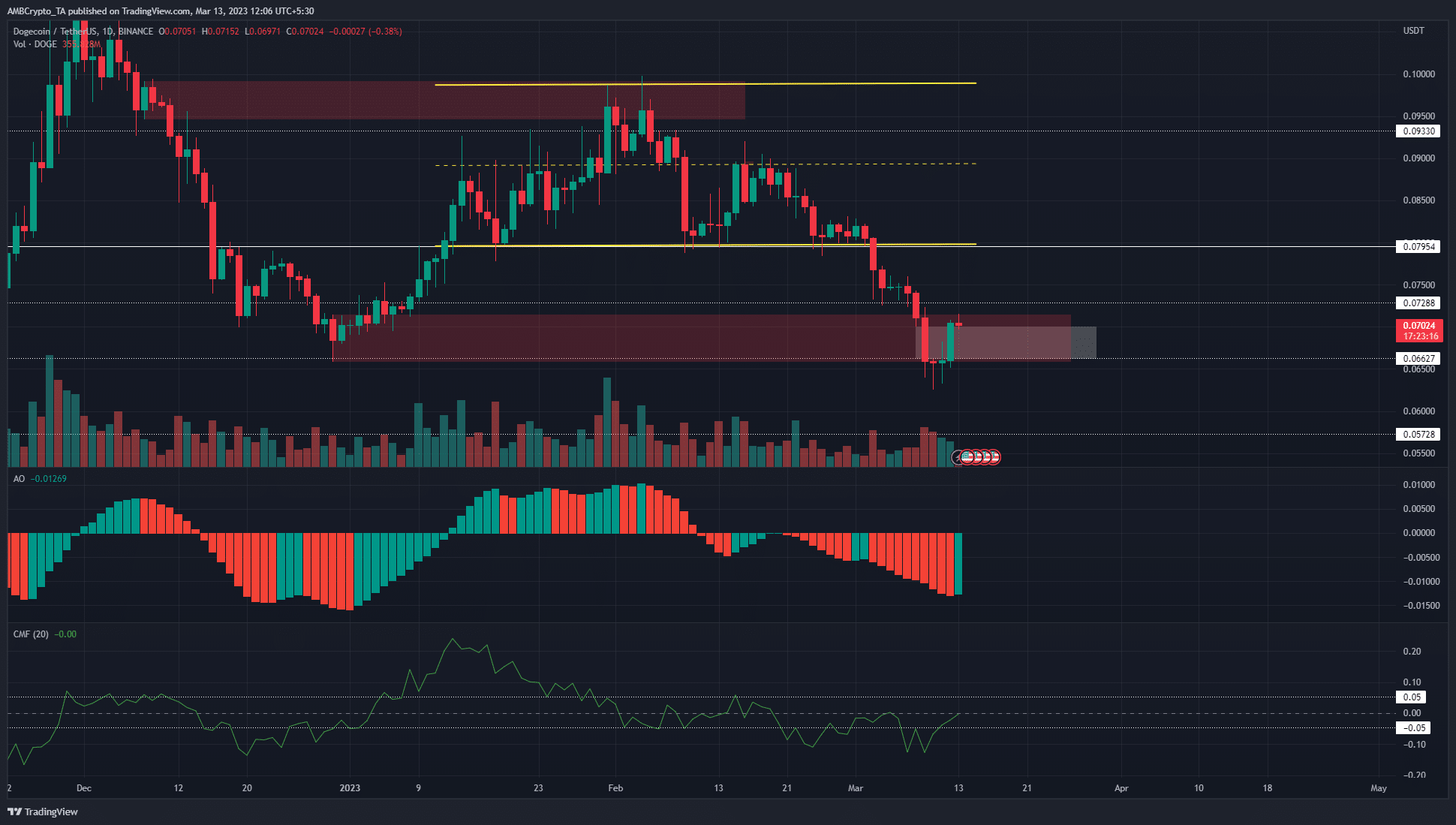

Source: DOGE/USDT on TradingView

Dogecoin fell sharply beneath the range lows of $0.08 on 3 March and has been on a sharp downward move since then. It briefly halted at the $0.073 support level before crashing to the $0.065 mark. In doing so, it broke beneath the bullish order block at $0.066 and flipped it to a bearish breaker (red).

This breaker block had confluence with an imbalance (white) that DOGE left on the charts over the past few days. At the time of writing, this gap had been filled but the price was yet to close a daily trading session above the breaker.

Even if it does move past the breaker, the structure on the daily timeframe would remain bearish until Dogecoin can beat the recent lower high at $0.076.

If DOGE saw a rejection near the $0.0715 mark, dipped lower to form a higher low, and move past the $0.073 resistance level, bulls can take heart.

How much are 1, 10, or 100 DOGE worth today?

This was one of the many scenarios that can unfold. Another was that DOGE bulls have been exhausted over the recent lower timeframe rally, and bears seize the initiative again.

This could force prices to drop once more and form new lows in the downtrend.

The AO showed bearish momentum remained strong, and the CMF did not show significant capital inflow into the market despite the recent gains.

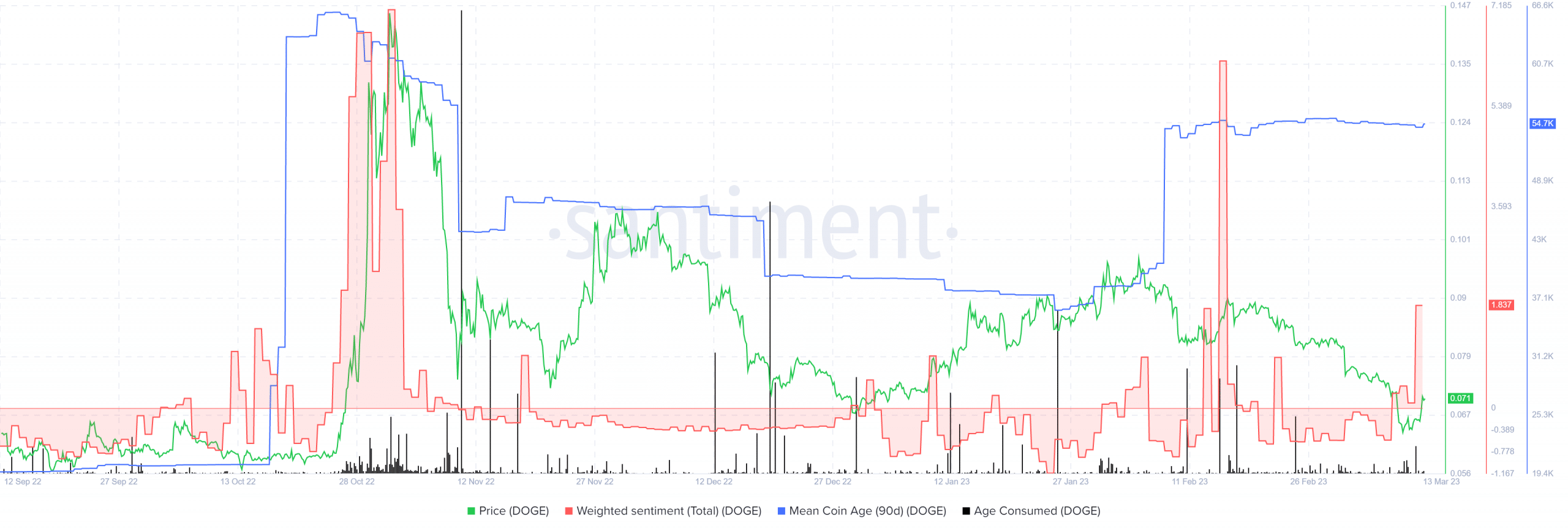

The weighted sentiment saw a rally as prices went higher

Source: Santiment

The rally of the past few hours likely contributed to the strong positive weighted sentiment seen behind Dogecoin on social media. The mean coin age remained on its flat trajectory. This showed there wasn’t an increased movement of the coin across addresses.

Similarly, the age-consumed metric did not see an extremely large spike. However, it did see a bigger surge over the weekend than it has in two weeks. This underlined the likelihood of selling pressure recently. This fact was corroborated by the large volume bars on the price chart.