- Big players like Uniswap and Lido attracted users.

- Some of the other performance indicators of the DeFi ecosystem fell short of expectations.

After suffering losses during the bear market of 2022, the decentralized finance (DeFi) ecosystem has made an incredible recovery in 2023.

According to on-chain analytics firm Dune, the month of May saw 778k users across various DeFi platforms, a figure last seen at the apex of the bull market phase in 2021.

A deeper look at the graph reveals that the number of users increased for three consecutive months in 2023 before declining slightly in April. However, the month of May more than made up for it by recording a 35% growth.

According to analysis by ????♂️ @richardchen39, May has seen 778k unique DeFi users

That’s more than any month since December 2021

???? pic.twitter.com/vLvgB0PD4r

— Dune (@DuneAnalytics) May 31, 2023

Not everything was hunky-dory

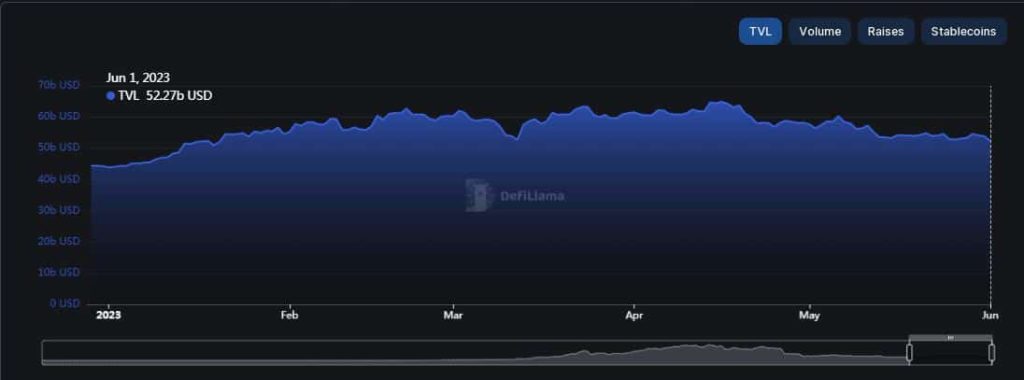

Despite the impressive expansion in user base, some of the other key performing indicators (KPIs) of the DeFi landscape fell short of expectations. The total value locked (TVL), the defining feature of DeFi growth and demand, slid further in May with no signs of recovery, according to DeFiLlama.

At the time of publication, assets worth $52.27 billion were deposited in smart contracts of different protocols. This represents a 19% retreat from the yearly peak reached in mid-April.

Source: DeFiLlama

Moreover, trading volumes on decentralized exchanges (DEXs) dipped further. May saw settlements of trades totaling $72.4 billion across non-custodial exchanges, a 2% monthly drop and nearly half of the record volume seen in March following the USD Coin [USDC] depegging crisis.

Source: DeFiLlama

DeFi behemoths continue to attract users

It was clear that while more users turned to DeFi protocols, most of them were performing low-value transactions. Memecoin trading could be a plausible reason to explain this narrative.

The world’s largest DEX by trading volume Uniswap [UNI] saw transactions worth more than $33 billion executed in May, per DeFiLlama. Additional data showed that the number of users on the DeFi behemoth surged dramatically in the first week of the month.

Moreover, Lido Finance [LDO], the largest liquid staking protocol, also registered a sharp uptick in the number of users, primarily driven by the launch of its V2 version which enabled Ethereum [ETH] withdrawals. In this way, it contributed to the increasing number of users in the DeFi ecosystem.

Source: DeFiLlama

Read Uniswap’s [UNI] Price Prediction 2023-24

The bottom line is that DeFi has proved to be a vanguard of financial revolution in the new decade.

From a little over 80,000 aggregate users in 2020, the ecosystem has expanded exponentially. It now accommodates more than 7.5 million at the time of publication, data from Dune revealed.

Source: Dune