- Curve’s TVL has reached a two-year low.

- CRV’s market consolidated in a tight range over the past two weeks.

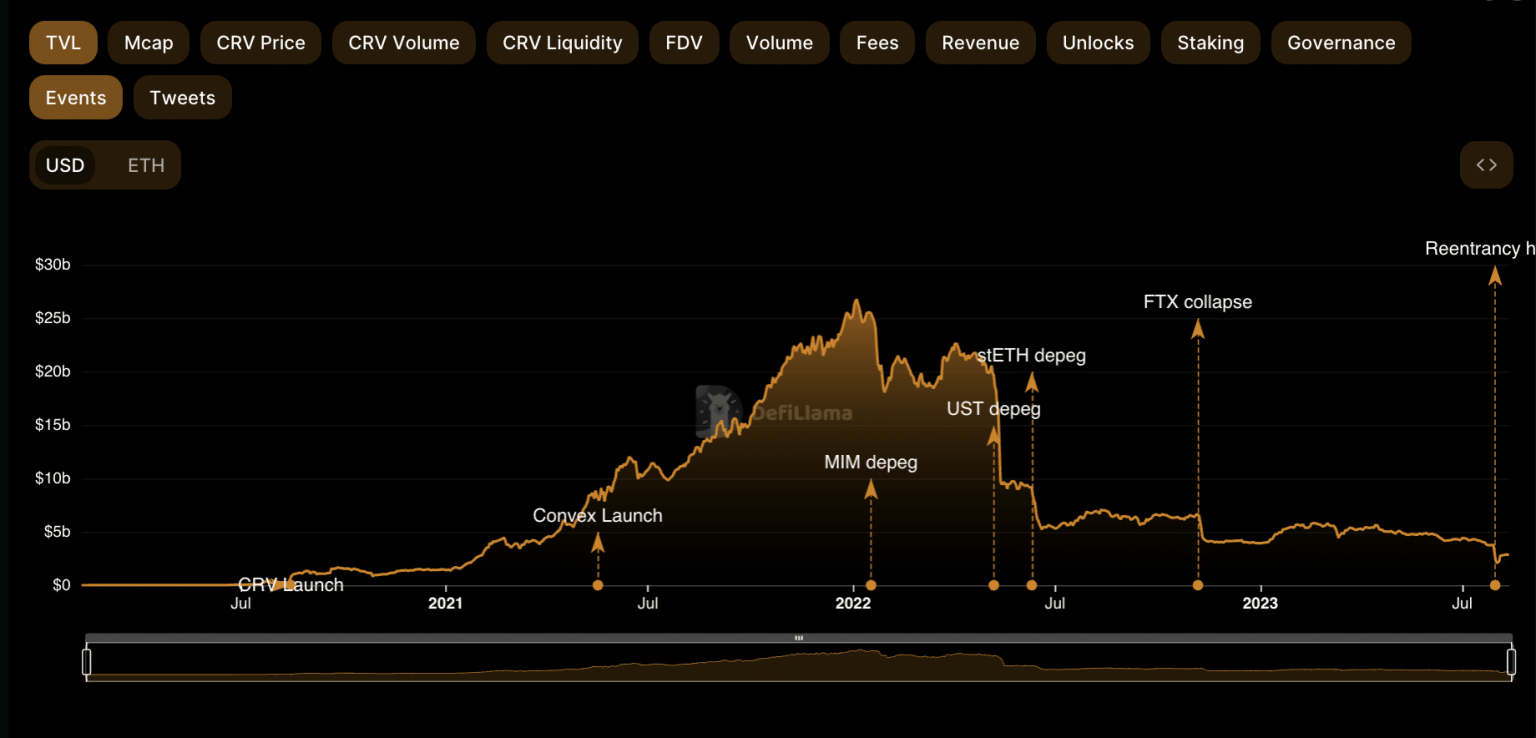

Amid multiple attempts to salvage the decentralized exchange (DEX), the total value of assets locked (TVL) on Curve Finance [CRV] has dropped to its lowest level in two years, data from DefiLlama revealed.

Is your portfolio green? Check out the CRV Profit Calculator

At $2.83 billion at the time of writing, the DEX’s TVL has dropped by 24% since the reentrancy exploit of 30 July.

With a 32% TVL decline in the last month, Curve slipped from its position as the third largest decentralized finance (DeFi) protocol before the hack to sixth position at press time.

Source: DefiLlama

Liquidity providers continue to say their goodbyes

While 70% of the $73 million stolen in the hack were successfully reclaimed, confidence in Curve continued to plummet at the time of writing. To avoid any further risk exposure, liquidity providers have since abandoned the project.

The DEX’s volume has since plummeted. Per data from Dune Analytics, trading volume on Curve totaled $100 million as of 10 August. Prior to the hack, this was $143 million.

Source: Dune Analytics

Activity on one of Curve’s leading pool ETH/stETH LP has dwindled since the hack. With increased funds removal, the total reserves held in the LP have dropped by 7% since 30 July.

In addition, trading volume in the pool has also decreased. Per data from Dune Analytics, this has been reduced by 69% in the last two weeks. As of 11 August, trading volume on the ETH/stETH LP totaled $25.52 million.

Source: Dune Analytics

While APR for liquidity provisioning on the pool rallied to 5% a day after the hack, it has since trended downward. At press time, this was 2.4%.

CRV remains flat

While CRV’s price dropped sharply following the hack, its price has remained within a tight range in the past two weeks. This showed that while accumulation has slowed, sell-offs have also not been exceedingly high.

Although positioned below their center lines, CRV’s momentum indicators were flat at press time. The Relative Strength Index (RSI) was 35.85, while the Money Flow Index (MFI) was 45.21.

Realistic or not, here’s CRV’s market cap in BTC’s terms

The Bollinger Bands indicator confirmed the state of consolidation in the CRV market. On the D1 chart, CRV’s price traded closely to the middle line of its Bollinger Bands.

This suggested that CRV was trending toward its moving average, and its price was relatively stable. However, with the wide gap between this indicator’s upper and lower bands, CRV’s price remained significantly volatile at press time.

Source: CRV/USDT on TradingView