- CRV’s price increased by 7% in the last 24 hours after Curve’s exploiter returned some of the stolen funds.

- However, on the daily chart, accumulation pressure remained low.

The price of Curve Finance [CRV] soared by over 7% in the last 24 hours following the news that the exploiter who stole over $24 million from the protocol has returned the funds.

Is your portfolio green? Check out the CRV Profit Calculator

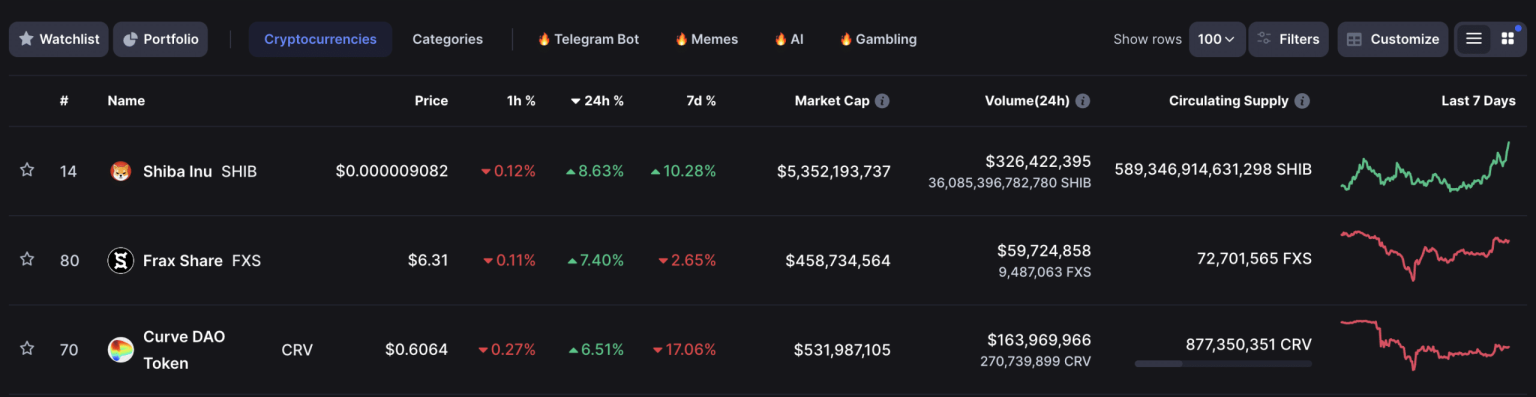

According to data from CoinMarketCap, the altcoin exchanged hands at $0.6065 at press time and ranked as the third asset with the most gains during the period under review.

Source: CoinMarketCap

Hacker swallows the “chill pill”

On July 30, Curve Finance experienced a drain in some of its liquidity pools due to a Vyper-based smart contract bug. This resulted in a cascading effect on the entire DeFi ecosystem as liquidity providers scampered to remove their funds from DeFi protocol.

Moreover, there was a general drop in total value locked (TVL) across the crypto vertical.

As the price of CRV fell in the days following the hack, concerns grew that Michael Egorov’s collateral would fall below the liquidation threshold, leading to contagion. However, in the past few days, the founder has been able to pay off some of his debts.

While Egorov sorted his debt obligations, Curve, and other protocols affected by the hack, Metronome and Alchemix left an on-chain message for the hackers on 3 August. According to the message, these protocols offered a 10% bounty on the stolen funds if the remaining 90% were returned.

Threatening legal action, the protocols added:

“If you choose not to partake in the voluntary return and complete the process by 6 August at 0800 UTC, we will expand the bounty to the public and offer the full 10% to the person who is able to identify you in a way that leads to your conviction in the courts.”

Spurred by the possibility of being exposed, the hacker returned a total of 4,820 alETH and 2,258 ETH to Alchemix Finance. Data from Etherscan showed that alETH was returned in three transactions, with the first being a test of 1 alETH.

The remaining alETH was returned in two batches, worth $1.7 million and $6.7 million, respectively. ETH was returned in a single transaction worth $4.2 million. The total value of the returned funds so far is around $12.7 million.

In an on-chain message added to the transaction, the hacker said:

“I saw some ridiculous views, so i want to clarify that I’m refunding you not because you can find me, it’s because I don’t want to ruin your project, maybe it’s a lot of money for a lot of people, but not for me, I’m smarter than all of you.”

Read Curve’s [CRV] Price Prediction 2023-24

Don’t get your hopes up

While CRV logged a price and trading volume uptick in the past 24 hours, an assessment of its movement on the daily chart suggested that the rally might be short-lived.

Key momentum indicators trended downward and were positioned below their respective neutral regions. This suggested that there was not enough accumulation to support the price growth. Hence, a downward correction was imminent.

Source: CRV/USD, TradingView