- CRV extends gains amid increased whale activity.

- ETH whales contribute to the demand for CRV despite being heavily overbought.

Curve Finance’s native token CRV just jumped to the top of the list of most traded crypto tokens among ETH whales. This outcome may pave the way for the next major price move for CRV given its current position.

How many are 1,10,100 CRVs worth today?

According to WhaleStats, CRV managed to surpass Shiba Inu to become the most traded token by ETH whales. Why is this important? Well, ETH whale activity often underscores strong demand, in which case investors can expect more upside.

???? JUST IN: $CRV @curvefinance flipped $SHIB for MOST TRADED token among top 100 #ETH whales

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#CRV #SHIB #whalestats #babywhale #BBW pic.twitter.com/2nQOaI8MiM

— WhaleStats (tracking crypto whales) (@WhaleStats) January 22, 2023

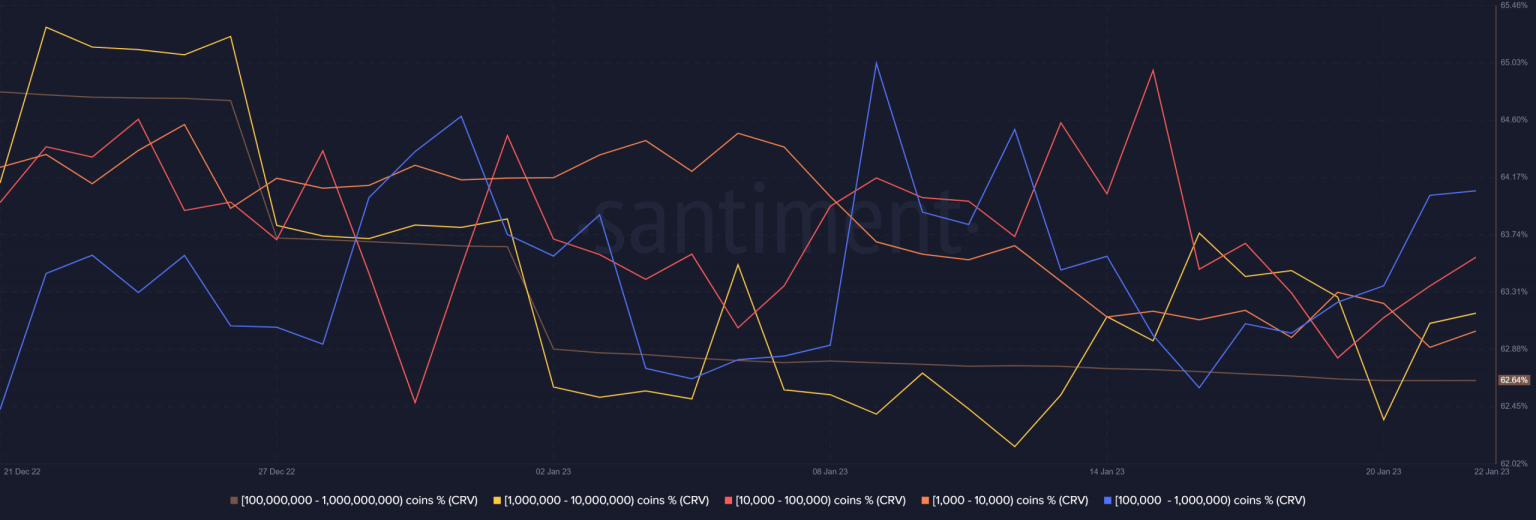

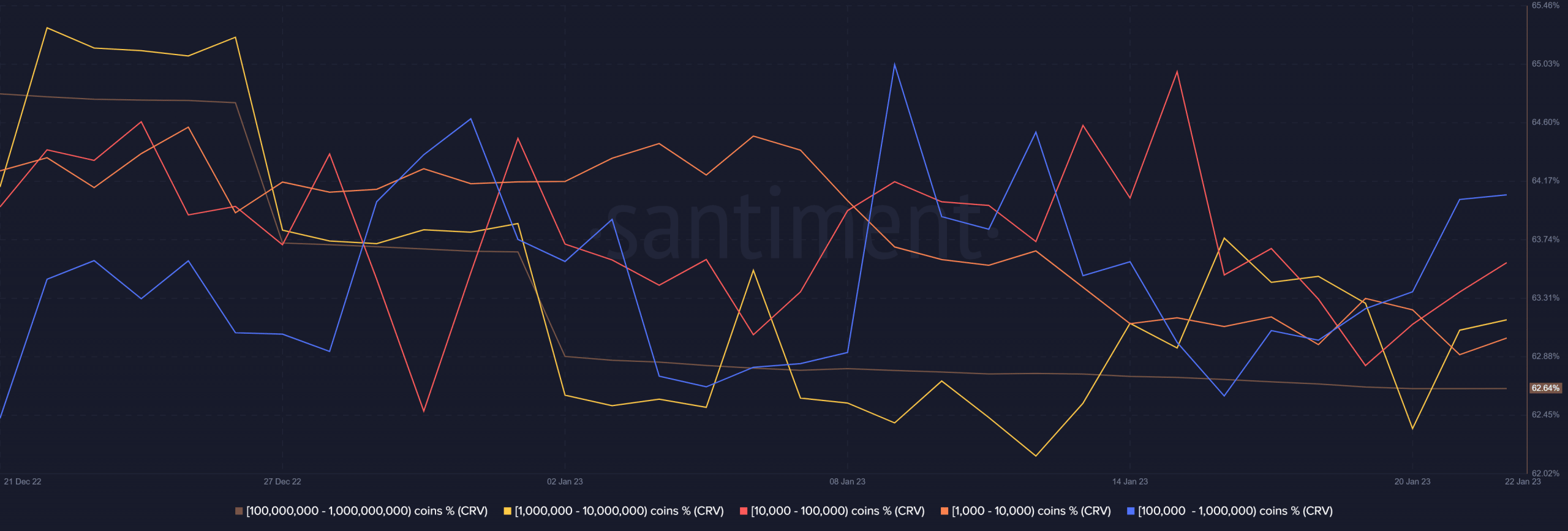

There is also a chance that the observed ETH whale activity may also represent incoming sell pressure but is that the case? CRV’s supply distribution reveals that the top addresses have been buying in the last three days.

Source: Santimenturve

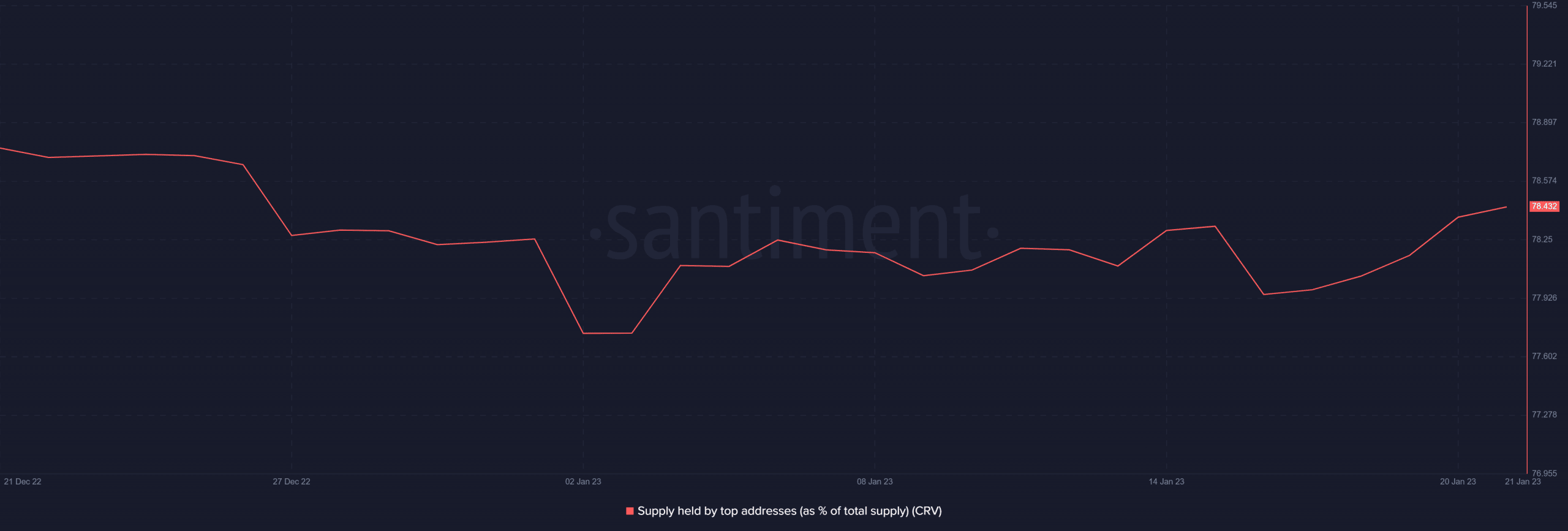

This suggests that CRV continued to enjoy strong demand during the weekend. In addition, the supply held by top addresses metric confirms that whales have continued to accumulate CRV. This may suggest that the observed surge in ETH whale transactions pertaining to the CRV token may reflect buying pressure.

Source Santiment

Are whales shielding CRV from the bears?

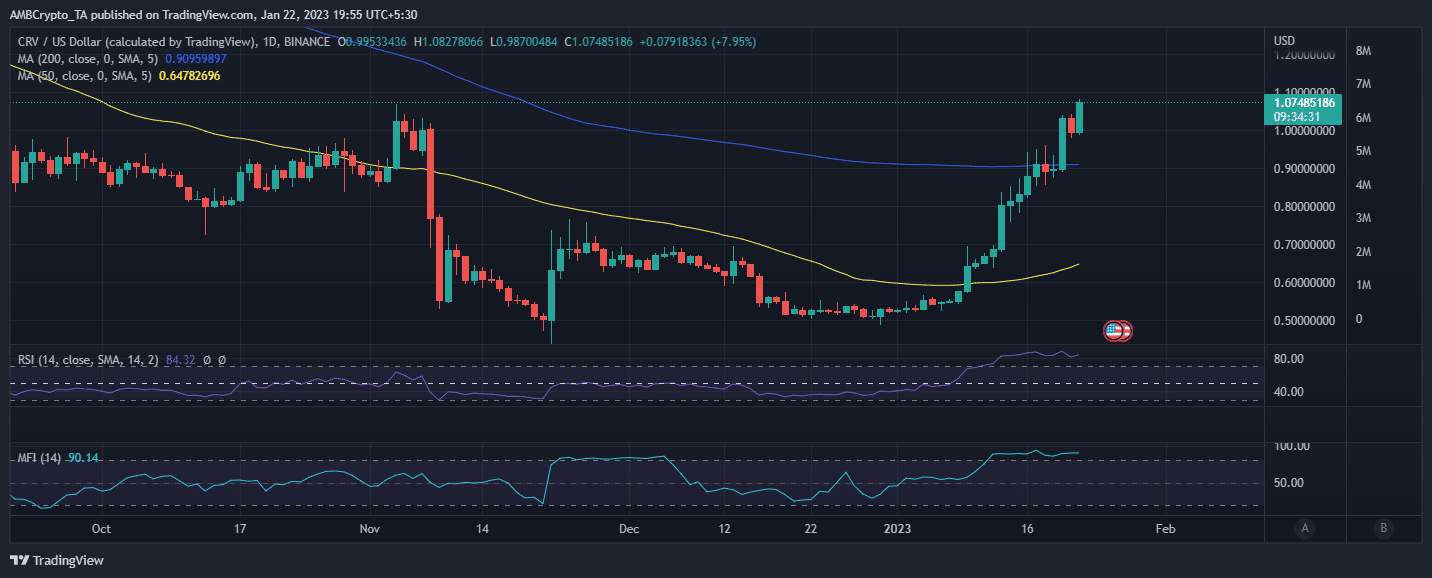

CRV’s price action has continued to extend its upside despite being deeply overbought. It managed a 7.40% upside in the last 24 hours at press time, reflecting strong demand. This allowed it to extend its rally above the 200-day moving average.

Source: TradingView

CRV traded at a 120% premium from its lowest price level at the end of December 2022. This makes it one of the top gainers among the major cryptocurrencies. However, CRV’s deeply overbought nature may encourage some selling pressure.

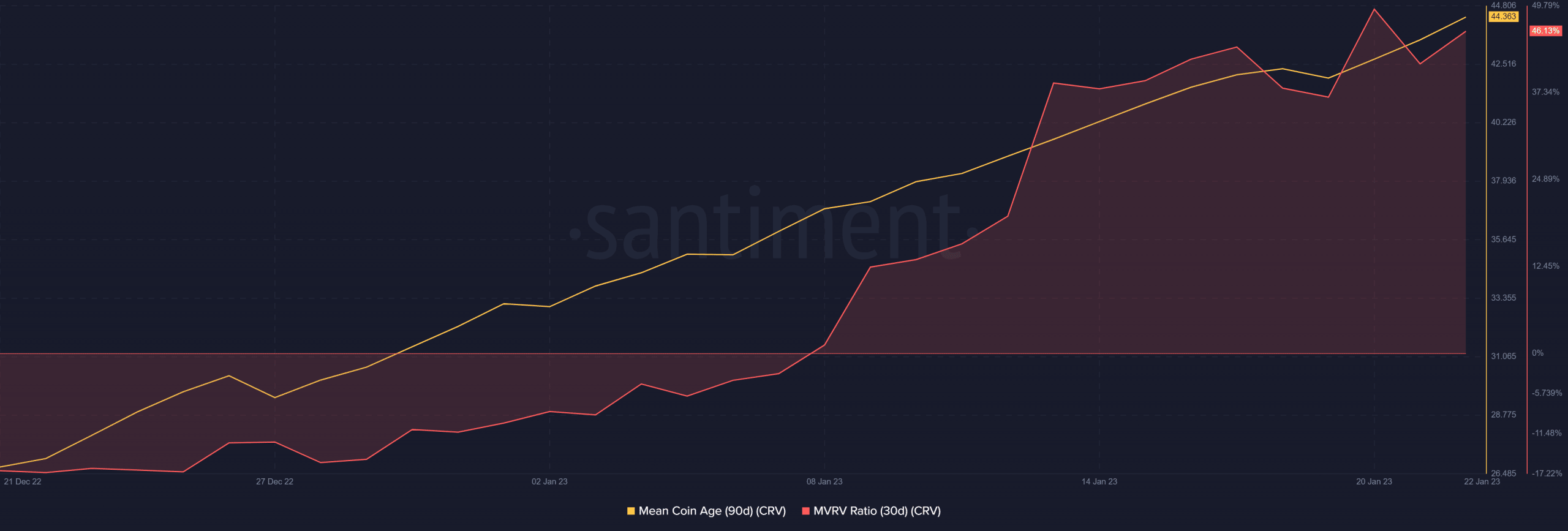

Both the MVRV ratio and the mean coin age are currently in the upper monthly range. This means CRV holders are deep in profit.

Source: Santiment

Is your portfolio green? Check out the CRV Profit Calculator

This outcome is contrary to the expectations of a pullback. A potential reason for this is that investors, especially whales, are more focused on long-term gains.

If the recent rally is the start of the next bull run, then the upside seen so far might just be the start of more recovery ahead. This might explain why whales are currently not in a rush to secure short-term profits.

Note that all this is speculative based on what we have seen so far. There are still some risks that may trigger a retracement and perhaps an erosion of the latest gains. Nevertheless, whales continue to demonstrate confidence in the market, and this may continue to favor the upside.