- Lido Finance records its largest-ever daily ETH stake inflow.

- LDO currently suffers from buyers’ exhaustion.

In a tweet published on 25 February, leading liquid Ethereum (ETH) staking platform Lido Finance [LDO] confirmed that it recorded its largest daily stake inflow with over 150,000 ETH staked.

Lido protocol has registered its largest daily stake inflow so far with over 150,000 ETH staked. ????

Upon reaching this number, a curious (but important) protocol safety feature called Staking Rate Limit was activated.

Here’s how it works???????? pic.twitter.com/ngBtWz7q18

— Lido (@LidoFinance) February 25, 2023

On-chain analytics Lookonchain platform found that the said 150,000 ether tokens had been staked by Tron founder Justin Sun.

In the early hours of 26 February, Sun staked an additional 10,000 ETH, bringing his total staked ETH portfolio to 200,100 ETH, worth around $320 million.

Justin Sun staked 10,000 $ETH($16M) on @LidoFinance again just now.

He currently staked 200,100 $ETH ($320M).

And he received an income of 18.68 $ ETH within 24 hours, the APY is ~3.6%.https://t.co/oZxE8KpjHy pic.twitter.com/OSFlkIUOGM

— Lookonchain (@lookonchain) February 26, 2023

According to Lido Finance, the surge in staked ETH in a single-day trade led to the activation of the protocol’s safety feature known as the Staking Rate Limit.

The Staking Rate Limit is employed on Lido as a dynamic mechanism to ensure the protocol’s safety and prevent rewards dilution caused by large inflows of stake.

Based on recent deposits, this mechanism decreases the total amount of stETH that can be minted at any given time using a sliding 24-hour window.

Is your portfolio green? Check out the LDO Profit Calculator

The protocol capacity is replenished on a block-by-block basis, with a recovery rate of around 6,200 ETH per hour. The limit applies to all parties trying to mint stETH, irrespective of the method employed.

State of ETH staking on Lido

Per data from Dune Analytics, 5.35 million ETH tokens have been staked through Lido Finance, bringing its share of the ETH-staking market to 29%.

With the Shanghai Upgrade scheduled to take place in a few weeks, these past few months have seen a surge in the creation of new liquid ETH staking protocols, leading to a gradual drop in Lido’s market share.

To provide context, Lido Finance held 32% of all staked ETH as of May 2022. However, with centralized staking platforms such as Coinbase offering higher Annual Percentage Rates (APR) to liquidity providers, these platforms witnessed a surge in ETH staking.

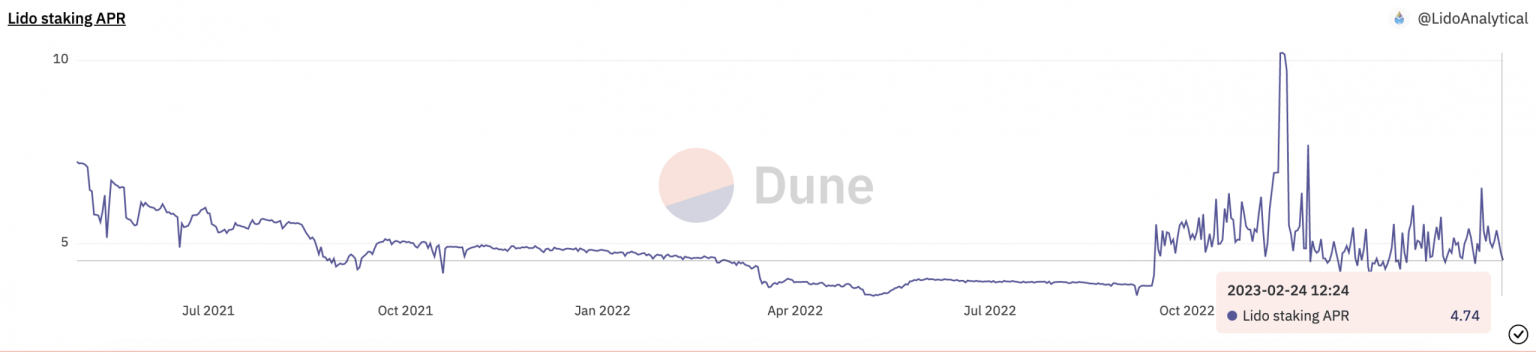

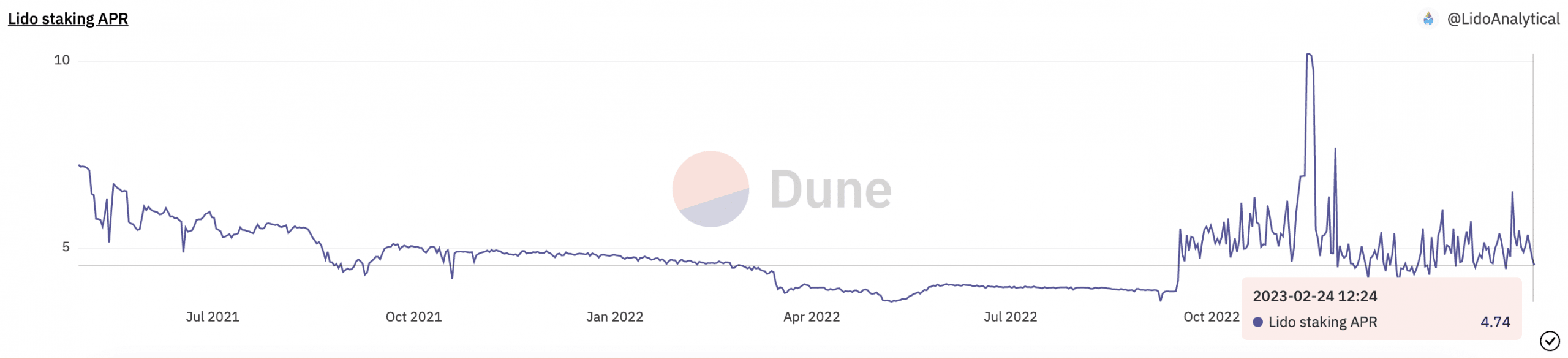

As for staking APR on Lido, it was pegged at 4.74% at press time. It peaked at a high of 10.20% last November and has since been on a downward trend.

Source: Dune Analytics

How much are 1,10,100 LDOs worth today?

LDO in the last 24 hours

At press time, LDO exchanged hands at $3, with its price spiking by 10% in the last 24 hours. However, while LDO’s price rallied, trading volume declined by 19% during the same period, per data from CoinMarketCap.

Price/trading volume divergence of this sort is usually common in a market where buyers are undergoing exhaustion. This suggested that a potential reversal in LDO’s price was imminent if the liquidity needed to drive up its price fails to enter the market.