- Chiliz’s network upgrade may increase demand exponentially.

- Short-term CHZ prospects remained weak, but the long-term outlook just got a lot better.

The Chiliz [CHZ] network was in the midst of a major network upgrade at press time. According to an update by founder Alexandre Dreyfus on 26 January, Chiliz 2.0 would introduce various positive changes.

The launch of @chiliz chain 2.0 – a curated blockchain for the sports & entertainment industry is coming. Staking, DEX, Whitelisting, new NFT standard, Memorabilia certification, Fan Tokens, and much more … with the help of 150 sports teams + 2M user base. Stay tuned. $CHZ https://t.co/mqK245SoxA

— Alexandre Dreyfus (@alex_dreyfus) January 26, 2023

Read Chiliz’s [CHZ] Price Prediction 2023-24

These changes included memorabilia certification, a new NFT standard, a new DEX and staking, among others. The network upgrade was in phase six at press time, which is the last stage dubbed Malagueta. Thus, the implementation of the aforementioned changes would soon be completed.

But what do these changes mean, and how will they affect investors and CHZ’s value? Well, the availability of a DEX and staking might be the biggest news of all. This is because such developments have the potential to encourage long-term hodling. Such an outcome might also prop up CHZ’s demand.

If this major Chiliz network upgrade is successful, then CHZ might benefit from more long-term demand. This move may strengthen its long-term outlook. The network itself will benefit from more utility, a move that might also support favorable investor sentiment.

What to expect from CHZ in the short-to-mid term

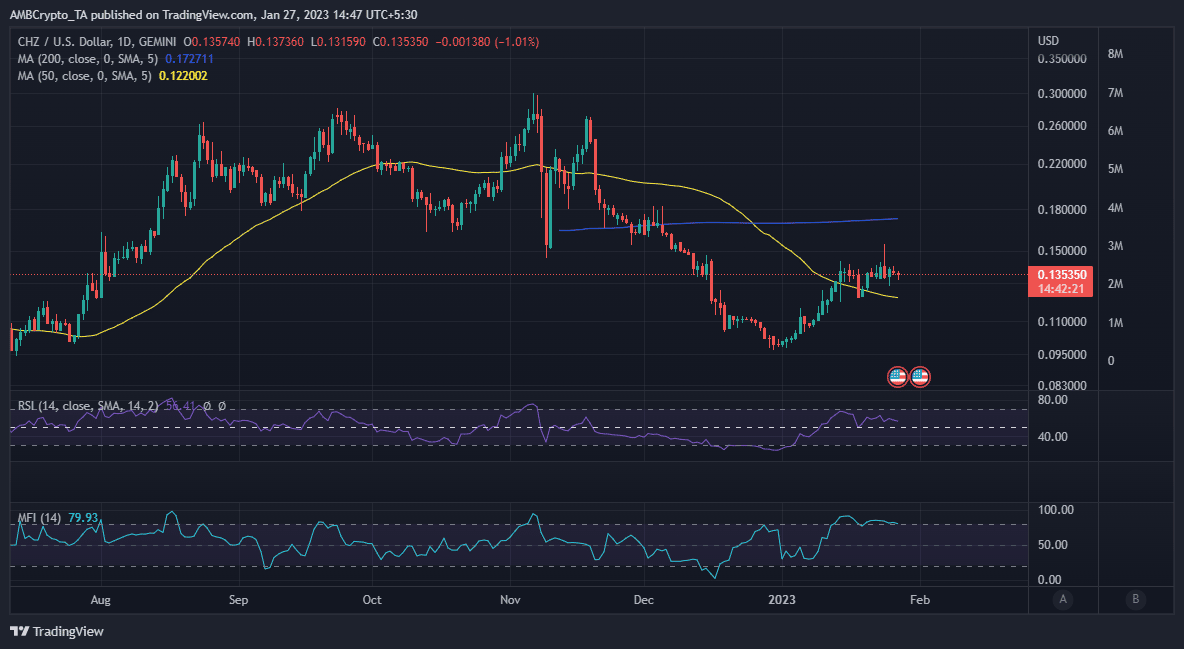

CHZ was experiencing a slowdown in demand at press time, despite the current expectations regarding the Chiliz 2.0 upgrade. Its $0.13 press time price represented a 10% discount from its monthly high.

Source: TradingView

CHZ’s money flow indicated that there is a threat of more outflows, courtesy of profit-taking, especially if the overall market conditions favor the downside. CHZ might avoid this if the upgrade triggered a resurgence of bullish demand.

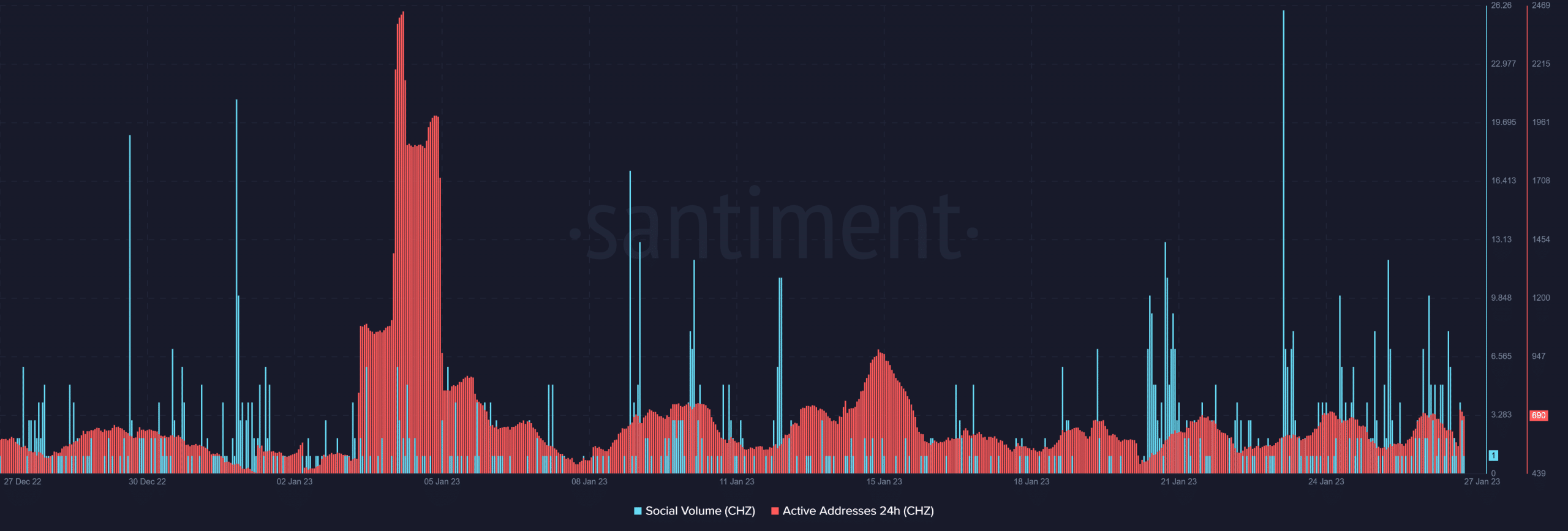

The last few days underscore healthy social volume, but not enough to suggest a strong renewed interest in CHZ. The number of daily active addresses also remained within the normal range, confirming that investors were not yet rushing to buy more.

Source: Santiment

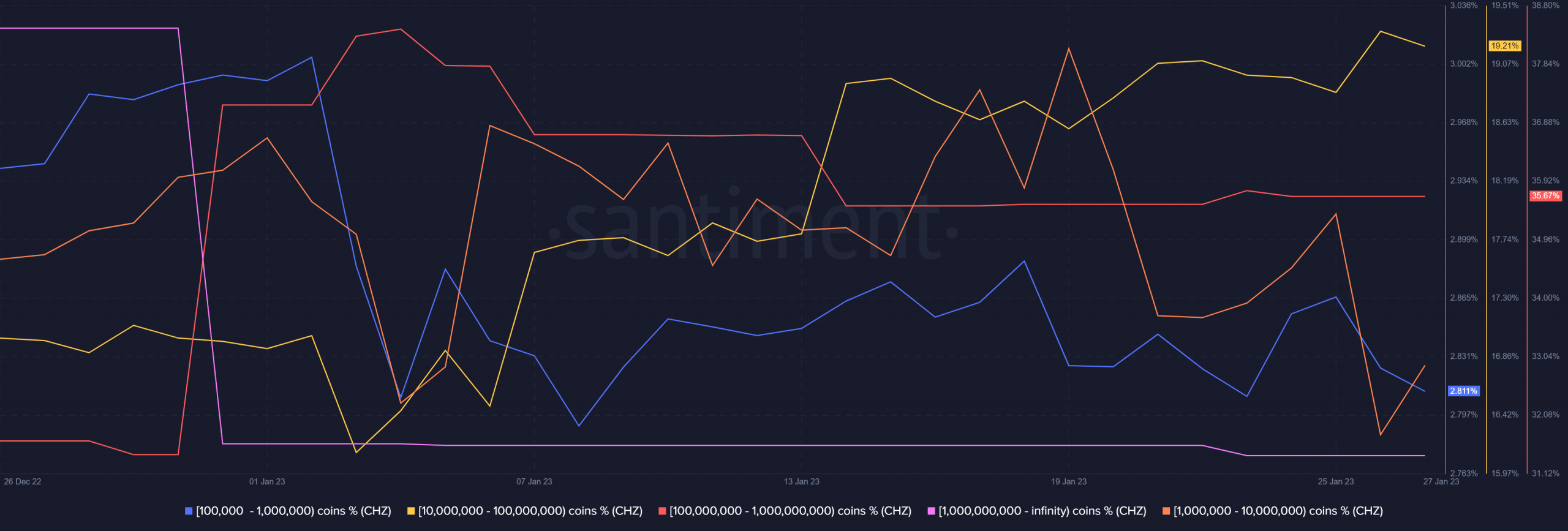

In addition, network growth tanked to a new monthly low in the last two days. This confirmed lower network activity, as was evident with the lower volatility in the last few days. CHZ’s supply distribution metric confirmed that the demand side was also lacking.

Source: Santiment

How much are 1,10,100 CHZs worth today?

Moreover, at press time, there was low buying pressure from the whales. This meant the short-term outlook may not really support a strong surge. It was still not clear whether that would change once the Chiliz 2.0 upgrade was completed. However, there were some favorable signs.

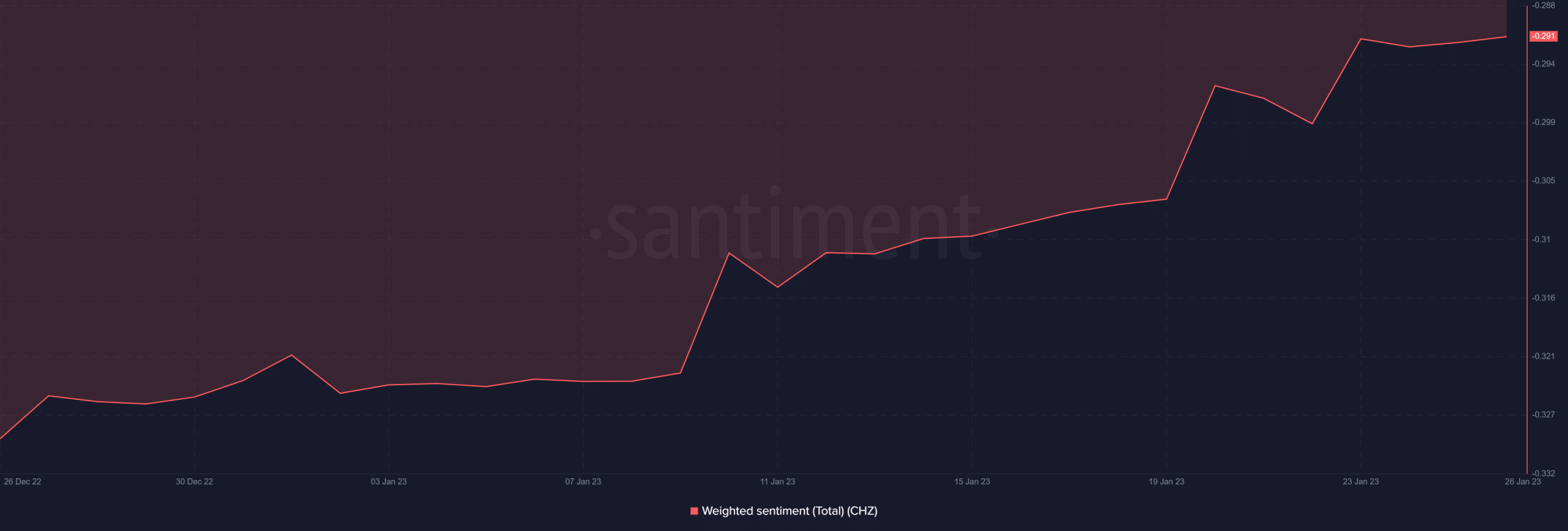

One example was the weighted sentiment metric, which was at its highest monthly level at press time. This meant that investors were still highly optimistic about CHZ’s prospects.

Source: Santiment