- LINK was down by more than 4% in the last seven days.

- Selling pressure on Chainlink was high, but a few indicators looked bullish.

Like most cryptos, Chainlink’s [LINK] price chart remained red, thanks to the bearish market condition. However, Chainlink has launched a new update for its staking ecosystem, which has the potential to help LINK investors enjoy profits.

Realistic or not, here’s LINK market cap in BTC‘s terms

Chainlink launched Staking v0.2

After the launch of Chanlink staking v0.1 back in December last year, the blockchain has now revealed the next update, v0.2. The first version consisted of a 25 million LINK staking pool. With the new release, the staking pool has been increased to 45 million LINK.

V0.2 has been rearchitected into a fully modular, extensionable, and upgradable staking platform.

The next version of #Chainlink Staking (v0.2) is on track to launch later this year.

Learn more about how v0.2 introduces greater staker flexibility, improved security guarantees for oracle services, a modular architecture for iterative upgrades, & more.https://t.co/4SodK1iuv1

— Chainlink (@chainlink) August 25, 2023

The update would not only provide greater flexibility but also improve security and introduce a dynamic reward mechanism. As per the official announcement, the launch of the v0.2 beta upgrade will progressively expand access to a broader scope of participants.

Beginning with a priority migration period for existing v0.1 stakers before entering Early Access and then General Access.

Will this help Chainlink investors?

At first glance, it might not look like the release can have an impact on LINK’s price, but a deeper delve into the scenario suggests otherwise. As the update would considerably increase the staking pool, it can be expected that more LINK tokens that are in circulation will get locked in staking.

This might cause a shortage in its supply and increase demand. And as per the demand and supply theory, when demand increases and supply decreases, prices tend to move up. Therefore, there were chances of the new staking update having a positive impact on LINK as it struggled to push its price up.

According to CoinMarketCap, LINK was down by more than 4% last week. At press time, it was trading at $5.91 with a market capitalization of $3.1 billion. A possible reason behind the downtrend might be an increase in selling pressure.

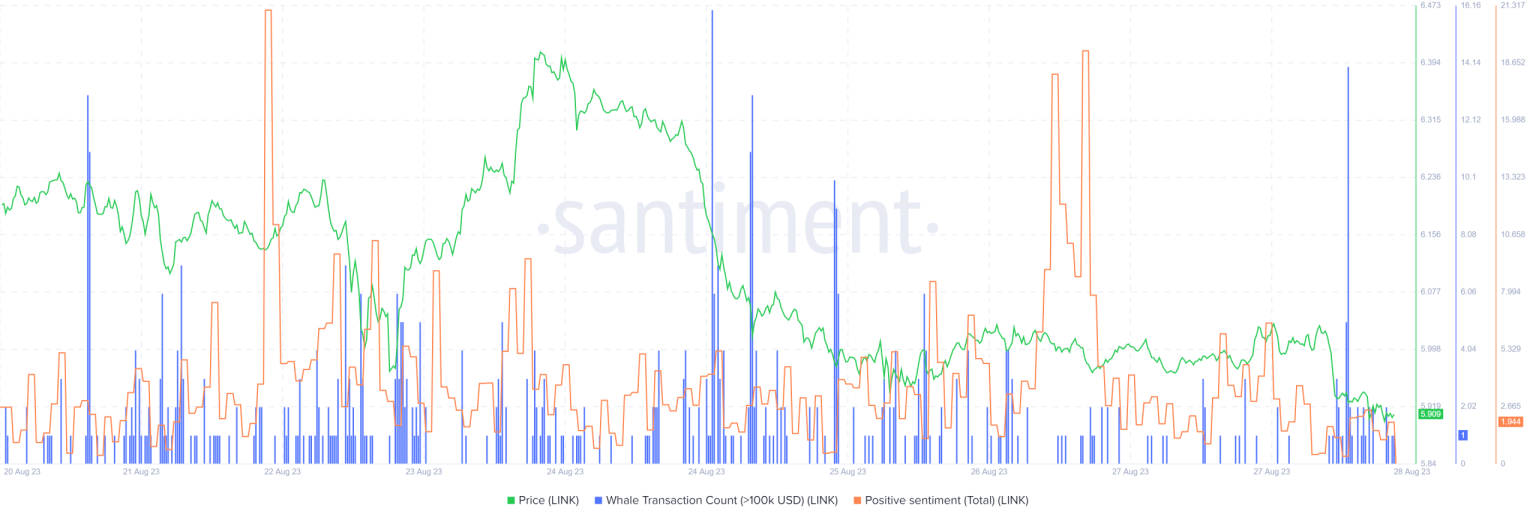

This was evident from LINK’s exchange netflow, as net deposits on exchanges were high compared to the seven-day average. Nonetheless, Chainlink’s positive sentiment spiked a few times, reflecting investors’ confidence. Whale activity around LINK also remained relatively high last week.

Source: Santiment

How much are 1,10,100 LINKs worth today

A few of the market indicators also looked bullish on LINK. For instance, both the Relative Strength Index (RSI) and the Money Flow Index (MFI) were entering the oversold zone, which can increase buying pressure.

Additionally, the MACD displayed the possibility of a bullish crossover. However, its On Balance Volume (OBV) remained low, which was concerning.

Source: TradingView