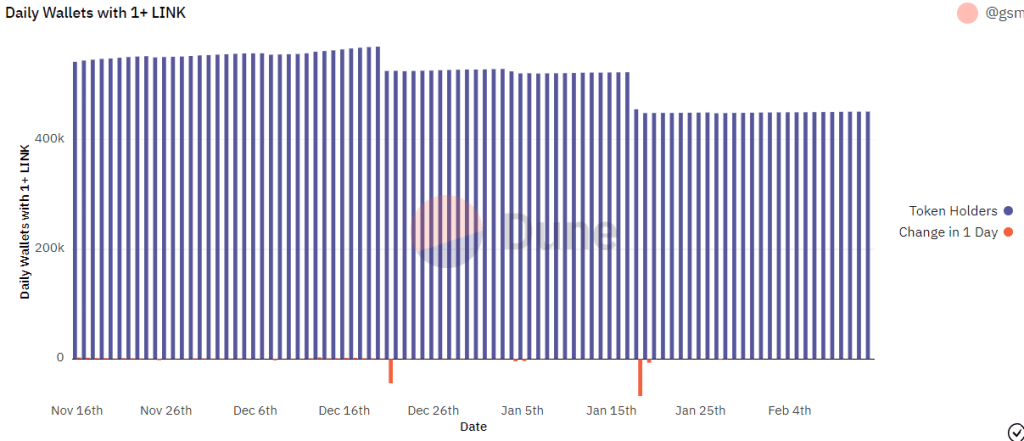

- The number of daily addresses with more than one LINK has been declining.

- On-chain performance looked concerning for LINK and so did the indicators.

Chainlink [LINK] adoption has been on the rise as the blockchain continues to expand its integrations. LINK recently announced multiple new integrations across four chains- Avalanche, BNB, Ethereum, and Polygon.

⬡ Chainlink Adoption Update ⬡

There were 12 integrations of 5 #Chainlink services across 4 different chains: #Avalanche, #BNBChain, #Ethereum, and #Polygon.

Chainlink is a key driver of #Web3 innovation. pic.twitter.com/x635fuhIlB

— Chainlink (@chainlink) February 12, 2023

Apart from this, LINK also managed to remain in the whales’ portfolio. WhaleStats, a popular Twitter handle that posts updates related to whale activity revealed that LINK was on the list of the cryptos that the top 100 Ethereum whales were holding. This was a positive update as it reflected the whales’ trust in LINK.

???? The top 100 #ETH whales are hodling

$666,300,027 $SHIB

$146,436,746 $BEST

$139,060,980 $CHSB

$128,710,645 $MATIC

$96,545,419 $BIT

$81,023,390 $LOCUS

$61,037,825 $LINK

$60,189,488 $CHZWhale leaderboard ????https://t.co/N5qqsCAH8j pic.twitter.com/4OIQYX3sdd

— WhaleStats (tracking crypto whales) (@WhaleStats) February 12, 2023

Realistic or not, here’s LINK market cap in BTC’s terms

However, despite the whales’ confidence, the broader market’s interest in LINK seems to have declined over the past few weeks.

Dune’s data revealed that the number of daily addresses with more than one LINK has been on a constant decline. A look at LINK’s on-chain performance provided a better understanding of this episode.

Source: Dune

Reasons to worry?

The decline in the number of holders can be somewhat attributed to LINK’s recent performance on the price front, thanks to the bearish market condition.

As per CoinMarketCap, LINK registered a nearly 3% price decline in the last 24 hours, and at the time of writing, it was trading at $6.77 with a market capitalization of over $3.4 billion.

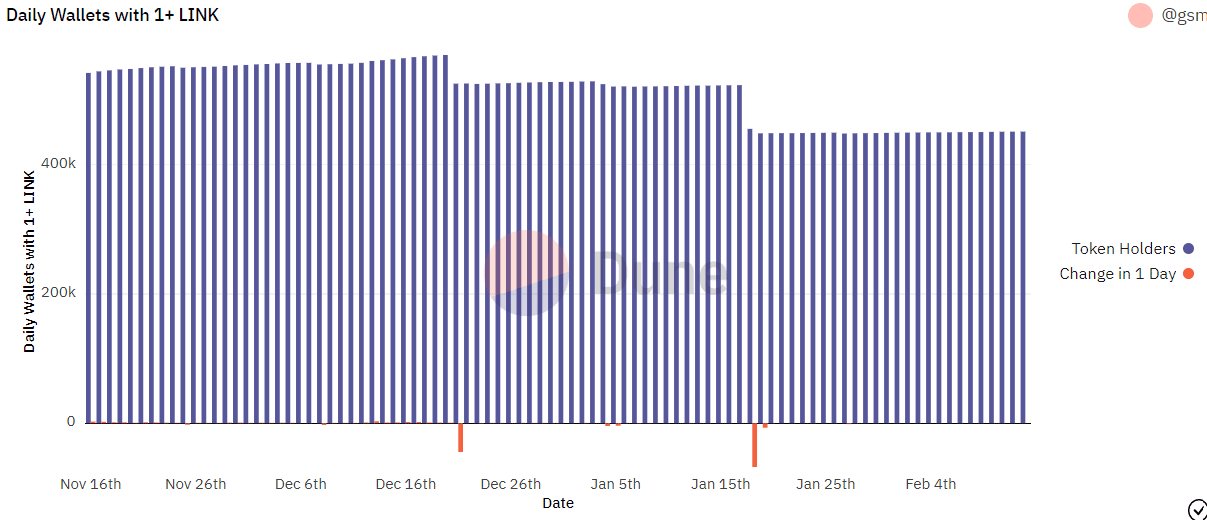

LINK’s performance on the metrics front also did not look promising, as most of the metrics supported the possibility of a further downtrend.

For instance, LINK’s demand in the derivatives market gradually declined as its DyDx funding rate went down. LINK’s exchange inflow spiked quite a few times during the last seven days, which was a bearish signal.

Furthermore, its MVRV Ratio fell significantly, raising the prospect of further price declines. In fact, the network’s popularity also took a blow as its social volume decreased.

Source: Santiment

How much are 1,10,100 LINKs worth today?

Caution is advised

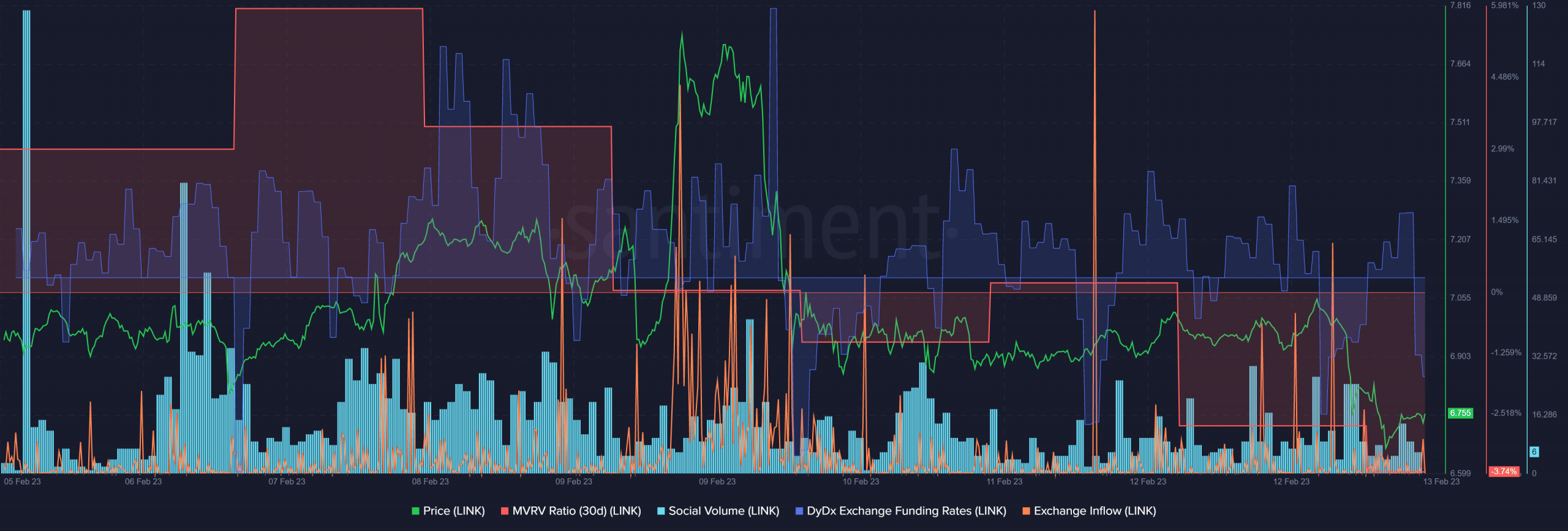

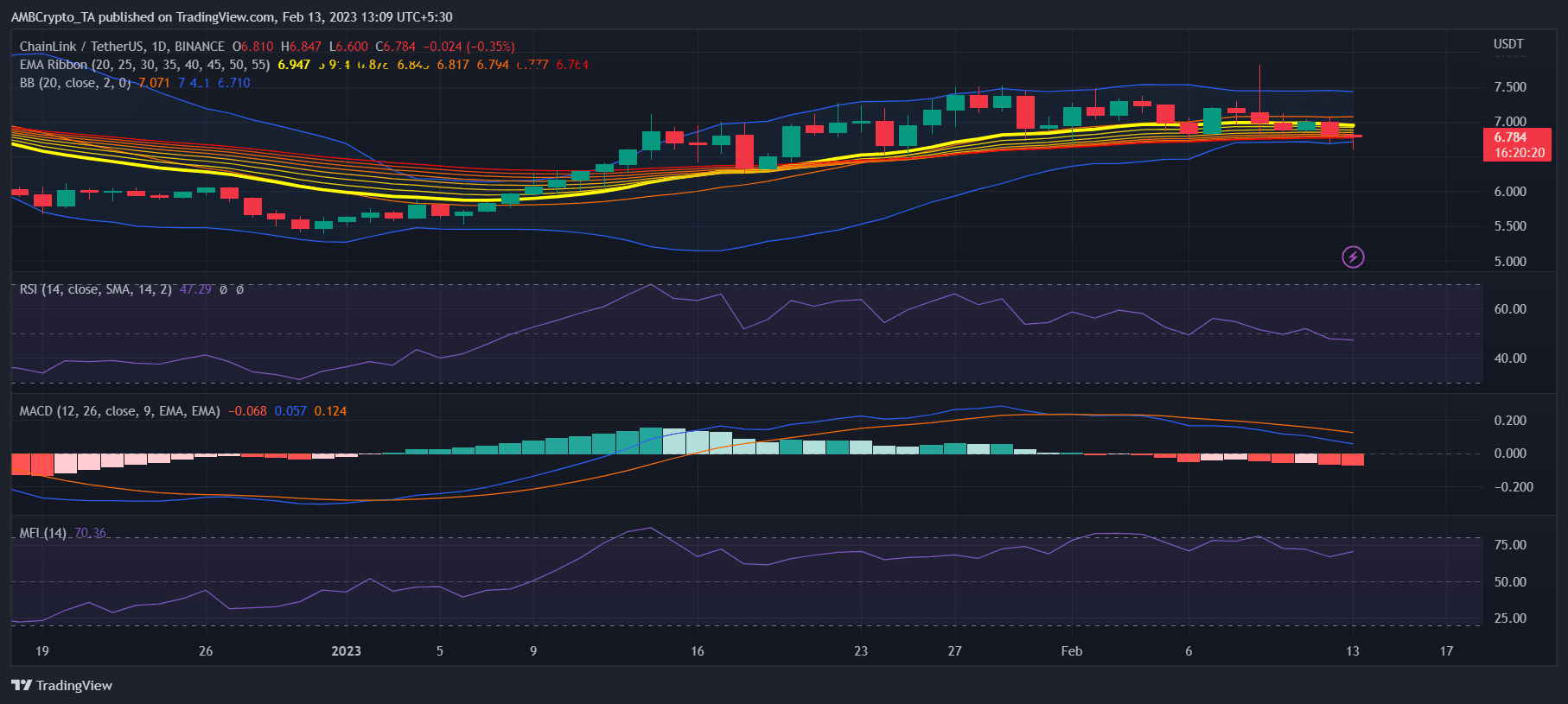

Like most of the metrics, LINK’s market indicators also painted a bearish picture for the token. The Exponential Moving Average (EMA) Ribbon revealed that the distance between the 20-day EMA and the 55-day EMA was reducing, increasing the chances of a bearish crossover.

LINK’s MACD showed that the bears were already leading the market. The Relative Strength Index (RSI) went below the neutral mark, which too was bearish.

Moreover, the Bollinger Bands revealed that LINK’s price was in a less volatile zone, decreasing the chances of a sudden northward breakout. Nonetheless, the Money Flow Index (MFI) gave slight hope for an uptick as it went up marginally.

Source: TradingView